- Japan

- /

- Auto Components

- /

- TSE:7220

Discover ESR-REIT And 2 More Stocks That May Be Priced Below Their Estimated Worth

Reviewed by Simply Wall St

In a week marked by mixed performances across major global indices, growth stocks have outshone their value counterparts, highlighting the ongoing divergence in market trends. With the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite reaching record highs amid economic reports and geopolitical developments, investors are increasingly focused on identifying opportunities that may be undervalued in this complex environment. In such conditions, discerning investors often look for stocks that are priced below their estimated worth—those with strong fundamentals but trading at lower valuations—offering potential for long-term growth as market dynamics evolve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.06 | US$99.93 | 49.9% |

| S Foods (TSE:2292) | ¥2744.00 | ¥5472.35 | 49.9% |

| Accent Group (ASX:AX1) | A$2.47 | A$4.91 | 49.7% |

| T'Way Air (KOSE:A091810) | ₩2530.00 | ₩5054.93 | 49.9% |

| Acerinox (BME:ACX) | €9.98 | €19.93 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1446.00 | ¥2883.68 | 49.9% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$19.71 | MX$39.28 | 49.8% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$53.95 | 49.8% |

| Visional (TSE:4194) | ¥8543.00 | ¥16998.76 | 49.7% |

| Equifax (NYSE:EFX) | US$266.82 | US$530.98 | 49.7% |

We'll examine a selection from our screener results.

