- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2368

Asian Insider-Owned Growth Stocks To Watch In April 2025

Reviewed by Simply Wall St

As trade tensions between the U.S. and China continue to escalate, impacting global markets and consumer sentiment, investors are closely monitoring the Asian market for opportunities amidst uncertainty. In such volatile times, growth companies with high insider ownership can offer a unique appeal, as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 27% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.7% | 24.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| UTour Group (SZSE:002707) | 23.5% | 32.7% |

| Synspective (TSE:290A) | 12.8% | 44.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

Here we highlight a subset of our preferred stocks from the screener.

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥315.73 billion.

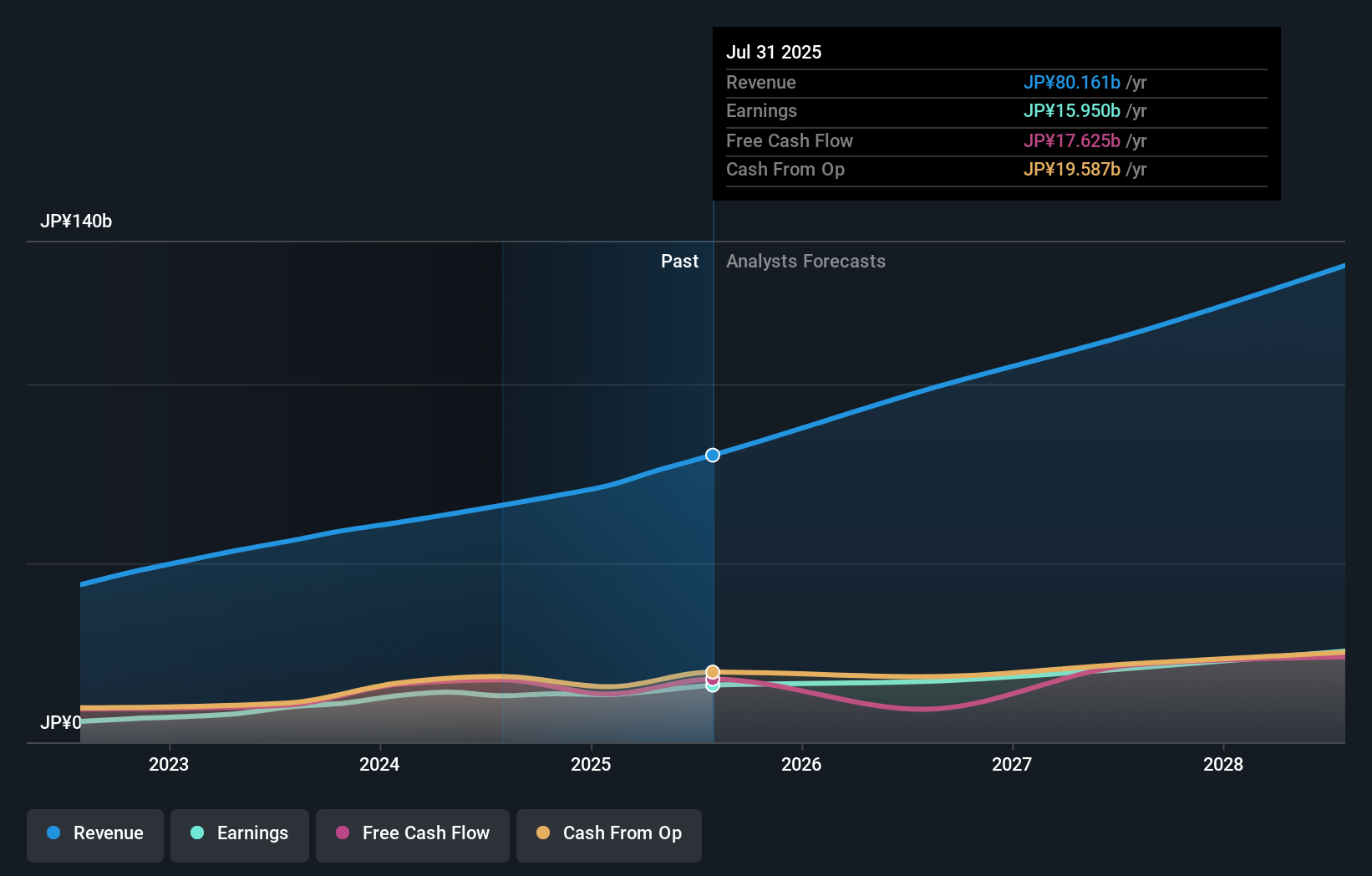

Operations: The company's revenue is primarily generated from its HR Tech segment, accounting for ¥69.50 billion, with an additional contribution of ¥2.10 billion from the Incubation segment.

Insider Ownership: 38.7%

Revenue Growth Forecast: 12.3% p.a.

Visional is trading at 52.2% below its estimated fair value, with analysts expecting a 20.6% price increase. Its earnings are forecast to grow at 14.6% annually, outpacing the JP market's 7.7%, though revenue growth is slower than the ideal high-growth threshold but still exceeds the market average of 4.3%. Despite no recent insider trading activity, Visional's strong historical earnings growth and high future return on equity make it a compelling consideration for growth-oriented investors in Asia.

- Click here to discover the nuances of Visional with our detailed analytical future growth report.

- According our valuation report, there's an indication that Visional's share price might be on the cheaper side.

Baycurrent (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Baycurrent, Inc. offers consulting services in Japan and has a market cap of ¥1.14 trillion.

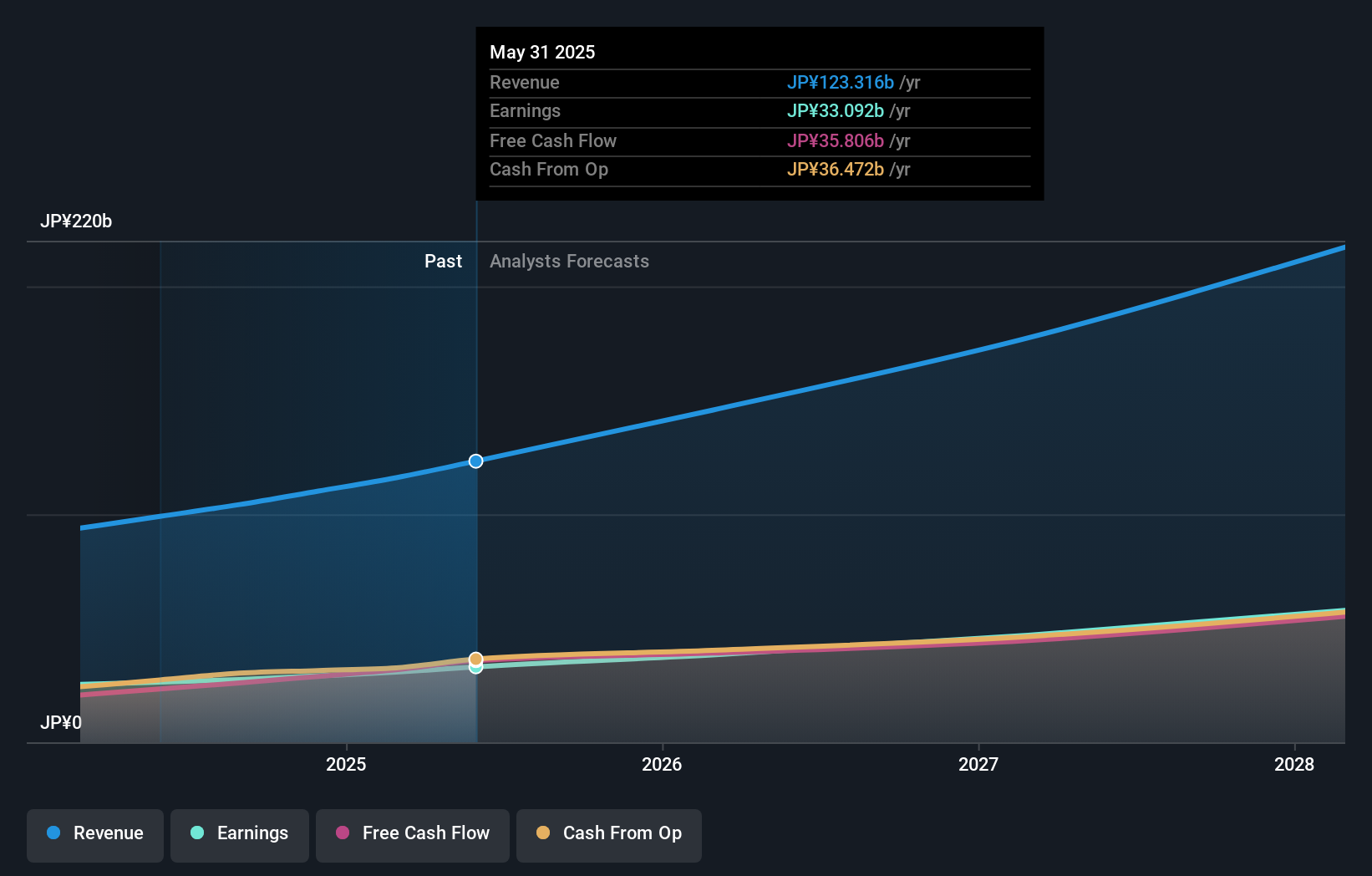

Operations: Baycurrent, Inc.'s revenue is derived from providing consulting services in Japan.

Insider Ownership: 13.9%

Revenue Growth Forecast: 18.2% p.a.

Baycurrent's earnings are projected to grow at 19.1% annually, surpassing the JP market's 7.7%. Despite recent share price volatility, the company trades at a significant discount to its fair value. Baycurrent has announced a ¥3 billion share buyback and increased dividends, reflecting strong shareholder return policies. Recent inclusion in the Nikkei 225 Index underscores its market prominence, while high insider ownership aligns management interests with shareholders amid robust revenue growth forecasts of 18.2% annually.

- Unlock comprehensive insights into our analysis of Baycurrent stock in this growth report.

- The analysis detailed in our Baycurrent valuation report hints at an inflated share price compared to its estimated value.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gold Circuit Electronics Ltd. is a Taiwanese company that designs, manufactures, processes, and distributes multilayer printed circuit boards, with a market cap of NT$89.06 billion.

Operations: The company generates revenue from its manufacturing and sales of printed circuit boards, amounting to NT$38.95 billion.

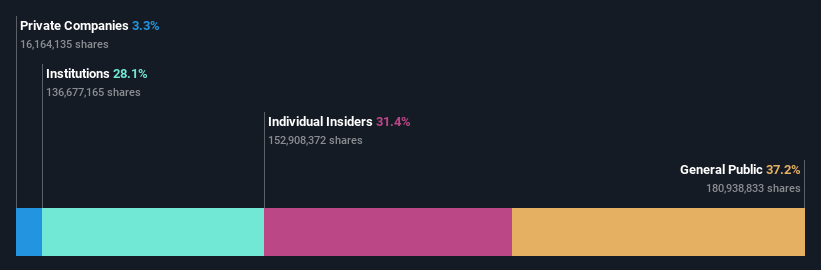

Insider Ownership: 31.4%

Revenue Growth Forecast: 17.7% p.a.

Gold Circuit Electronics is experiencing robust growth, with earnings increasing by 59.1% over the past year and revenue expected to grow annually at 17.7%, outpacing the Taiwan market's average. Despite high share price volatility, its price-to-earnings ratio of 15.9x remains attractive compared to the market average of 17.6x. Recent earnings announcements showed significant improvements in sales and net income, while insider ownership aligns management interests with shareholders amid expectations of substantial profit growth above market rates.

- Click to explore a detailed breakdown of our findings in Gold Circuit Electronics' earnings growth report.

- Our comprehensive valuation report raises the possibility that Gold Circuit Electronics is priced lower than what may be justified by its financials.

Make It Happen

- Click here to access our complete index of 640 Fast Growing Asian Companies With High Insider Ownership.

- Searching for a Fresh Perspective? Trump has pledged to "unleash" American oil and gas and these 20 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Gold Circuit Electronics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2368

Gold Circuit Electronics

Designs, manufactures, processes, and distributes multilayer printed circuit boards in Taiwan.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives