Discovering Three Promising Undiscovered Gems For Your Portfolio

Reviewed by Simply Wall St

As global markets continue to rally, with major indices like the S&P 500 reaching record highs amid optimism over trade policies and AI advancements, investors are increasingly looking for opportunities beyond large-cap stocks. In this environment of heightened enthusiasm and economic shifts, identifying promising small-cap stocks can be a strategic move for diversifying portfolios and capturing potential growth in emerging sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 46.58% | 6.59% | 23.75% | ★★★★★★ |

| Korea Ratings | NA | 0.84% | 0.92% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 7.52% | 53.96% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Hansae Yes24 Holdings | 80.77% | 1.28% | 9.02% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Avant Group (TSE:3836)

Simply Wall St Value Rating: ★★★★★★

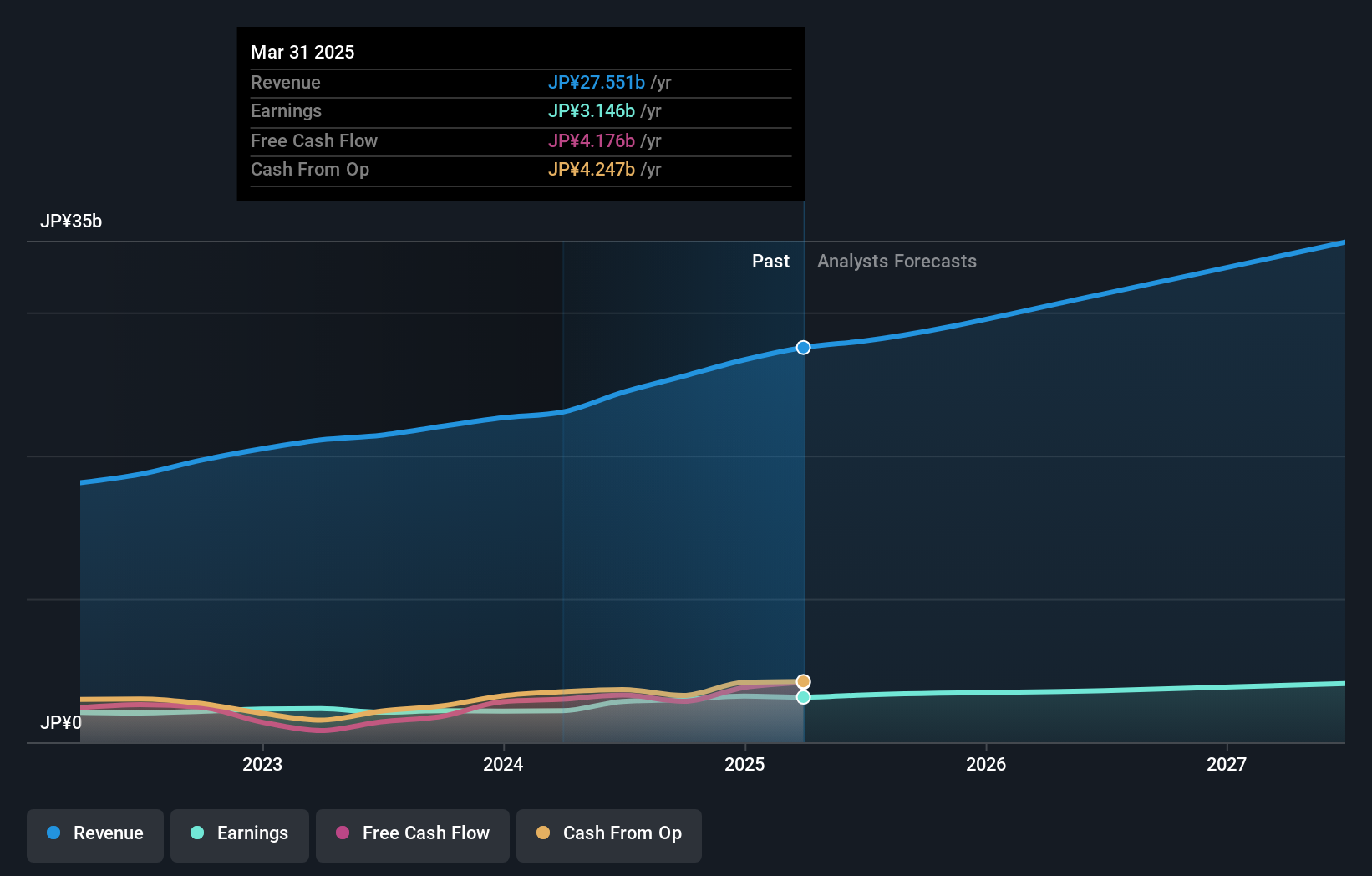

Overview: Avant Group Corporation, with a market cap of ¥72.47 billion, operates through its subsidiaries to provide accounting, business intelligence, and outsourcing services.

Operations: Avant Group generates revenue primarily from its Digital Transformation Business, Management Solutions Business, and Group Governance Business, with the Digital Transformation segment contributing ¥9.16 billion. The company experiences a net sales reduction of ¥438.36 million due to inter-segment transfers.

Avant Group, a nimble player in the market, boasts high-quality earnings and impressive profitability. With no debt on its books for over five years, it remains financially robust. Its earnings growth of 35% last year outpaced the IT industry's 11%, indicating strong operational performance. Despite recent share price volatility, Avant trades at an attractive 47% below its estimated fair value. The company recently completed a buyback of 615,600 shares for ¥828.93 million, reflecting confidence in its valuation. Future prospects look promising with forecasted annual earnings growth of over 18%.

- Take a closer look at Avant Group's potential here in our health report.

Understand Avant Group's track record by examining our Past report.

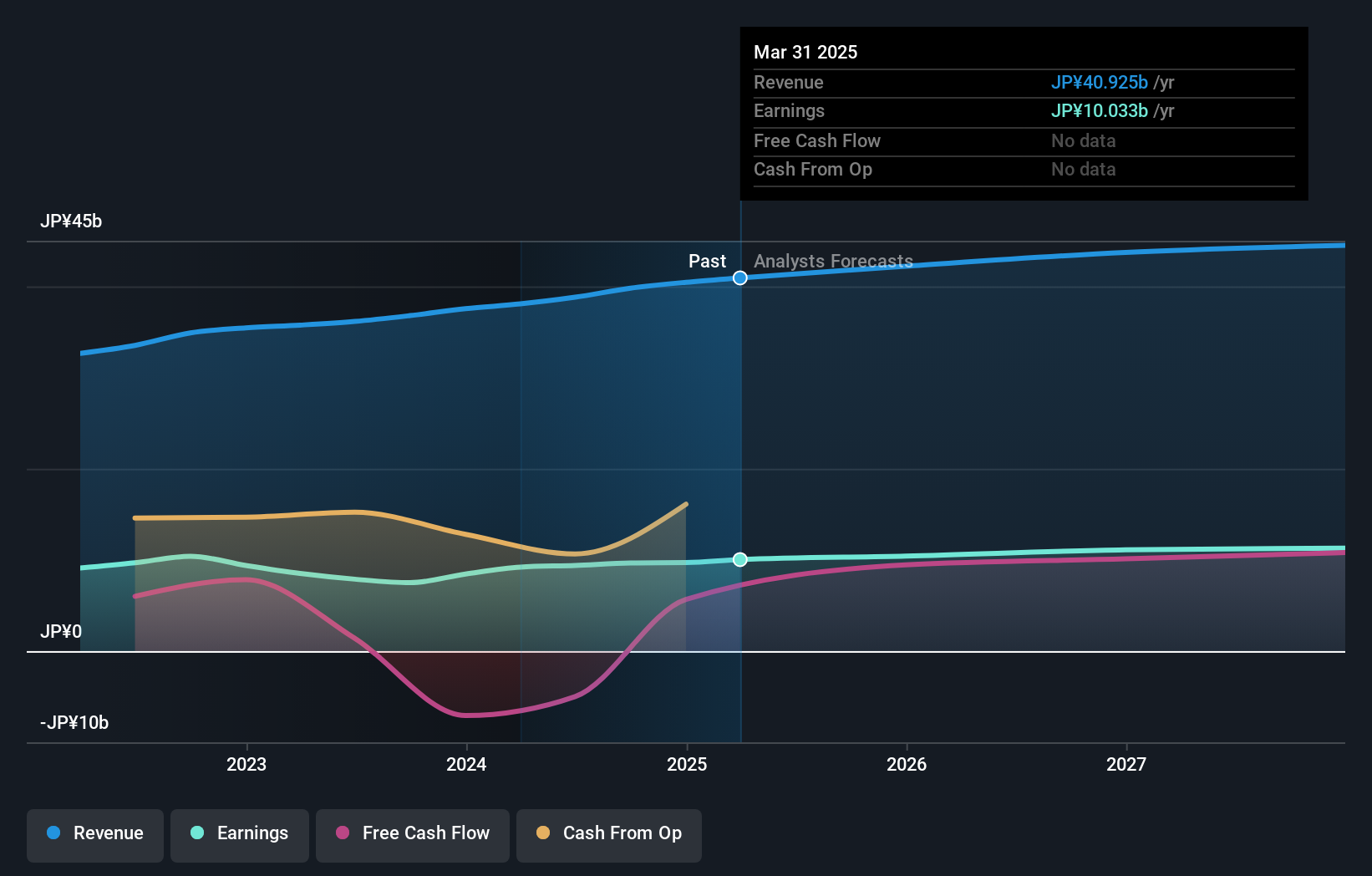

KOSAIDO Holdings (TSE:7868)

Simply Wall St Value Rating: ★★★★☆☆

Overview: KOSAIDO Holdings Co., Ltd. is a Japanese company primarily involved in the printing industry, with a market capitalization of approximately ¥73.37 billion.

Operations: KOSAIDO Holdings generates revenue from multiple segments, with Human Resources Services contributing ¥14.87 billion and Funeral Proceeds adding ¥10.30 billion. The company also earns from Information services at ¥5.75 billion and Asset Consultation at ¥1.57 billion, while Funeral Public Benefit accounts for ¥5.69 billion of its revenue streams.

KOSAIDO Holdings, a smaller player in the commercial services sector, has shown robust earnings growth of 19.3% over the past year, outpacing the industry average of 8.7%. The company’s financial health seems stable with a satisfactory net debt to equity ratio of 15.2%, and its interest payments are well covered by EBIT at a multiple of 50.2x. Recently, KOSAIDO completed a share buyback program repurchasing 3 million shares for ¥1,586 million to enhance capital efficiency and flexibility, reflecting strategic financial management amidst market volatility over recent months.

- Get an in-depth perspective on KOSAIDO Holdings' performance by reading our health report here.

Explore historical data to track KOSAIDO Holdings' performance over time in our Past section.

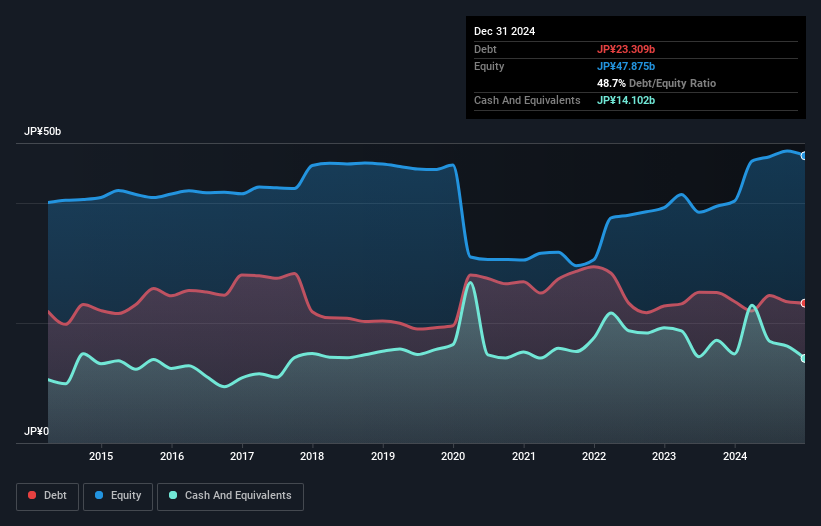

TokyotokeibaLtd (TSE:9672)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tokyotokeiba Ltd. is involved in the rental of horse racing facilities in Japan and has a market capitalization of approximately ¥119.69 billion.

Operations: Tokyotokeiba generates revenue primarily from its public competition business, contributing ¥28.41 billion, followed by the warehouse rental business at ¥5.61 billion and the amusement park business at ¥3.78 billion. The company experiences a net profit margin trend worth noting over recent periods.

Tokyotokeiba Ltd. stands out with its earnings growth of 28.9% over the past year, surpassing the Hospitality industry's 24.3%. Trading at 43.6% below its estimated fair value, this company seems to offer a compelling investment case, particularly given its satisfactory net debt to equity ratio of 5.5%. Interest payments are well covered by EBIT at an impressive 1373 times coverage, indicating strong financial health. Despite not being free cash flow positive, Tokyotokeiba's profitability ensures no immediate concern about cash runway; however, it recently affirmed a stable dividend payout of ¥60 per share for the year ending December 2024.

- Navigate through the intricacies of TokyotokeibaLtd with our comprehensive health report here.

Evaluate TokyotokeibaLtd's historical performance by accessing our past performance report.

Make It Happen

- Delve into our full catalog of 4667 Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3836

Avant Group

Through its subsidiaries, provides accounting, business intelligence, and outsourcing services.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives