Discovering NEXTIN And 2 Additional Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

In the face of global market volatility, with U.S. equities experiencing declines and inflation concerns persisting, investors are increasingly turning their attention to stocks that may be undervalued. Discovering value in such an environment requires a keen eye for companies trading below their intrinsic worth, offering potential opportunities amidst broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥17.11 | CN¥34.17 | 49.9% |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY39.32 | TRY78.59 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.89 | 49.9% |

| Helens International Holdings (SEHK:9869) | HK$1.93 | HK$3.85 | 49.9% |

| Elekta (OM:EKTA B) | SEK61.10 | SEK122.02 | 49.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.93 | CN¥43.78 | 49.9% |

| Meriaura Group Oyj (OM:MERIS) | SEK0.49 | SEK0.98 | 50% |

| Constellium (NYSE:CSTM) | US$10.32 | US$20.58 | 49.9% |

| W5 Solutions (OM:W5) | SEK47.20 | SEK93.96 | 49.8% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.8% |

Let's dive into some prime choices out of the screener.

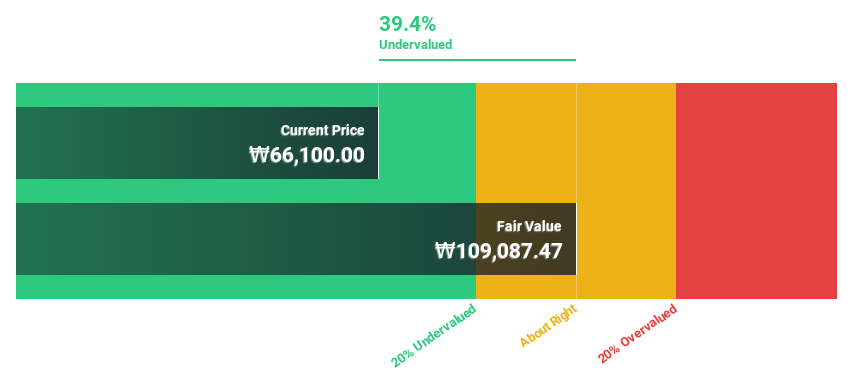

NEXTIN (KOSDAQ:A348210)

Overview: NEXTIN, Inc. specializes in manufacturing defect inspection and metrology systems for the semiconductor and display industries in South Korea, with a market cap of approximately ₩603.66 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Equipment and Services segment, which generated approximately ₩101.98 billion.

Estimated Discount To Fair Value: 15.2%

NEXTIN is trading 15.2% below its estimated fair value of ₩68,865.14, indicating potential undervaluation based on cash flows. Earnings have grown by 7.6% over the past year and are forecast to grow significantly at 36.3% annually, outpacing the KR market's growth rate. Recent buybacks totaling ₩4,991.89 million may support share price stability and enhance shareholder value despite mixed earnings results for the third quarter of 2024 compared to the previous year.

- The growth report we've compiled suggests that NEXTIN's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of NEXTIN stock in this financial health report.

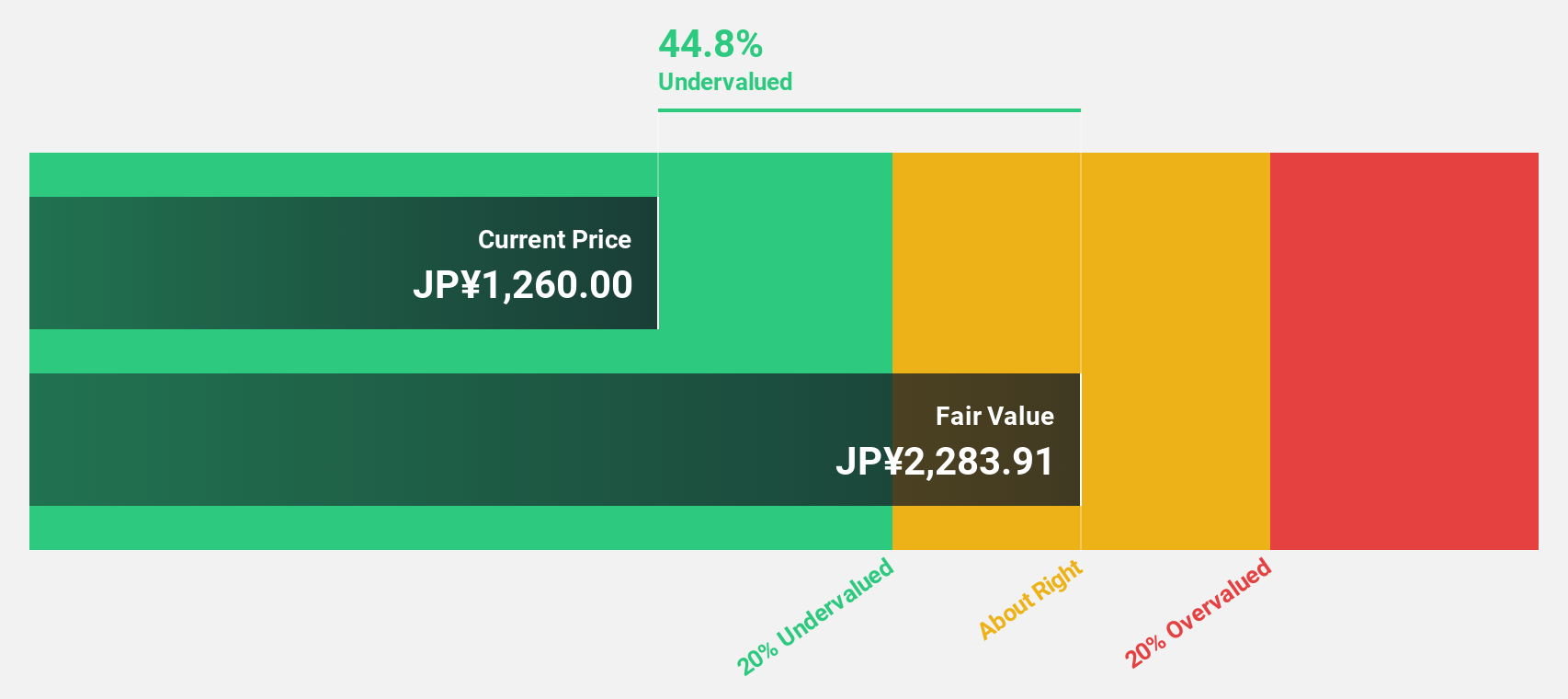

Raksul (TSE:4384)

Overview: Raksul Inc. operates as a provider of printing services in Japan, with a market capitalization of approximately ¥68.34 billion.

Operations: Revenue segments for the company include printing services in Japan, totaling ¥53.10 billion.

Estimated Discount To Fair Value: 16.3%

Raksul is trading 16.3% below its estimated fair value of ¥1,400.75, suggesting undervaluation based on cash flows. Despite a decrease in profit margins from 3.7% to 2.4%, earnings are projected to grow significantly at 24.9% annually, surpassing the JP market's growth rate. A recent share buyback program worth ¥700 million aims to enhance profitability and cash flow generation, while a strategic company split seeks to bolster business competitiveness and agility.

- Upon reviewing our latest growth report, Raksul's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Raksul with our comprehensive financial health report here.

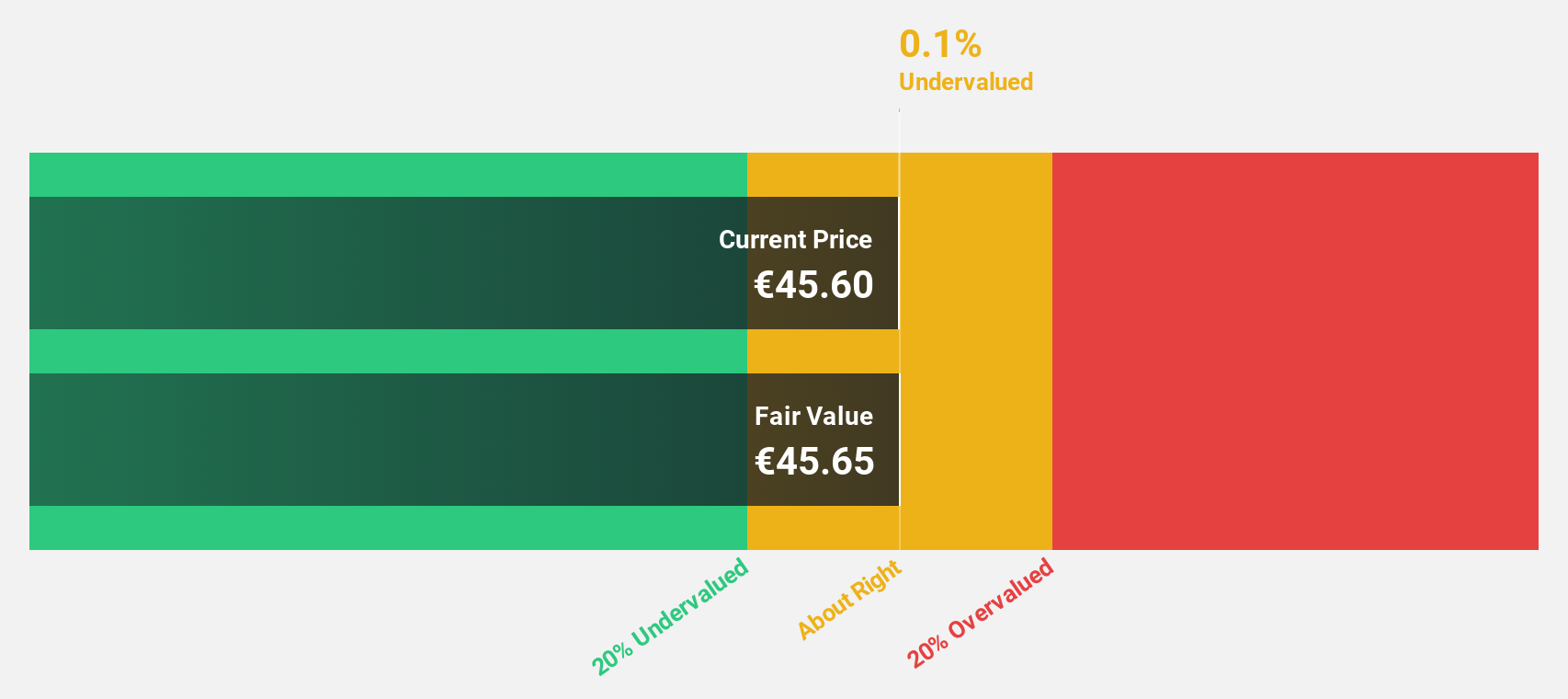

init innovation in traffic systems (XTRA:IXX)

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of €377.27 million.

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, amounting to €245.89 million.

Estimated Discount To Fair Value: 22.9%

init innovation in traffic systems is trading 22.9% below its fair value estimate of €49.52, indicating undervaluation based on cash flows. Earnings are expected to grow significantly at 27.8% annually, outpacing the German market's growth rate. Recent earnings reports show a solid increase in sales to €178.12 million for the first nine months of 2024, although net income slightly decreased in Q3 compared to last year, reflecting short-term challenges amidst strong long-term prospects.

- Our comprehensive growth report raises the possibility that init innovation in traffic systems is poised for substantial financial growth.

- Get an in-depth perspective on init innovation in traffic systems' balance sheet by reading our health report here.

Turning Ideas Into Actions

- Reveal the 870 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if init innovation in traffic systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IXX

init innovation in traffic systems

Engages in the provision of intelligent transportation systems solutions for public transportation worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives