As global markets continue to react positively to recent political developments and economic indicators, with major U.S. indices reaching record highs amid AI enthusiasm and softer tariff expectations, investors are increasingly looking towards dividend stocks as a way to balance growth potential with income generation. In this context, selecting dividend stocks that offer both stability and the potential for capital appreciation can be an effective strategy in navigating today's dynamic market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.39% | ★★★★★☆ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★☆ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Betsson (OM:BETS B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Betsson AB (publ) operates an online gaming business through its subsidiaries, focusing on markets in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of SEK19.92 billion.

Operations: Betsson AB (publ) generates its revenue primarily from its Casinos & Resorts segment, which accounted for €1.05 billion.

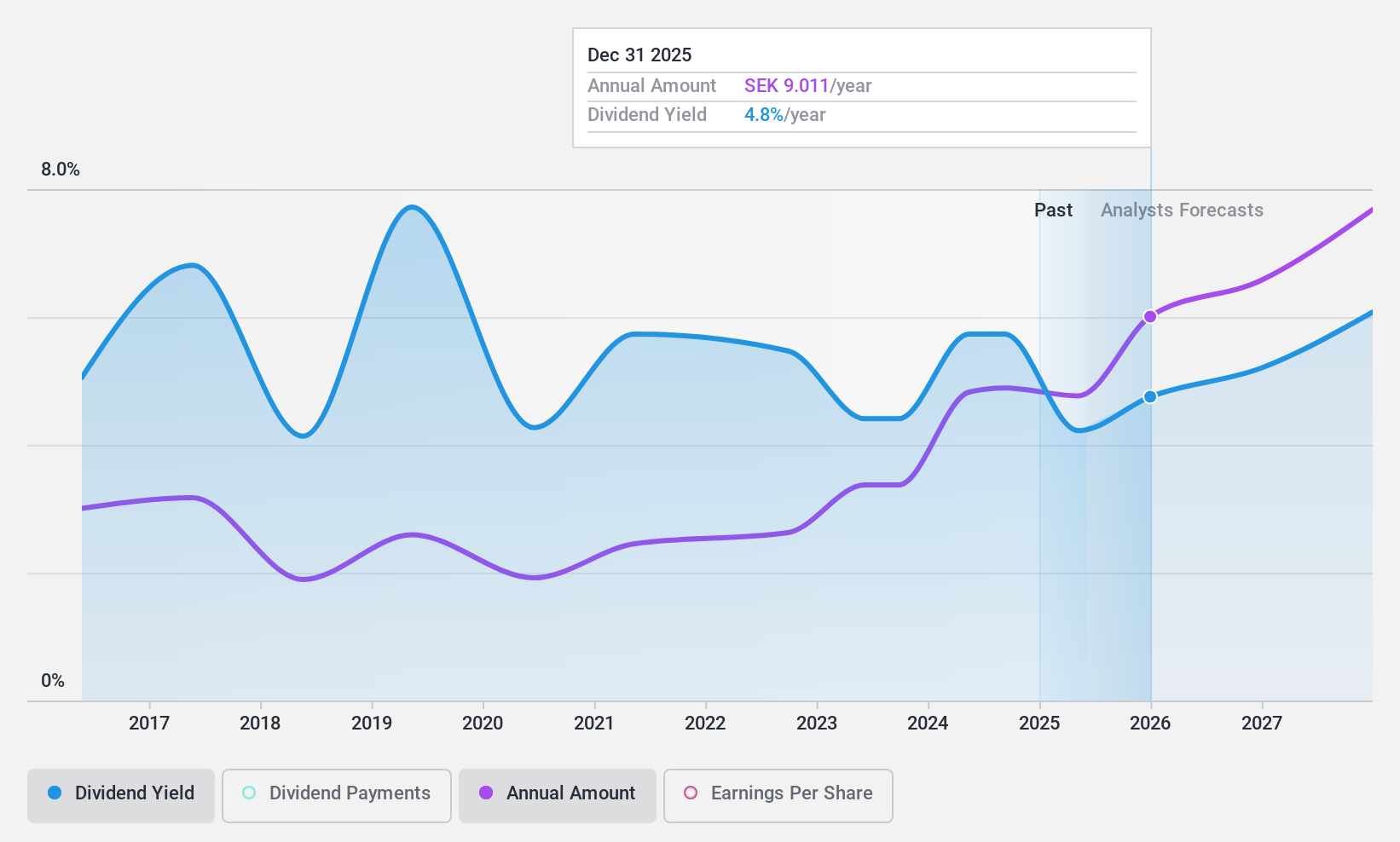

Dividend Yield: 5.1%

Betsson's dividend payments have been volatile and unreliable over the past decade, yet they are well-covered by both earnings and cash flows, with payout ratios of 51.9% and 46.3%, respectively. Trading at a significant discount to its estimated fair value, Betsson offers a competitive dividend yield in the top quartile of the Swedish market. Recent management changes might influence future performance but do not directly impact current dividends or their sustainability.

- Dive into the specifics of Betsson here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Betsson shares in the market.

Sato Holdings (TSE:6287)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sato Holdings Corporation manufactures and sells labeling products both in Japan and internationally, with a market cap of ¥71.68 billion.

Operations: Sato Holdings Corporation's revenue is primarily derived from its Auto-ID Solutions segments, generating ¥85.40 billion overseas and ¥85.56 billion in Japan.

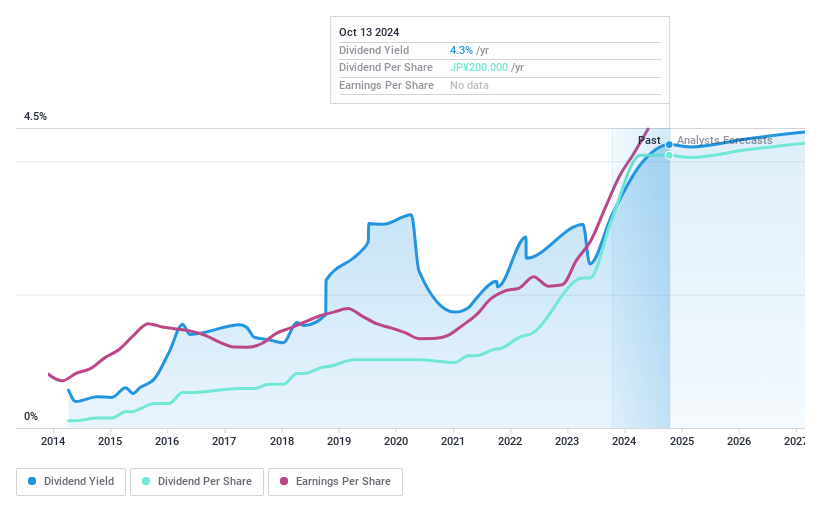

Dividend Yield: 3.4%

Sato Holdings offers a stable dividend profile with payments reliably increasing over the past decade. Its dividends are well-covered by earnings and cash flows, maintaining payout ratios of 52.1% and 35.8%, respectively. Despite a dividend yield of 3.35% being below the top tier in Japan, recent increases from JPY 36 to JPY 37 per share reflect ongoing growth. The company has also raised its earnings guidance for fiscal year-end March 2025, indicating robust financial health.

- Click here and access our complete dividend analysis report to understand the dynamics of Sato Holdings.

- The analysis detailed in our Sato Holdings valuation report hints at an inflated share price compared to its estimated value.

Takeuchi Mfg (TSE:6432)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takeuchi Mfg. Co., Ltd. is a company that manufactures and sells construction machinery both in Japan and internationally, with a market cap of ¥255.02 billion.

Operations: Takeuchi Mfg. Co., Ltd.'s revenue segments primarily focus on the manufacturing and sale of construction machinery across domestic and international markets.

Dividend Yield: 3.7%

Takeuchi Mfg. trades at 50.3% below estimated fair value, offering potential value for investors. Despite a low payout ratio of 23.8%, dividends are not well covered by free cash flows, with a high cash payout ratio of 363.2%. The dividend yield of 3.74% is slightly below Japan's top tier but has been stable and reliable over the past decade. Recent share buybacks totaling ¥7 billion may indicate confidence in its financial position despite forecasted earnings decline.

- Get an in-depth perspective on Takeuchi Mfg's performance by reading our dividend report here.

- Our valuation report unveils the possibility Takeuchi Mfg's shares may be trading at a discount.

Summing It All Up

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1969 more companies for you to explore.Click here to unveil our expertly curated list of 1972 Top Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Takeuchi Mfg, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Takeuchi Mfg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6432

Takeuchi Mfg

Manufactures and sells construction machinery in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives