- Japan

- /

- Professional Services

- /

- TSE:6098

A Fresh Look at Recruit Holdings (TSE:6098) Valuation After Completing Major Share Buyback Program

Reviewed by Kshitija Bhandaru

Recruit Holdings (TSE:6098) just wrapped up an ambitious share repurchase, buying back nearly 10 million shares for over ¥79 billion. The move is intended to maximize shareholder returns and support future growth strategies.

See our latest analysis for Recruit Holdings.

Following the announcement and swift completion of its buyback program, Recruit Holdings has seen its share price remain steady near ¥7,961. While recent share price action has lacked momentum, the company’s 1-year total shareholder return is little changed. At the same time, management’s capital moves indicate longer-term growth ambitions.

If you’re considering where else to invest amid these strategic moves, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Given the company’s robust buyback activity and the share price’s subdued response, investors may be wondering if Recruit Holdings is now trading at a discount or if the market already anticipates its growth trajectory. Is there real upside left, or is future performance already factored in?

Most Popular Narrative: 19.3% Undervalued

Compared to its last close near ¥7,961, the widely followed narrative assigns Recruit Holdings a fair value of ¥9,868, suggesting material upside from here. This positioning frames the narrative as forward-looking and growth-oriented.

Recruit's ongoing strategic investment in automation and digitalization, especially within HR Technology and coding workflows, is driving sustainable improvements in efficiency and productivity. This is expected to materially expand future operating margins and boost earnings, even in a subdued revenue growth environment.

Curious about which bold forecasts back this valuation? There is a sharp focus on rising profit margins and transformative technology. The real surprise is how analysts project these changes to fully justify the premium. Find out exactly what sets their numbers apart.

Result: Fair Value of ¥9,868 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in global labor demand and slow adoption of new HR technology platforms may hinder Recruit Holdings’ anticipated growth and margin expansion.

Find out about the key risks to this Recruit Holdings narrative.

Another View: Looking at Market Comparisons

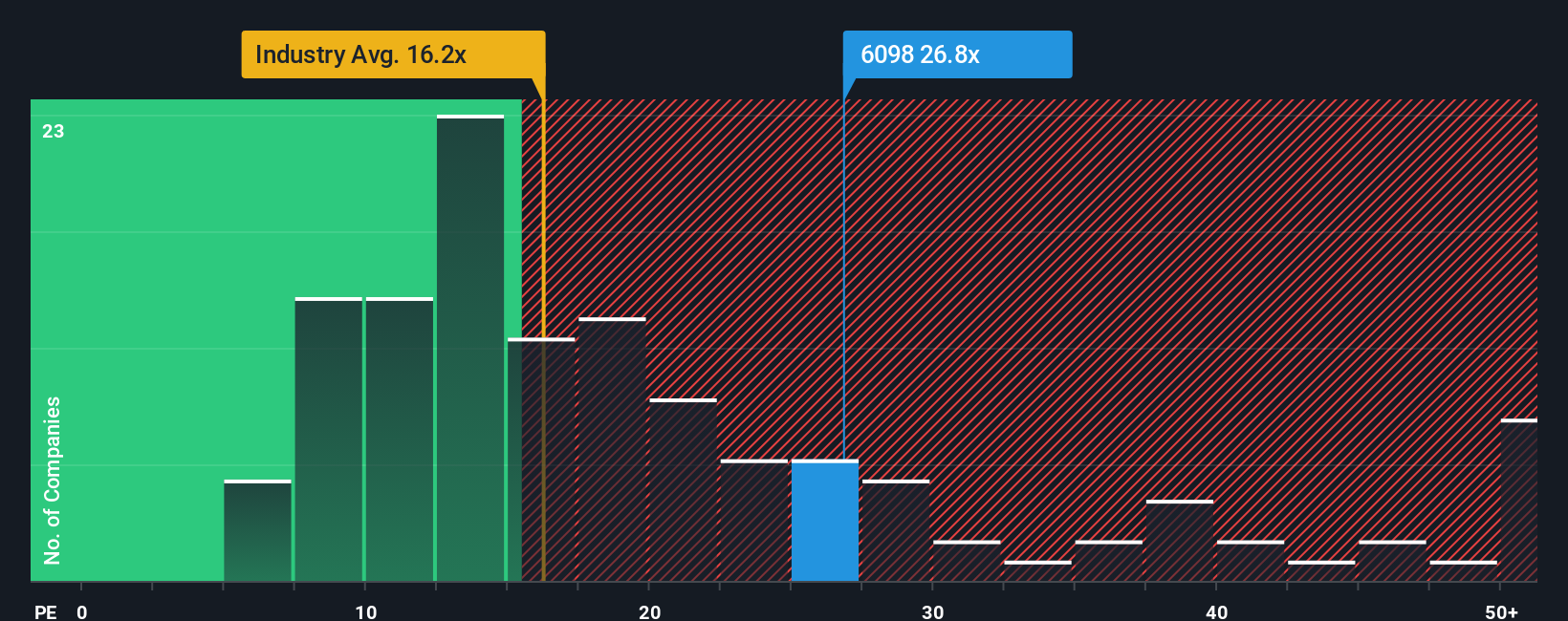

While the analyst consensus hints at upside, current market-based valuation tells a different story. Recruit Holdings trades at a price-to-earnings ratio of 26.7x, which is higher than its industry peers at 15.8x and above the peer group at 24.1x. That is well above the fair ratio of 31.9x our models suggest the market might eventually reflect. For now, it means investors pay a premium and risk a pullback if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Recruit Holdings Narrative

If you’re looking to challenge the consensus or want to dig into the numbers on your own, you can easily build a custom Recruit Holdings narrative in just a few minutes. Do it your way

A great starting point for your Recruit Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and move fast on opportunities others might overlook, with uniquely targeted stock ideas driven by the latest Simply Wall St data.

- Spot high-potential AI leaders early and propel your portfolio by checking out these 24 AI penny stocks. These companies are making advancements in automation, machine learning, and intelligent solutions.

- Boost your yield with consistent payouts when you browse these 19 dividend stocks with yields > 3% and tap into companies delivering dividend returns above 3%.

- Capitalize on overlooked value by reviewing these 885 undervalued stocks based on cash flows. Fundamental cash flow metrics in this group signal real opportunity for growth-driven investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6098

Recruit Holdings

Provides HR technology and business solutions that transforms the world of work.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives