- Japan

- /

- Professional Services

- /

- TSE:6551

Why Investors Shouldn't Be Surprised By Tsunagu Group Holdings, Inc.'s (TSE:6551) 26% Share Price Surge

Tsunagu Group Holdings, Inc. (TSE:6551) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 26%.

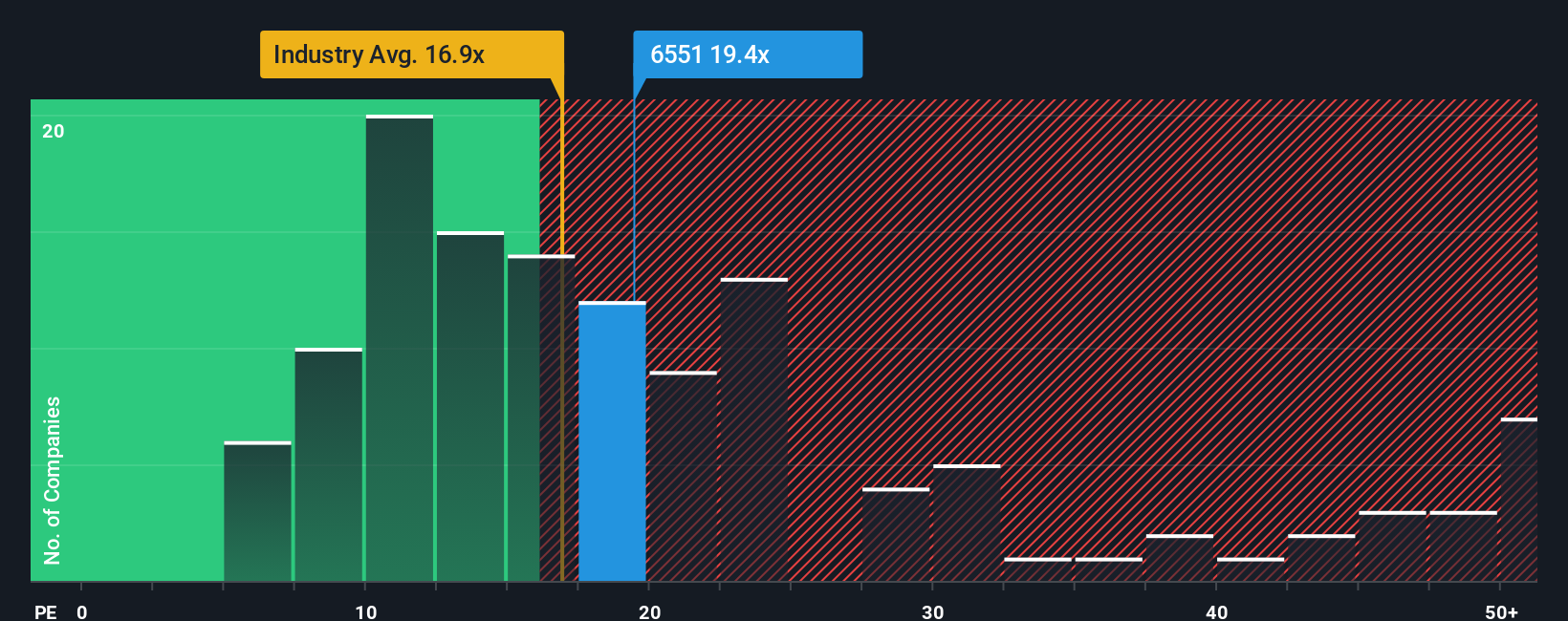

After such a large jump in price, Tsunagu Group Holdings' price-to-earnings (or "P/E") ratio of 19.4x might make it look like a sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 14x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

For instance, Tsunagu Group Holdings' receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Tsunagu Group Holdings

How Is Tsunagu Group Holdings' Growth Trending?

In order to justify its P/E ratio, Tsunagu Group Holdings would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 1.4%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 63% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is only predicted to deliver 11% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why Tsunagu Group Holdings is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Tsunagu Group Holdings' P/E

The large bounce in Tsunagu Group Holdings' shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Tsunagu Group Holdings revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 3 warning signs for Tsunagu Group Holdings that you need to take into consideration.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tsunagu Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6551

Tsunagu Group Holdings

Engages in the consulting and recruitment agency services.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives