- Japan

- /

- Oil and Gas

- /

- TSE:2734

Arata And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, investor sentiment has been rattled by cautious Federal Reserve commentary and looming political uncertainties, causing a broad decline in U.S. stocks with smaller-cap indexes being hit the hardest. Despite these challenges, strong economic indicators such as robust GDP growth and rising retail sales suggest underlying resilience that could benefit small-cap companies poised for growth. In this environment, identifying stocks with solid fundamentals and untapped potential is crucial. Companies like Arata stand out as undiscovered gems that may offer promising opportunities for investors seeking to navigate these turbulent times effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.27% | -7.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| TechNVision Ventures | 14.35% | 20.69% | 63.60% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Arata (TSE:2733)

Simply Wall St Value Rating: ★★★★★☆

Overview: Arata Corporation operates as a wholesaler of daily goods, cosmetics, household goods, and pet supplies in Japan with a market capitalization of approximately ¥104.31 billion.

Operations: Arata generates revenue primarily from its wholesale business of daily necessities and cosmetics, amounting to ¥964.28 billion. The company's net profit margin is a key financial metric to consider in evaluating its profitability.

Arata, a promising player in the market, has demonstrated robust financial health with its net debt to equity ratio at 11.3%, indicating satisfactory leverage management. The company's earnings growth of 12.8% over the past year outpaced the Retail Distributors industry average of -1.5%, showcasing its competitive edge and high-quality earnings profile. Additionally, Arata's interest payments are well covered by EBIT at a multiple of 126.8x, reflecting strong operational efficiency and profitability. Recent activities include completing a share buyback program repurchasing 923,800 shares for ¥2,999 million and announcing a reduced dividend payout of JPY 51 per share for Q2 2024 compared to JPY 83 previously.

- Dive into the specifics of Arata here with our thorough health report.

Explore historical data to track Arata's performance over time in our Past section.

SALA (TSE:2734)

Simply Wall St Value Rating: ★★★★★★

Overview: SALA Corporation, with a market cap of ¥56.93 billion, operates in Japan primarily through its subsidiaries in the energy supply and solutions sector.

Operations: SALA Corporation generates revenue primarily from its Energy & Solutions Business, which accounts for ¥121.37 billion, followed by the Engineering & Maintenance Business at ¥36.38 billion. The Animal Healthcare Business contributes ¥25.46 billion to the overall revenue stream.

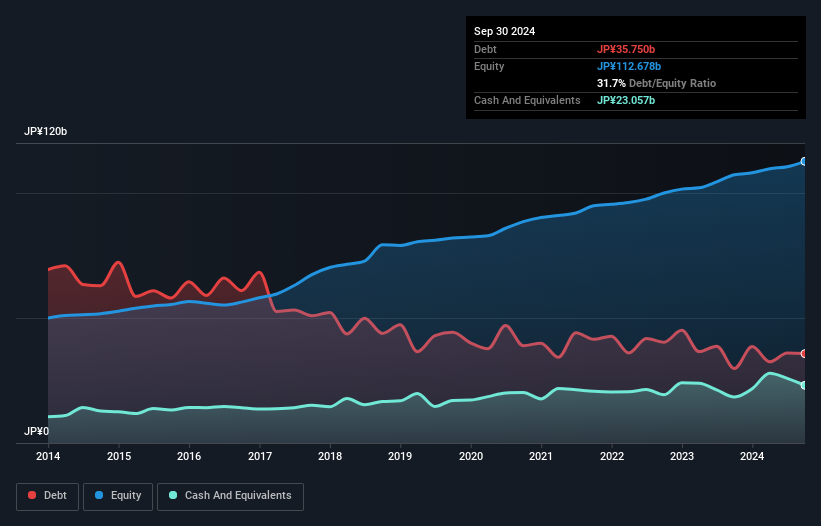

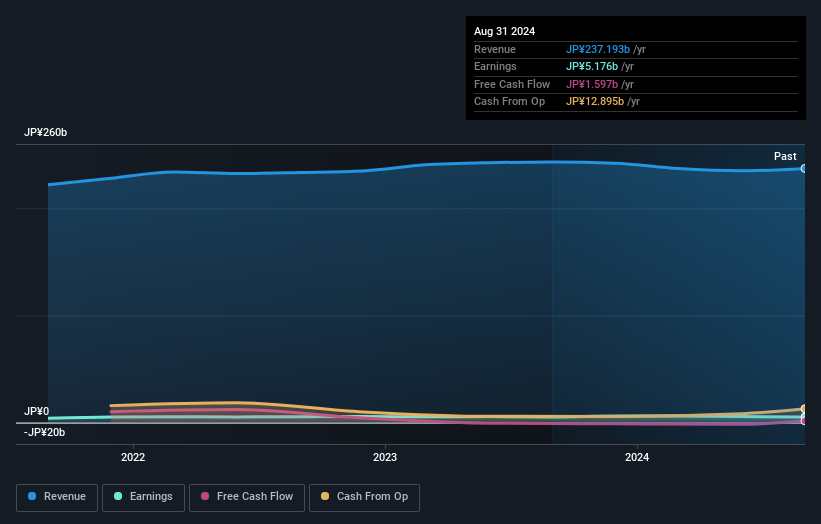

SALA, a smaller player in its industry, showcases high-quality earnings and a satisfactory net debt to equity ratio of 38.2%, which indicates solid financial health. Its interest payments are comfortably covered by EBIT at 199.1 times, suggesting strong operational efficiency. However, the past year's earnings growth was negative at -1.1%, contrasting with the Oil and Gas industry's average growth of 7%. The company's price-to-earnings ratio stands at 11.1x, below the JP market average of 13.4x, hinting at potential undervaluation in comparison to peers within its sector.

- Get an in-depth perspective on SALA's performance by reading our health report here.

Review our historical performance report to gain insights into SALA's's past performance.

AOKI Holdings (TSE:8214)

Simply Wall St Value Rating: ★★★★★☆

Overview: AOKI Holdings Inc. operates in Japan across multiple sectors, including fashion, anniversary and bridal services, entertainment, and real estate rental, with a market capitalization of ¥107.90 billion.

Operations: AOKI Holdings generates revenue primarily from its fashion business, contributing ¥100.66 billion, and entertainment sector, adding ¥75.97 billion. The anniversary and bridal segment provides an additional ¥10.82 billion in revenue, while real estate leasing contributes ¥6.71 billion.

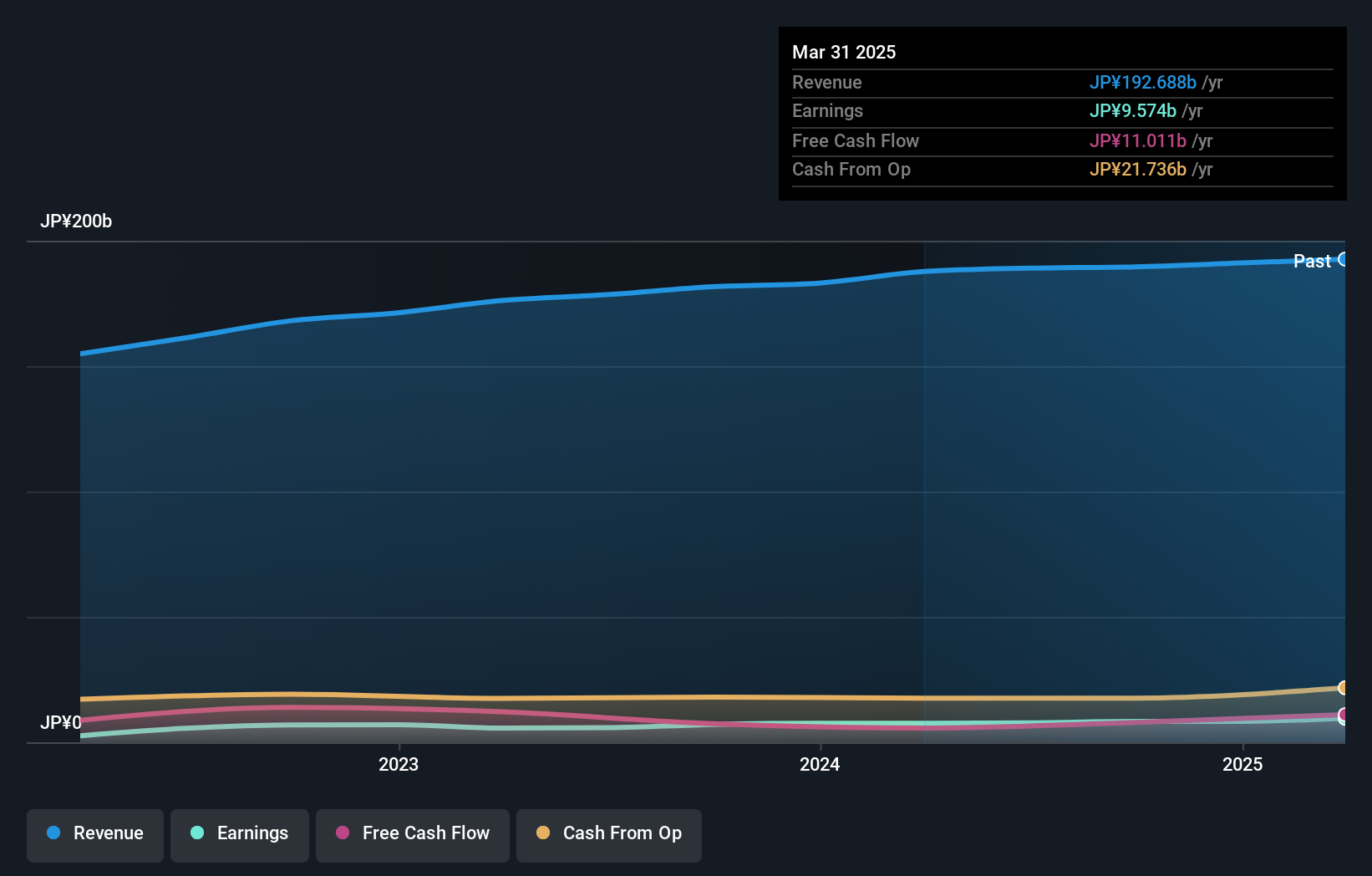

AOKI Holdings, a small cap player in the specialty retail sector, has shown notable financial resilience and growth. Over the past year, earnings surged by 16.8%, outpacing industry peers at 10.5%. The company's net debt to equity ratio stands at a satisfactory 6.6%, indicating prudent financial management, while interest payments are well covered with EBIT covering them 93 times over. Recently updated guidance projects net sales of ¥191.8 billion and operating profit of ¥15 billion for fiscal year ending March 2025, reflecting confidence in its strategic direction despite a slight increase in debt-to-equity from five years ago.

- Navigate through the intricacies of AOKI Holdings with our comprehensive health report here.

Gain insights into AOKI Holdings' historical performance by reviewing our past performance report.

Key Takeaways

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4619 more companies for you to explore.Click here to unveil our expertly curated list of 4622 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2734

SALA

Through its subsidiaries, engages in the energy supply and solution business in Japan.

Good value with adequate balance sheet.

Market Insights

Community Narratives