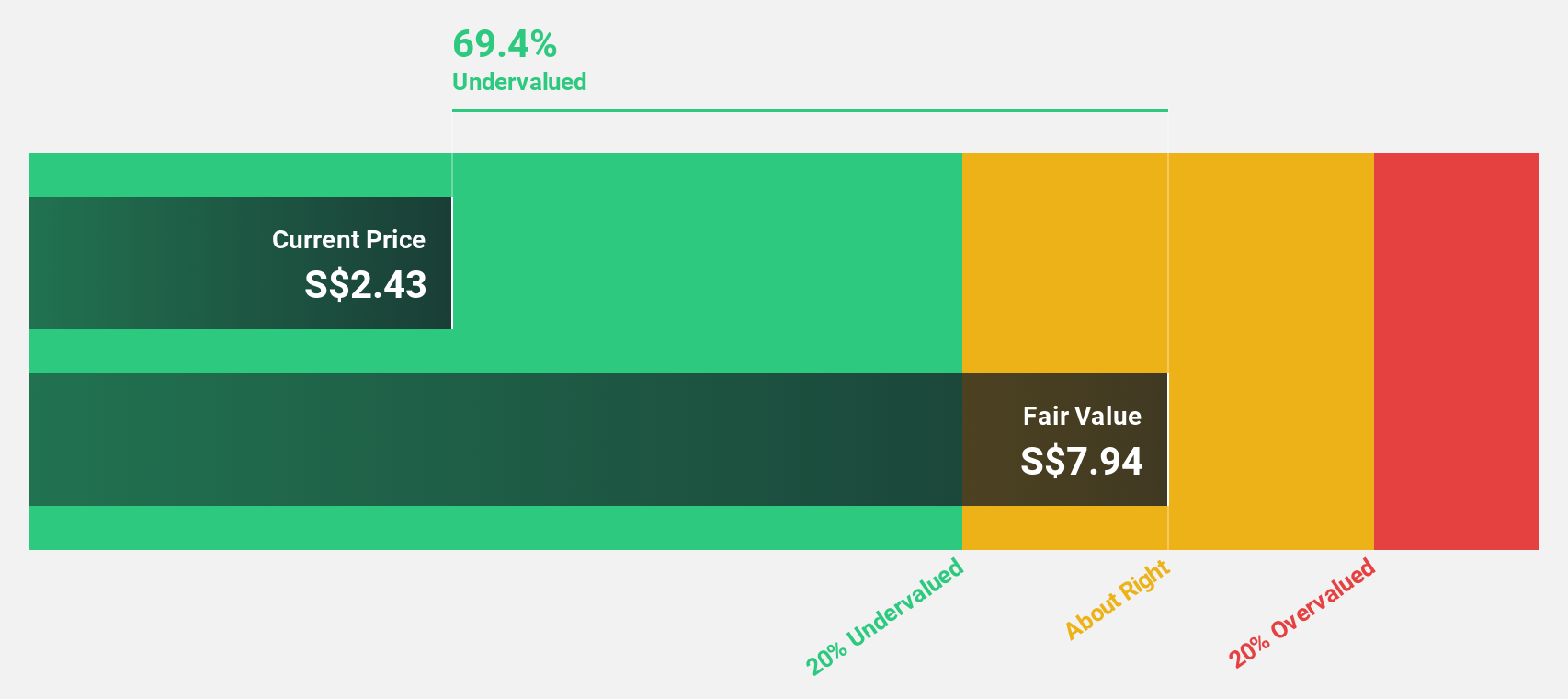

ESR-REIT (SGX:J91U)

Overview: ESR-LOGOS REIT is a prominent Asia Pacific S-REIT focused on New Economy sectors, with a market cap of SGD2.09 billion.

Operations: The company generates revenue of SGD374.31 million from its investments in industrial properties.

Estimated Discount To Fair Value: 29.4%

ESR-REIT is trading at S$0.27, significantly undervalued compared to its estimated fair value of S$0.38, based on discounted cash flow analysis. The REIT's revenue growth is expected to outpace the Singapore market slightly, with forecasts indicating profitability within three years. Despite a history of shareholder dilution and an unstable dividend track record, recent share buyback initiatives aim to enhance return on equity and stabilize market confidence amidst ongoing business expansions.

- Our earnings growth report unveils the potential for significant increases in ESR-REIT's future results.

- Dive into the specifics of ESR-REIT here with our thorough financial health report.

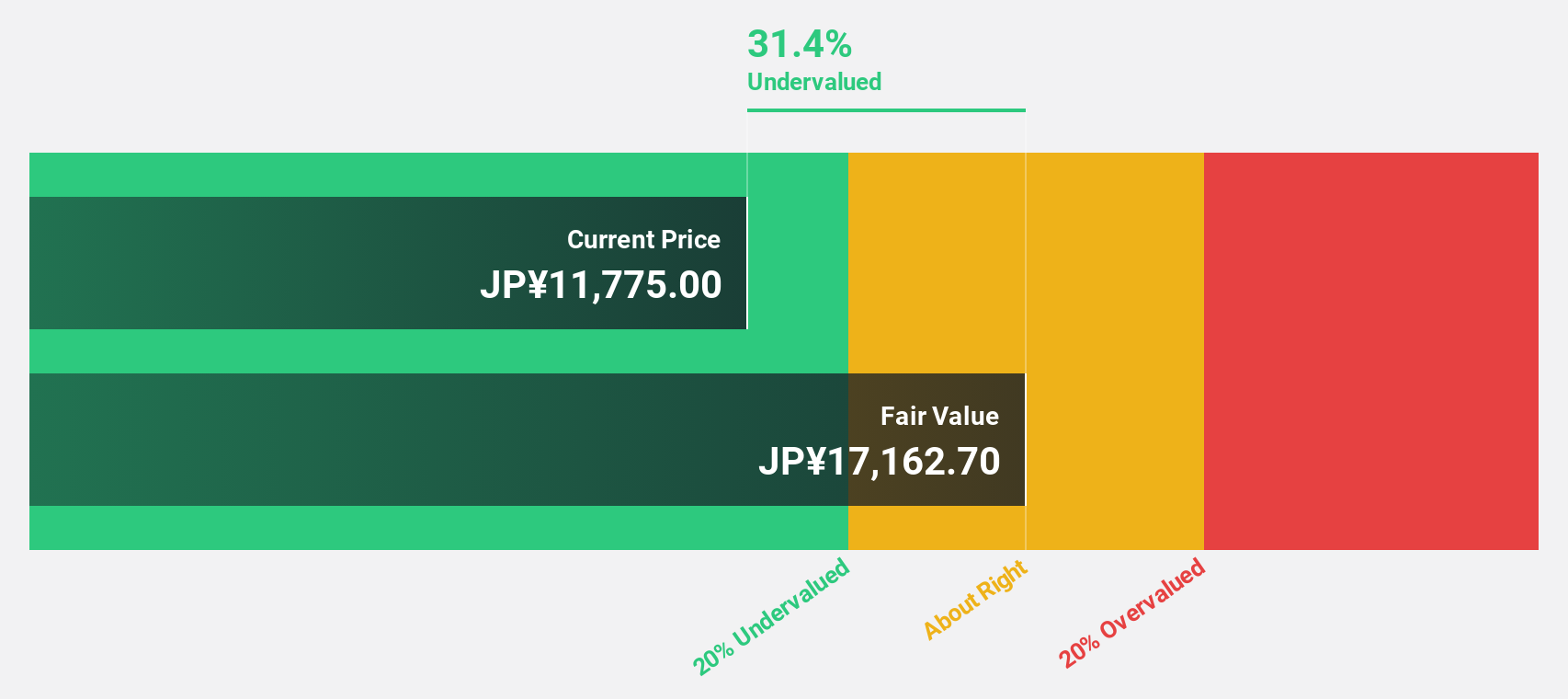

Visional (TSE:4194)

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥326.96 billion.

Operations: The company's revenue is primarily derived from its HR Tech segment, which accounts for ¥63.84 billion, with an additional contribution of ¥2.26 billion from the Incubation segment.

Estimated Discount To Fair Value: 49.7%

Visional is trading at ¥8,543, significantly below its estimated fair value of ¥16,998.76 based on discounted cash flow analysis. The company's revenue and earnings are projected to grow faster than the Japanese market at 11% and 12.42% annually, respectively. Despite slower revenue growth compared to high-growth benchmarks, Visional's robust earnings trajectory and undervaluation position it as a compelling option for investors seeking value based on cash flows.

- The growth report we've compiled suggests that Visional's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Visional stock in this financial health report.

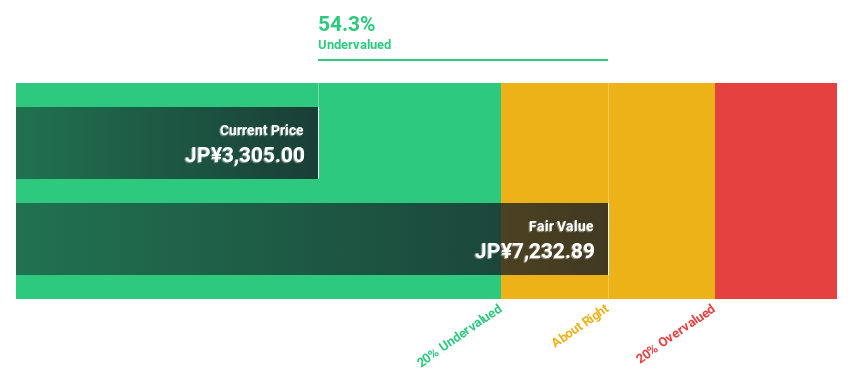

Musashi Seimitsu Industry (TSE:7220)

Overview: Musashi Seimitsu Industry Co., Ltd. manufactures and sells transportation equipment both in Japan and internationally, with a market capitalization of ¥249.32 billion.

Operations: Revenue Segments (in millions of ¥): The company generates revenue through the manufacturing and sale of transportation equipment across various markets.

Estimated Discount To Fair Value: 48.6%

Musashi Seimitsu Industry is trading at ¥4,040, well below its estimated fair value of ¥7,865.67 according to discounted cash flow analysis. Despite a high debt level and recent share price volatility, the company shows promise with earnings forecasted to grow 25.53% annually over the next three years—outpacing the Japanese market's growth rate. This undervaluation alongside strong earnings prospects makes Musashi Seimitsu an intriguing consideration for value-focused investors.

- Insights from our recent growth report point to a promising forecast for Musashi Seimitsu Industry's business outlook.

- Click here to discover the nuances of Musashi Seimitsu Industry with our detailed financial health report.

Taking Advantage

- Unlock our comprehensive list of 894 Undervalued Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7220

Musashi Seimitsu Industry

Manufactures and sells transportation equipment in Japan and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives