- Japan

- /

- Professional Services

- /

- TSE:2471

S-Pool (TSE:2471) Earnings Growth Surges, Challenging Valuation Concerns on Premium Price

Reviewed by Simply Wall St

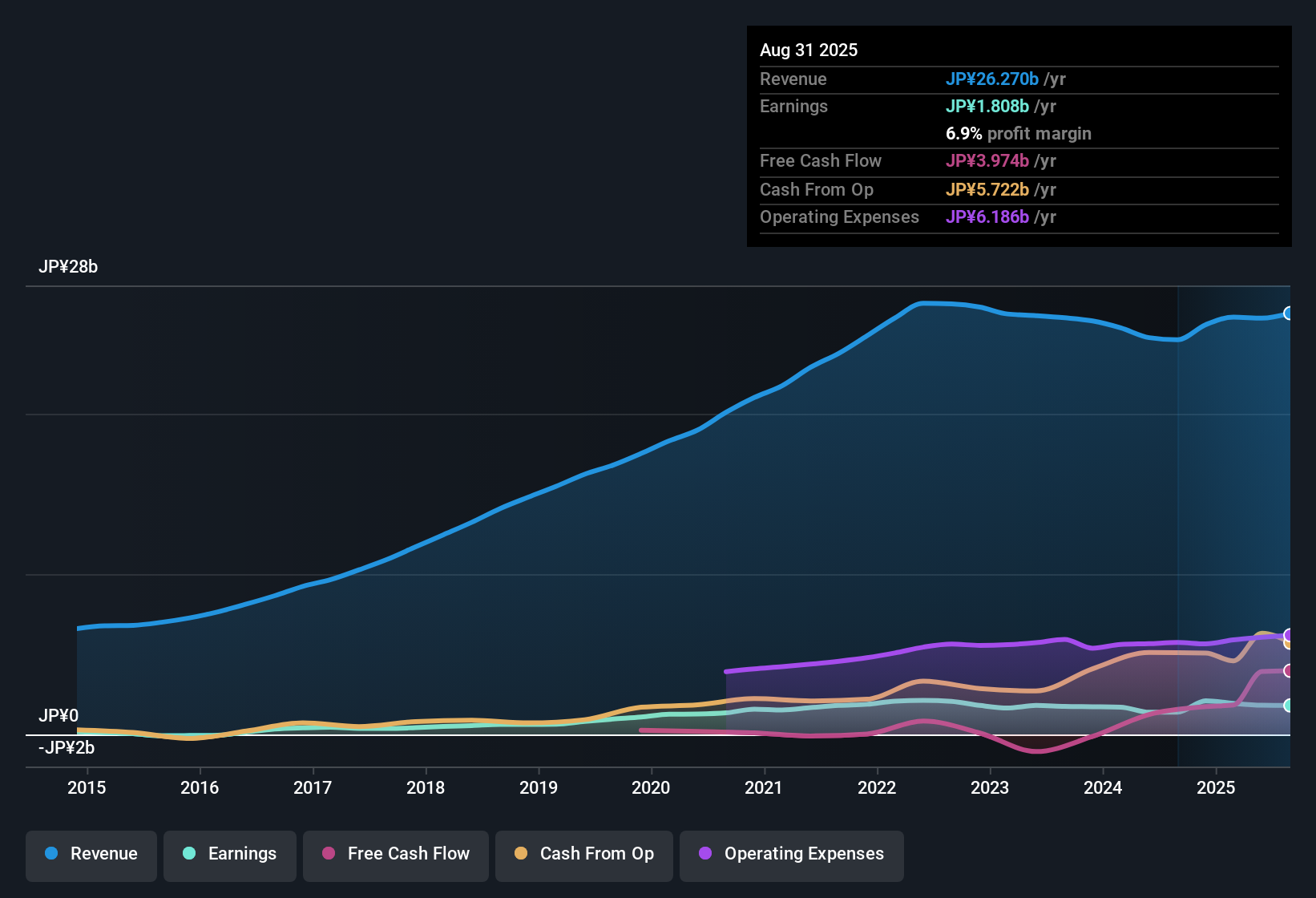

S-Pool (TSE:2471) delivered standout results in its latest disclosure, with earnings growth accelerating to 29.9% over the past year compared to its 5-year average of 1.4% per year. The company’s net profit margin also improved to 6.9% from 5.7%, and forecasts point to EPS climbing at a 13.6% annual rate while revenue is expected to rise by 7.7% per year, eclipsing growth expectations for the broader Japanese market. With high-quality earnings and widening margins backing this progress, investors are likely to take notice of the robust outlook even as the company trades at a premium to some fair value measures.

See our full analysis for S-Pool.This sets the stage for a look at how the company's numbers compare to the big-picture narratives in the market. It also raises the question of whether investor sentiment is in sync with the fundamentals.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Strengthen Alongside Profit Quality

- S-Pool’s net profit margin climbed to 6.9% from 5.7% previously, a meaningful improvement that highlights increasingly efficient operations and higher earnings quality.

- Market participants watching margin trends note that high-quality earnings are typically a bullish signal for business durability.

- Even as the company’s margin increased, the jump from 5.7% to 6.9% puts S-Pool ahead of many outsourcing peers, supporting optimism about sustainable profitability.

- Bulls see this momentum as setting the company up to capitalize on sector tailwinds if the efficiency can be maintained in future years.

Peer Comparison: Lower P/E, Higher Growth

- S-Pool trades at a Price-To-Earnings Ratio (P/E) of 14.5x, noticeably below its peer group average of 21x and marginally under the industry average of 15.4x, despite outpacing broader market growth forecasts.

- The prevailing investment view highlights a tension: while a lower P/E usually suggests relatively modest growth expectations or higher risk, S-Pool’s revenue is actually forecast to grow at 7.7% annually versus 4.4% for the broader Japanese market.

- Investors may find this combination surprising, as it is unusual for a firm with above-industry growth prospects to trade at a discount to both sector and peer average multiples.

- This supports a narrative of hidden value, provided the company’s premium to DCF fair value is adequately explained.

Premium to DCF Fair Value Poses a Question

- S-Pool’s share price of ¥336 significantly exceeds its DCF fair value estimate of ¥105.6, flagging a 218% premium that may prompt investors to reexamine the risk/reward profile despite otherwise attractive metrics.

- In the context of this gap, the prevailing view points out that markets sometimes price in sector tailwinds or intangible business strengths that are not captured by fundamental valuation models.

- Bulls may argue this premium reflects strong sector momentum and robust growth guidance, with enhanced earnings quality helping justify the market’s optimism.

- Critically, the relatively weak financial position flagged in the risk data means this valuation gap could attract greater scrutiny if growth stalls or market sentiment shifts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on S-Pool's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite S-Pool’s impressive growth, its significant premium to fair value and relatively weak financial position make its long-term risk profile less secure.

If you’re looking for alternatives with sturdier finances and more resilience, check out solid balance sheet and fundamentals stocks screener (1980 results) for companies with stronger balance sheets and fundamentals that can help them withstand market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2471

Solid track record established dividend payer.

Market Insights

Community Narratives