- Japan

- /

- Wireless Telecom

- /

- TSE:147A

Insider-Favored Growth Companies To Watch In January 2025

Reviewed by Simply Wall St

As global markets continue to rally, buoyed by optimism surrounding potential trade deals and advancements in artificial intelligence, growth stocks have outperformed their value counterparts for the first time this year. In such an environment, companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Let's take a closer look at a couple of our picks from the screened companies.

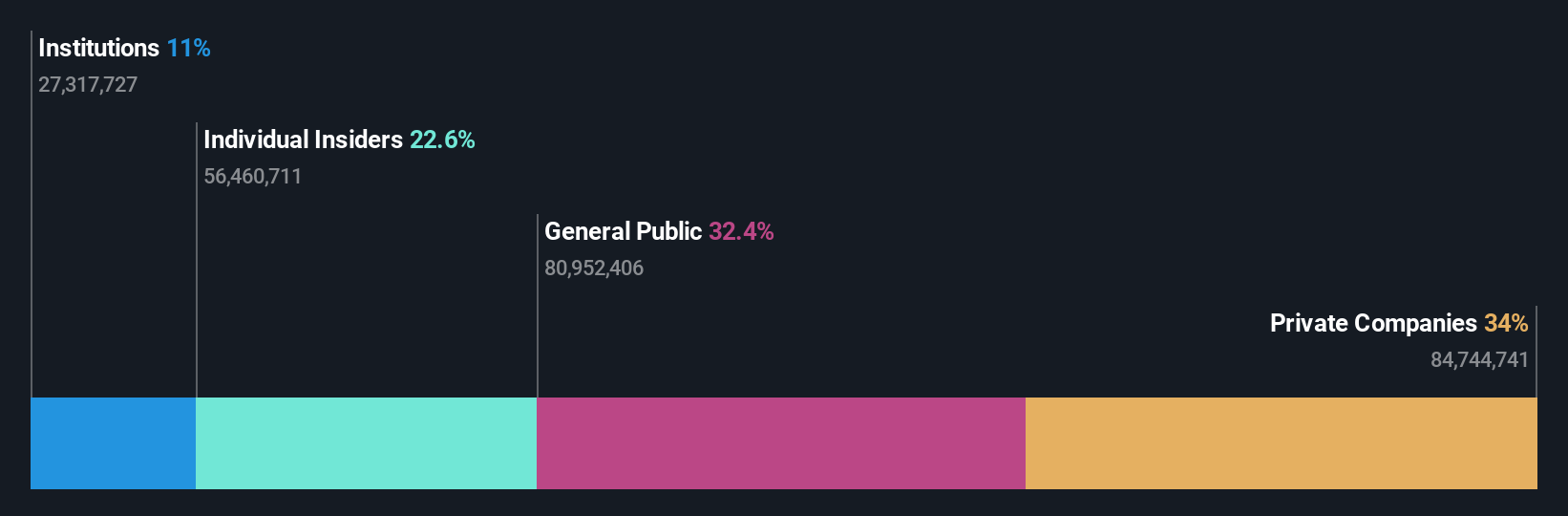

Guangdong Haomei New MaterialsLtd (SZSE:002988)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Haomei New Materials Co., Ltd. specializes in the research, development, manufacture and sale of aluminum profiles in China with a market cap of CN¥4.99 billion.

Operations: Guangdong Haomei New Materials Co., Ltd. generates revenue through the research, development, production, and sale of aluminum profiles within China.

Insider Ownership: 23.6%

Guangdong Haomei New Materials Ltd. shows promising growth prospects with forecasted earnings growth of 27.3% annually, surpassing the CN market average. Despite slower revenue growth at 16.8%, it remains above market expectations and trades at a favorable price-to-earnings ratio of 22x compared to the broader market's 35.1x. However, concerns include unsustainable dividends and low future return on equity projections, while insider trading activities have been minimal recently.

- Unlock comprehensive insights into our analysis of Guangdong Haomei New MaterialsLtd stock in this growth report.

- The analysis detailed in our Guangdong Haomei New MaterialsLtd valuation report hints at an deflated share price compared to its estimated value.

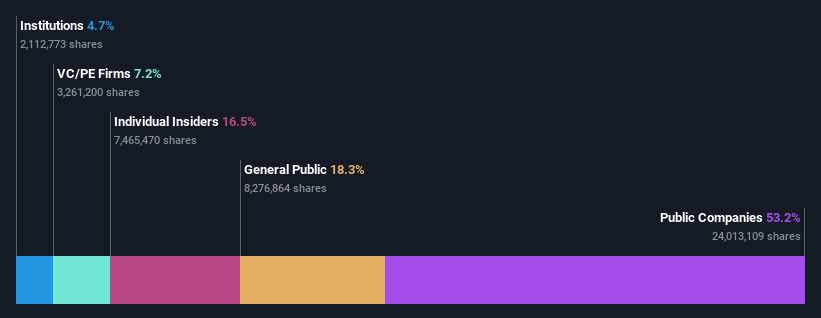

Soracom (TSE:147A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Soracom, Inc. offers Internet of Things (IoT) based cellular connectivity solutions and has a market capitalization of approximately ¥50.27 billion.

Operations: The company's revenue is primarily generated from its IoT Platform segment, which accounts for ¥7.93 billion.

Insider Ownership: 16.5%

Soracom is poised for substantial growth, with projected annual earnings increases of 36.8%, outpacing the JP market. Revenue is expected to rise by 21.9% annually, driven by innovative products like their newly launched iSIM technology, which enhances IoT connectivity and device efficiency. Despite recent share price volatility and outdated financial data, Soracom's strategic partnerships with industry leaders support its expansion in the IoT sector without significant insider trading activity reported recently.

- Click here and access our complete growth analysis report to understand the dynamics of Soracom.

- Our comprehensive valuation report raises the possibility that Soracom is priced higher than what may be justified by its financials.

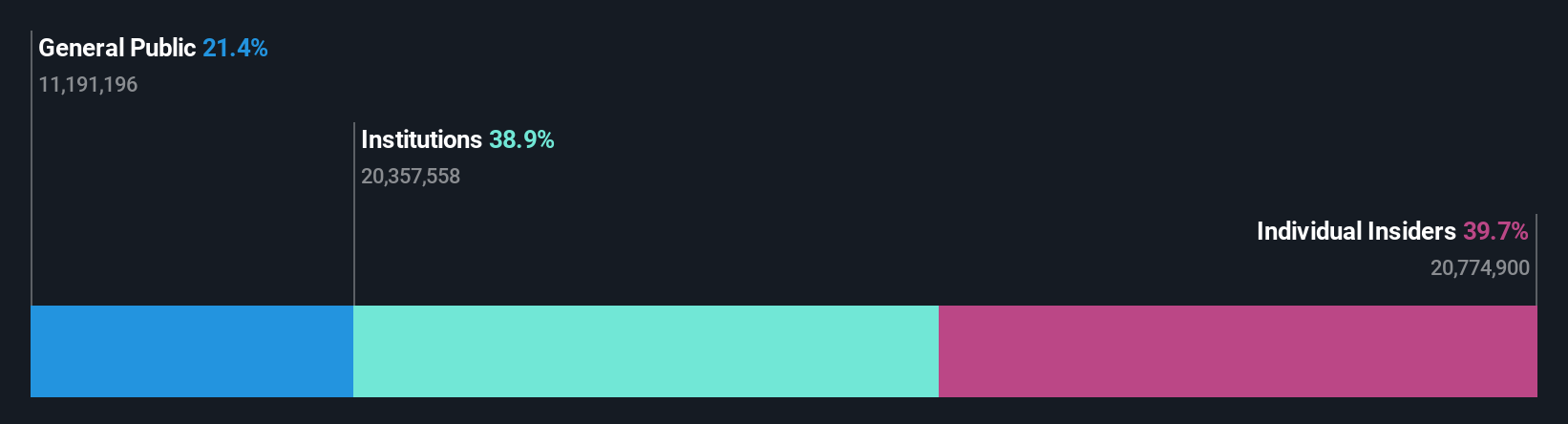

DIP (TSE:2379)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DIP Corporation is a labor force solution company that offers personnel recruiting services in Japan, with a market cap of ¥121.99 billion.

Operations: The company generates revenue from its DX Business, which accounts for ¥6.63 billion, and its Human Resources Services Business, contributing ¥49.55 billion.

Insider Ownership: 39.7%

DIP Corporation is positioned for growth, with revenue expected to increase by 8.5% annually, surpassing the JP market average. Earnings are forecasted to grow at 15.8% per year, reflecting strong performance potential despite a lack of recent insider trading activity. The stock trades at a significant discount to its fair value and offers good relative value compared to peers. However, it has an unstable dividend history and projected earnings growth doesn't exceed the high threshold of 20%.

- Click here to discover the nuances of DIP with our detailed analytical future growth report.

- The valuation report we've compiled suggests that DIP's current price could be quite moderate.

Seize The Opportunity

- Investigate our full lineup of 1469 Fast Growing Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Soracom, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:147A

Soracom

Provides Internet of Things (IoT) based cellular connectivity solutions.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives