- Japan

- /

- Professional Services

- /

- TSE:6088

3 Stocks Estimated To Be Trading At Discounts Ranging From 31% To 42.6%

Reviewed by Simply Wall St

As global markets react to cautious Federal Reserve commentary and political uncertainties, investors are navigating a complex landscape marked by rate cuts and economic resilience. Amid these fluctuations, the search for undervalued stocks becomes increasingly relevant, as they can offer potential opportunities when broader market sentiment is uncertain. In this environment, identifying stocks trading at significant discounts may provide value-oriented investors with a chance to capitalize on mispriced assets.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1310.00 | ¥2607.13 | 49.8% |

| Xiamen Bank (SHSE:601187) | CN¥5.69 | CN¥11.34 | 49.8% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK450.98 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.76 | 50% |

| NCSOFT (KOSE:A036570) | ₩205500.00 | ₩409953.04 | 49.9% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.15 | 49.9% |

| Informa (LSE:INF) | £7.992 | £15.92 | 49.8% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.10 | 49.8% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥13.24 | CN¥26.38 | 49.8% |

Let's explore several standout options from the results in the screener.

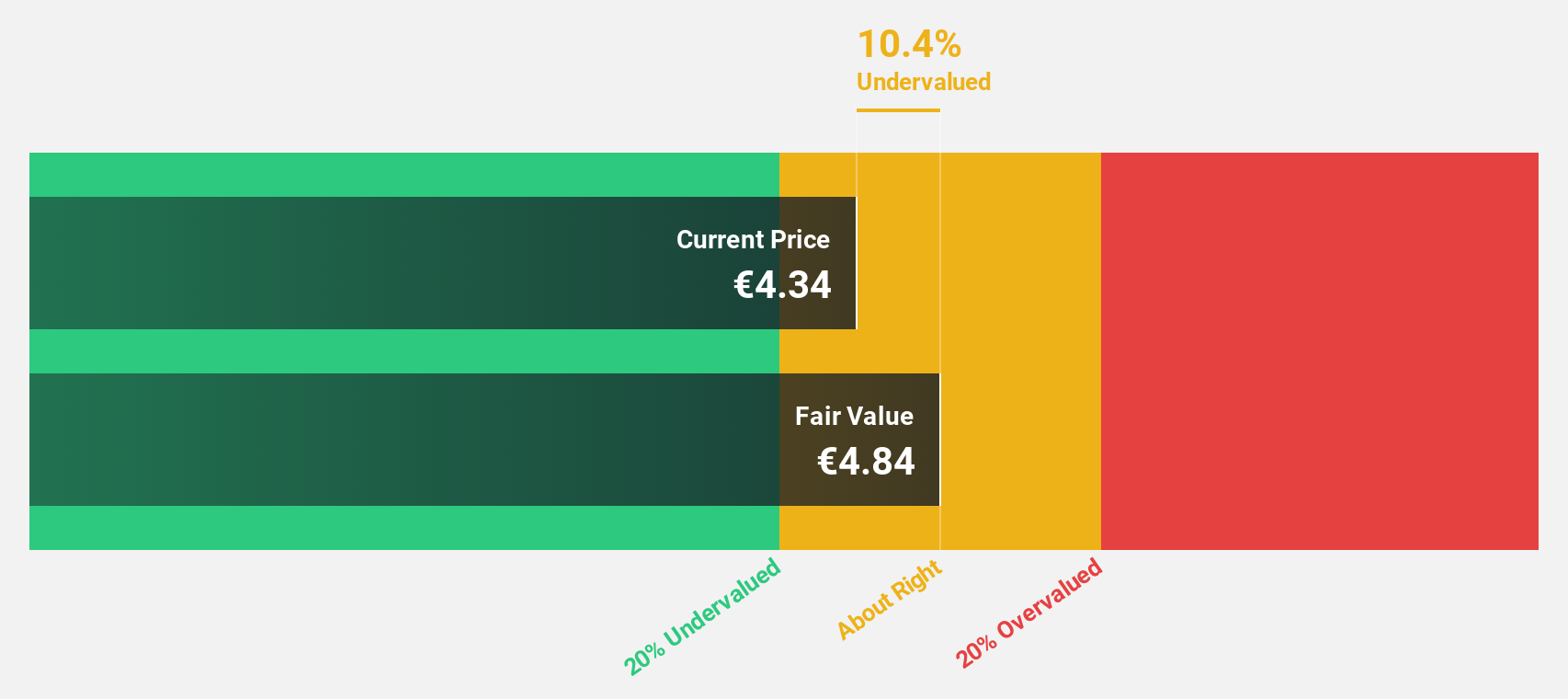

Datalogic (BIT:DAL)

Overview: Datalogic S.p.A. manufactures and sells automatic data capture and process automation products globally, with a market cap of €267.96 million.

Operations: Datalogic's revenue segments include automatic data capture and process automation products sold globally.

Estimated Discount To Fair Value: 31%

Datalogic is trading at €5, significantly below its fair value estimate of €7.24, indicating it may be undervalued based on cash flows. Despite a decline in sales to €366.36 million for the nine months ended September 2024, net income increased to €12.57 million from the previous year. Earnings are forecasted to grow significantly by 23.4% annually, outpacing both revenue growth and Italian market averages, though profit margins have decreased recently.

- According our earnings growth report, there's an indication that Datalogic might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Datalogic.

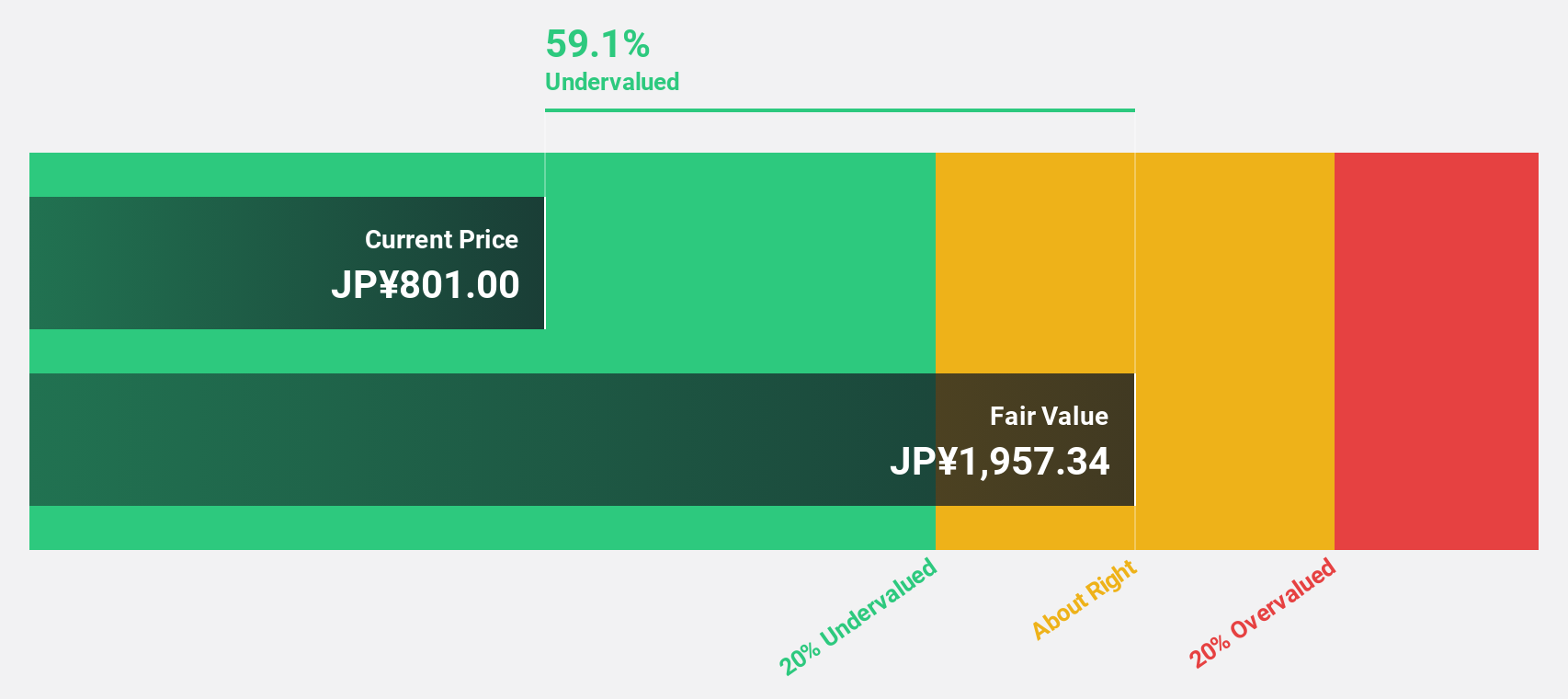

Takara Bio (TSE:4974)

Overview: Takara Bio Inc. operates in the bioindustry, CDMO, and gene therapy sectors across Japan, China, the rest of Asia, the United States, Europe, and internationally with a market cap of ¥120.78 billion.

Operations: The company generates revenue from its Drug Discovery segment, amounting to ¥44.15 billion.

Estimated Discount To Fair Value: 42.6%

Takara Bio is trading at ¥997, significantly below its estimated fair value of ¥1738.4, suggesting undervaluation based on cash flows. Its earnings are projected to grow substantially at 26% annually, surpassing the Japanese market average of 8%. However, profit margins have decreased from 13.2% to 2.1%, and future return on equity is expected to remain low at 4.7%, highlighting potential concerns despite strong earnings growth forecasts.

- Upon reviewing our latest growth report, Takara Bio's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Takara Bio.

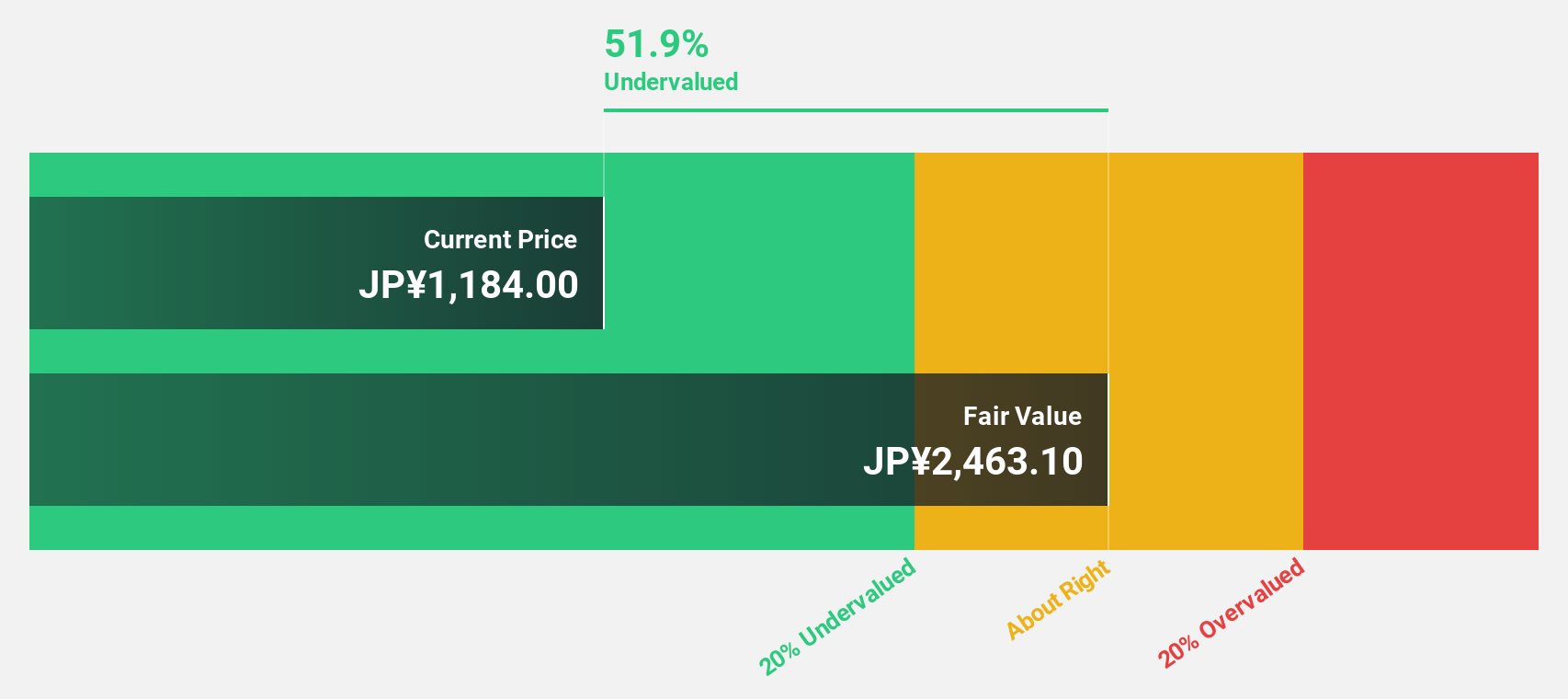

SIGMAXYZ Holdings (TSE:6088)

Overview: SIGMAXYZ Holdings Inc. operates in Japan, providing consulting, investment, and M&A advisory services, with a market cap of ¥76.33 billion.

Operations: The company generates revenue primarily from its consulting business, which accounts for ¥24.30 billion, and its investment business, contributing ¥184.92 million.

Estimated Discount To Fair Value: 37.3%

SIGMAXYZ Holdings is trading at ¥890, considerably below the estimated fair value of ¥1,420.26, highlighting potential undervaluation based on cash flows. Earnings are expected to grow at 15.3% annually, outpacing the Japanese market average of 8%. Despite a recent dividend cut and high share price volatility, revenue growth forecasts remain robust at 14.7% per year, and the company maintains a strong return on equity forecast of 28.7% in three years.

- Our growth report here indicates SIGMAXYZ Holdings may be poised for an improving outlook.

- Take a closer look at SIGMAXYZ Holdings' balance sheet health here in our report.

Seize The Opportunity

- Gain an insight into the universe of 870 Undervalued Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6088

SIGMAXYZ Holdings

Engages in the consulting, investment, and M&A advisory businesses in Japan.

Outstanding track record with flawless balance sheet and pays a dividend.