- Japan

- /

- Professional Services

- /

- TSE:6098

What Recruit Holdings (TSE:6098)'s Swift ¥79 Billion Share Buyback Means For Shareholders

Reviewed by Sasha Jovanovic

- Recruit Holdings announced and swiftly completed a share repurchase program in late September 2025, buying back 9,849,000 shares, equivalent to 0.69% of its outstanding shares, for ¥79.01 billion using company funds.

- This rapid execution of a board-approved buyback, positioned to support capital efficiency and long-term business strategy, highlights the company’s focus on maximizing shareholder returns and strengthening its financial flexibility.

- We’ll explore how Recruit Holdings’ recently completed share buyback further impacts its capital management and long-term investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Recruit Holdings Investment Narrative Recap

To be a shareholder in Recruit Holdings, you’ll want confidence in the company’s ability to leverage its investment in automation, digitalization, and capital management to drive stable earnings growth, even if labor markets remain soft. The recently completed share buyback supports a shareholder-focused approach but does not meaningfully change the near-term catalyst, which is a recovery in US and international hiring demand. The most important risk, a prolonged slowdown in staffing revenue, remains unaddressed by this capital action.

Among recent announcements, Recruit’s board-approved buyback program disclosed on September 25, 2025 is most relevant. This program, funded with company resources, aimed at maximizing shareholder returns and capital efficiency. Completing 0.69% of outstanding shares in less than two days highlights Recruit’s ability to execute financial decisions swiftly in the context of subdued market conditions.

However, investors should be aware that despite these shareholder-friendly activities, weakness in US and European staffing markets may continue to...

Read the full narrative on Recruit Holdings (it's free!)

Recruit Holdings' outlook anticipates ¥4,042.8 billion in revenue and ¥580.9 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 4.6% and an increase in earnings of ¥157.9 billion from the current level of ¥423.0 billion.

Uncover how Recruit Holdings' forecasts yield a ¥9868 fair value, a 25% upside to its current price.

Exploring Other Perspectives

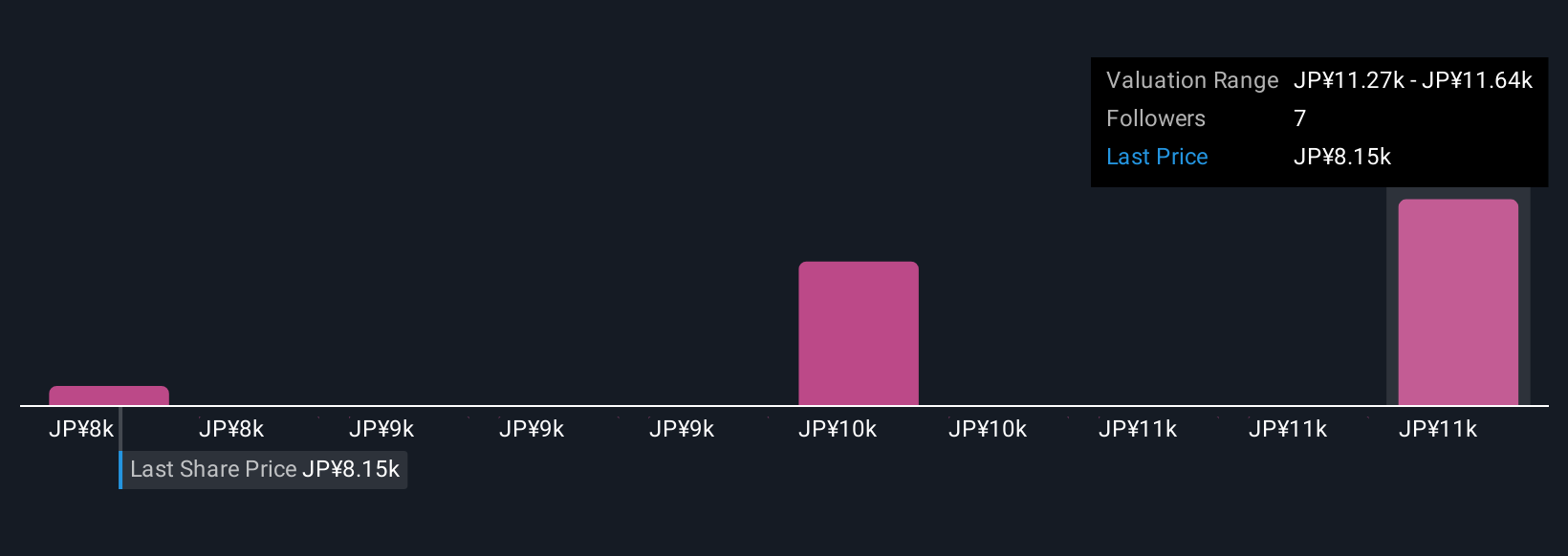

Simply Wall St Community members provided four fair value estimates for Recruit ranging from ¥7,900 to ¥11,666 per share. Given ongoing international revenue pressures, your own outlook on demand trends could significantly shift how you view the company’s performance potential, explore these different viewpoints for a fuller picture.

Explore 4 other fair value estimates on Recruit Holdings - why the stock might be worth just ¥7900!

Build Your Own Recruit Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Recruit Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Recruit Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Recruit Holdings' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6098

Recruit Holdings

Provides HR technology and business solutions that transforms the world of work.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives