- Japan

- /

- Commercial Services

- /

- TSE:4658

3 Top Dividend Stocks To Consider In Your Portfolio

Reviewed by Simply Wall St

In recent weeks, global markets have experienced volatility, driven by cautious commentary from the Federal Reserve and political uncertainties such as looming government shutdowns. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income streams and potential resilience in turbulent times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

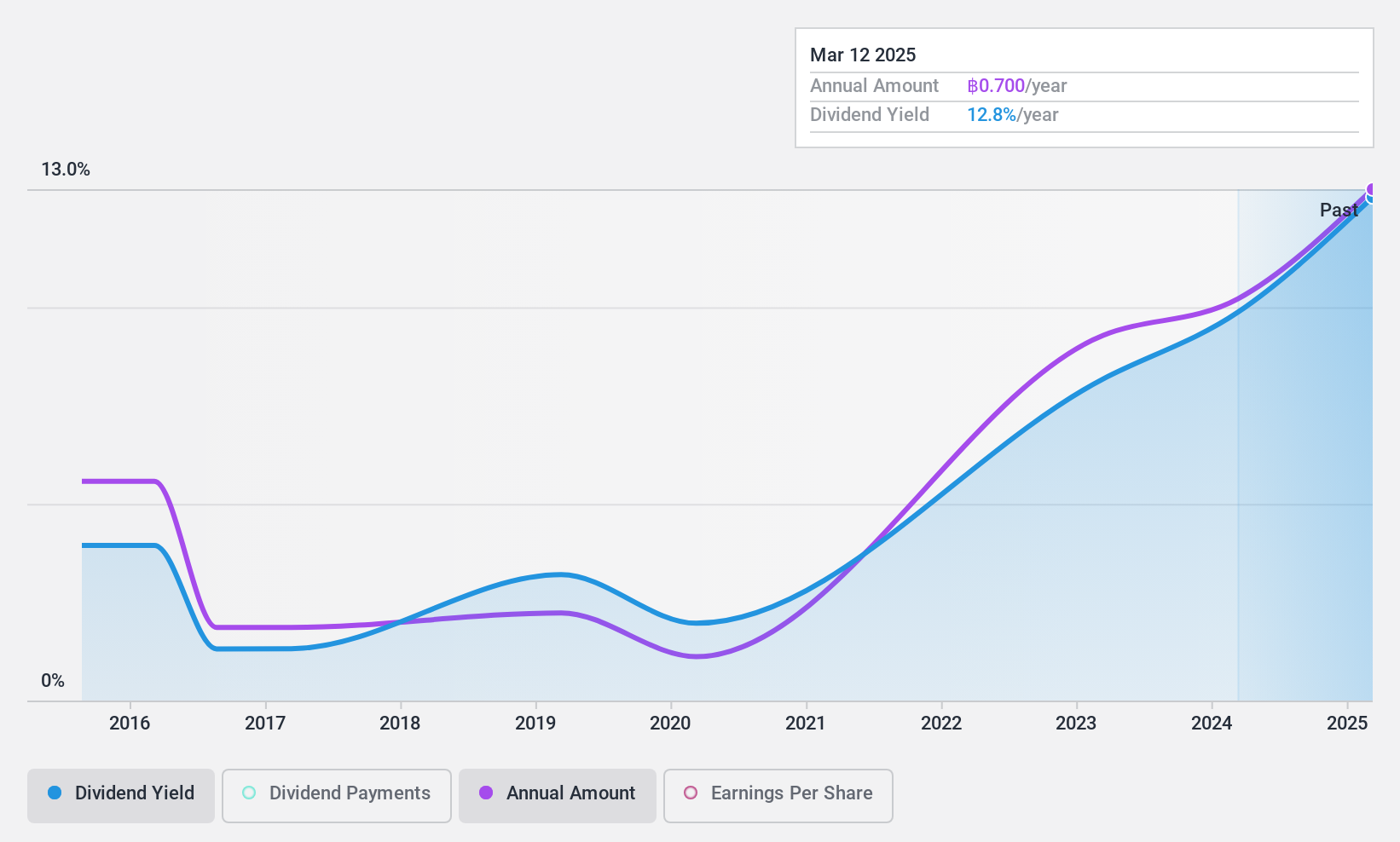

Khonburi Sugar (SET:KBS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Khonburi Sugar Public Company Limited manufactures and distributes sugar in Thailand, Asia, Europe, and internationally with a market cap of THB3.42 billion.

Operations: Khonburi Sugar Public Company Limited generates revenue primarily from its sugar cane segment (THB11.50 billion), followed by sugar and molasses trading (THB1.86 billion), and utilities (THB1.87 billion).

Dividend Yield: 9.6%

Khonburi Sugar's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 27.2% and 28.7%, respectively, despite a volatile dividend history over the past decade. The company offers a high dividend yield of 9.65%, placing it in the top quarter of Thai market payers, though its financial position is burdened by significant debt levels. Recent earnings showed mixed results with increased nine-month net income but a third-quarter net loss.

- Click to explore a detailed breakdown of our findings in Khonburi Sugar's dividend report.

- Our comprehensive valuation report raises the possibility that Khonburi Sugar is priced lower than what may be justified by its financials.

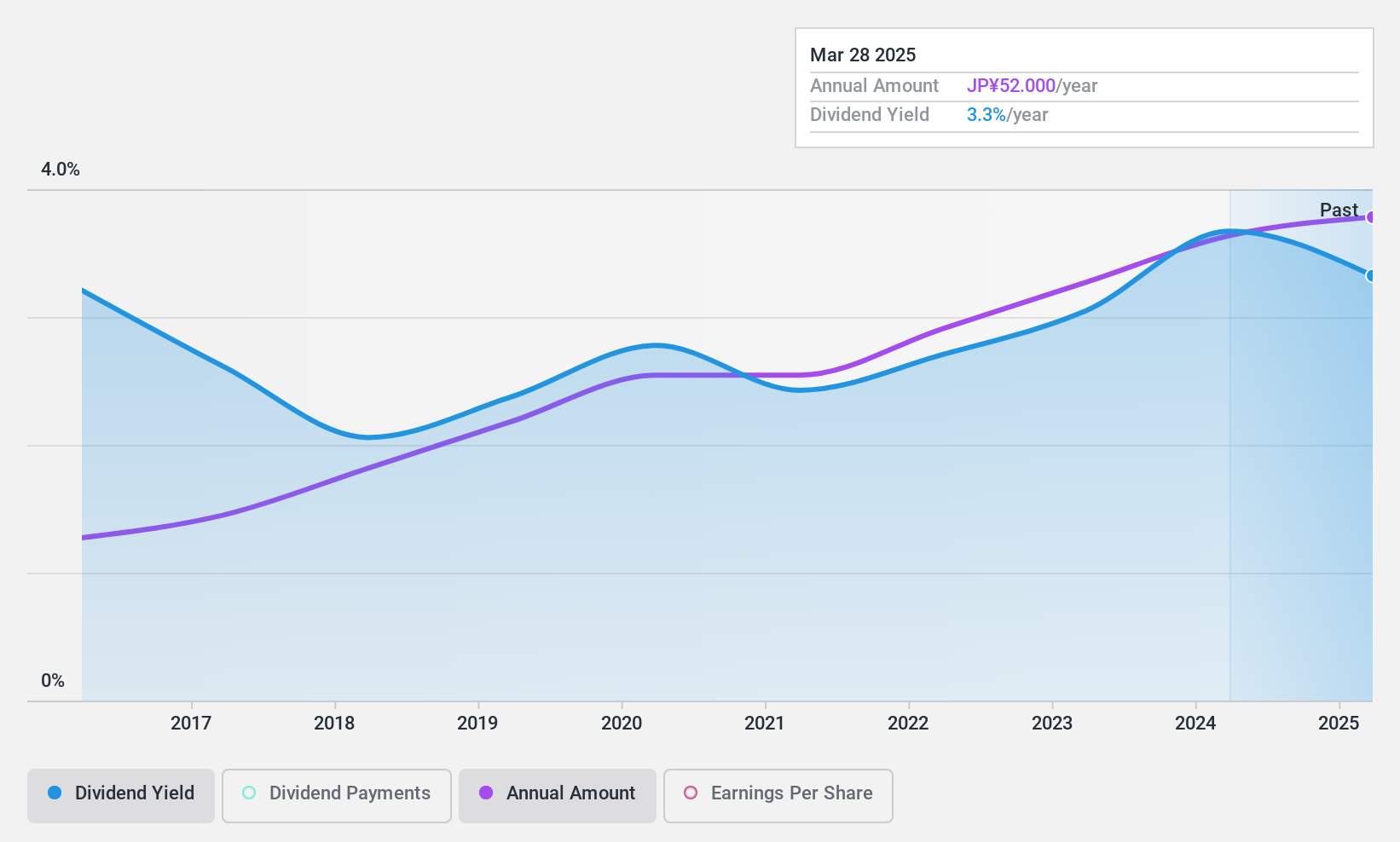

Pro-Ship (TSE:3763)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pro-Ship Incorporated develops, sells, consults, and customizes solution packages for asset and sales management in Japan with a market cap of ¥19.95 billion.

Operations: Pro-Ship Incorporated generates revenue through its development, sales, consulting, and customization services for solution packages focused on asset and sales management in Japan.

Dividend Yield: 3.2%

Pro-Ship's dividend payments are well-supported by earnings and cash flows, with payout ratios of 41.8% and 39.5%, respectively, reflecting stability over the past decade. Although its 3.23% yield is below Japan's top quartile, recent adoption of a progressive dividend policy signals commitment to increasing dividends. The company trades at a significant discount to estimated fair value and has shown strong earnings growth of 40% this year, enhancing its attractiveness for dividend investors.

- Unlock comprehensive insights into our analysis of Pro-Ship stock in this dividend report.

- Our expertly prepared valuation report Pro-Ship implies its share price may be lower than expected.

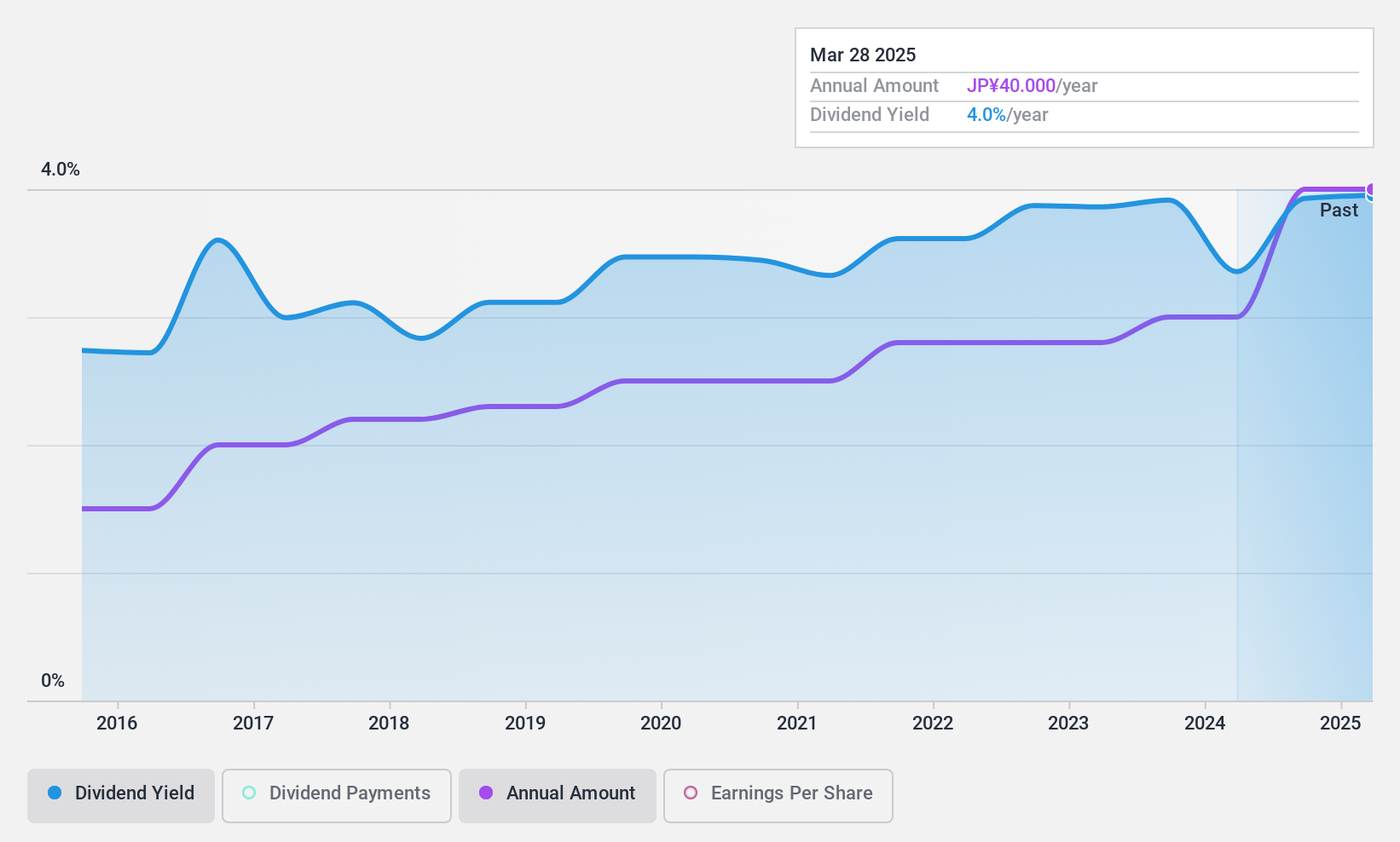

Nippon Air conditioning Services (TSE:4658)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Air Conditioning Services Co., Ltd. operates in the air conditioning services industry and has a market cap of ¥35.61 billion.

Operations: Nippon Air Conditioning Services Co., Ltd. generates its revenue from various segments within the air conditioning services industry, with specific amounts not provided in the text.

Dividend Yield: 3.9%

Nippon Air Conditioning Services offers a compelling dividend profile with a 3.88% yield, placing it in Japan's top quartile. Despite stable and growing dividends over the past decade, the lack of free cash flow coverage raises sustainability concerns. The company trades at an attractive price-to-earnings ratio of 11.4x compared to the market average of 13.4x, though high non-cash earnings warrant caution regarding dividend reliability despite strong recent earnings growth of 38.7%.

- Get an in-depth perspective on Nippon Air conditioning Services' performance by reading our dividend report here.

- Our valuation report unveils the possibility Nippon Air conditioning Services' shares may be trading at a discount.

Make It Happen

- Click this link to deep-dive into the 1951 companies within our Top Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Air conditioning Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4658

Nippon Air conditioning Services

Nippon Air conditioning Services Co., Ltd.

Excellent balance sheet established dividend payer.