- Japan

- /

- Professional Services

- /

- TSE:6532

3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 33.6%

Reviewed by Simply Wall St

As global markets navigate challenges such as trade policy uncertainties and inflation concerns, the Asian stock market remains a focal point for investors seeking opportunities. In this environment, identifying undervalued stocks can be particularly appealing, as these investments may offer potential value when broader market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhou International Group Holdings (SEHK:2313) | HK$58.70 | HK$115.37 | 49.1% |

| Avant Group (TSE:3836) | ¥1809.00 | ¥3533.92 | 48.8% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.30 | CN¥30.36 | 49.6% |

| MEC (TSE:4971) | ¥2694.00 | ¥5325.18 | 49.4% |

| Cosmax (KOSE:A192820) | ₩180500.00 | ₩354936.27 | 49.1% |

| Takara Bio (TSE:4974) | ¥854.00 | ¥1692.75 | 49.5% |

| LITALICO (TSE:7366) | ¥1097.00 | ¥2136.11 | 48.6% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.67 | SGD1.33 | 49.6% |

| BalnibarbiLtd (TSE:3418) | ¥1106.00 | ¥2184.91 | 49.4% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥8.55 | CN¥16.97 | 49.6% |

Let's dive into some prime choices out of the screener.

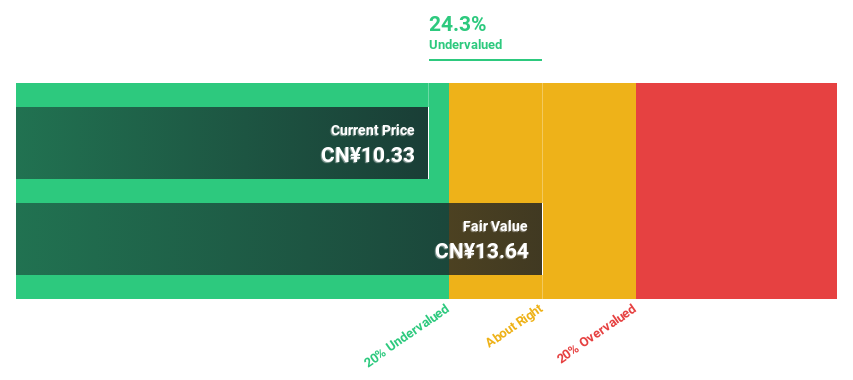

China Jushi (SHSE:600176)

Overview: China Jushi Co., Ltd. manufactures and sells fiberglass both domestically and internationally, with a market cap of CN¥48.92 billion.

Operations: The company's revenue primarily comes from the production and sales of glass fiber and its products, totaling CN¥15.08 billion.

Estimated Discount To Fair Value: 10.7%

China Jushi, trading at CN¥12.22, is 10.7% below its estimated fair value of CN¥13.68, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 27.4% annually, outpacing the Chinese market's growth rate of 25.2%. However, profit margins have declined from last year due to large one-off items and dividends are not well covered by free cash flows, suggesting some financial caution is warranted.

- Our expertly prepared growth report on China Jushi implies its future financial outlook may be stronger than recent results.

- Take a closer look at China Jushi's balance sheet health here in our report.

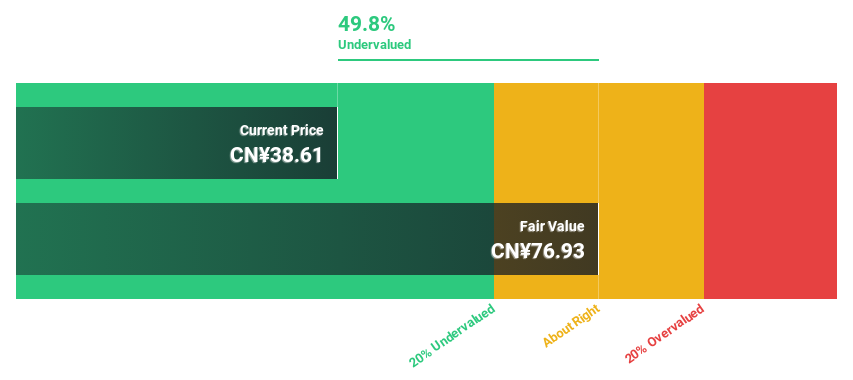

Tibet Rhodiola Pharmaceutical Holding (SHSE:600211)

Overview: Tibet Rhodiola Pharmaceutical Holding Co. operates in the pharmaceutical industry, focusing on the development and sale of traditional Tibetan medicine, with a market cap of CN¥12.74 billion.

Operations: The company generates its revenue primarily from the development and sale of traditional Tibetan medicine.

Estimated Discount To Fair Value: 33.6%

Tibet Rhodiola Pharmaceutical Holding, priced at CN¥39.53, is trading 33.6% below its estimated fair value of CN¥59.52, highlighting undervaluation based on cash flows. Despite slower earnings growth forecasts of 16.6% compared to the Chinese market's 25.2%, revenue is expected to grow robustly at 25.9% annually, surpassing market averages. Recent earnings showed a net income increase from CN¥800.91 million to CN¥1,051.29 million year-over-year despite declining sales figures.

- The analysis detailed in our Tibet Rhodiola Pharmaceutical Holding growth report hints at robust future financial performance.

- Click here to discover the nuances of Tibet Rhodiola Pharmaceutical Holding with our detailed financial health report.

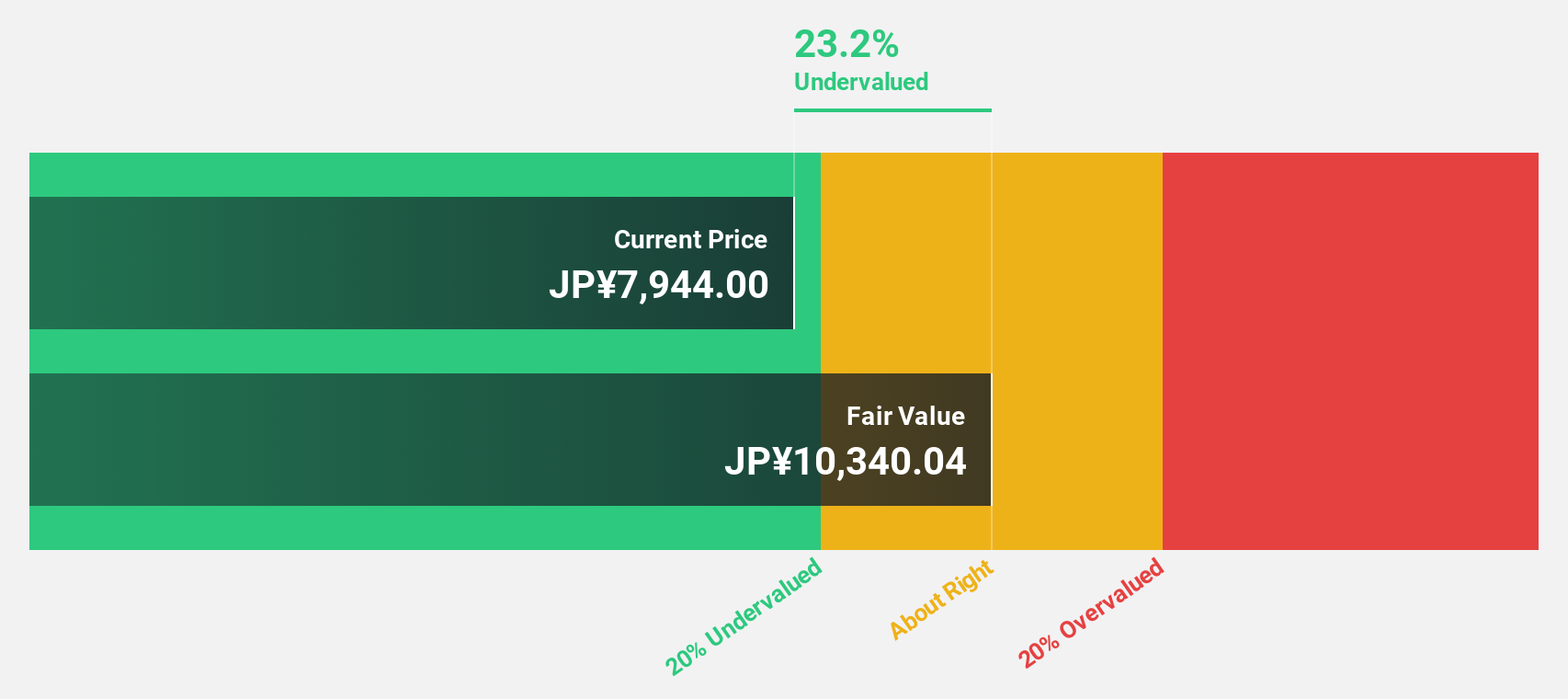

Baycurrent (TSE:6532)

Overview: Baycurrent, Inc. offers consulting services in Japan and has a market cap of ¥1.01 trillion.

Operations: Baycurrent, Inc.'s revenue is primarily derived from its consulting services in Japan.

Estimated Discount To Fair Value: 27.8%

BayCurrent Consulting is trading at ¥6,663, significantly below its estimated fair value of ¥9,226.38, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow at 19.9% annually, outpacing the Japanese market's 8.1%. Revenue growth is expected at 18.6% per year but remains below the 20% threshold for high growth classification. Recent volatility in share price may present both opportunities and risks for investors considering this stock.

- Our earnings growth report unveils the potential for significant increases in Baycurrent's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Baycurrent.

Turning Ideas Into Actions

- Explore the 275 names from our Undervalued Asian Stocks Based On Cash Flows screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Baycurrent, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Baycurrent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6532

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives