- Japan

- /

- Commercial Services

- /

- TSE:2305

STUDIO ALICE (TSE:2305) Margin Improvement Challenges Persistent Bearish Narratives on Turnaround Prospects

Reviewed by Simply Wall St

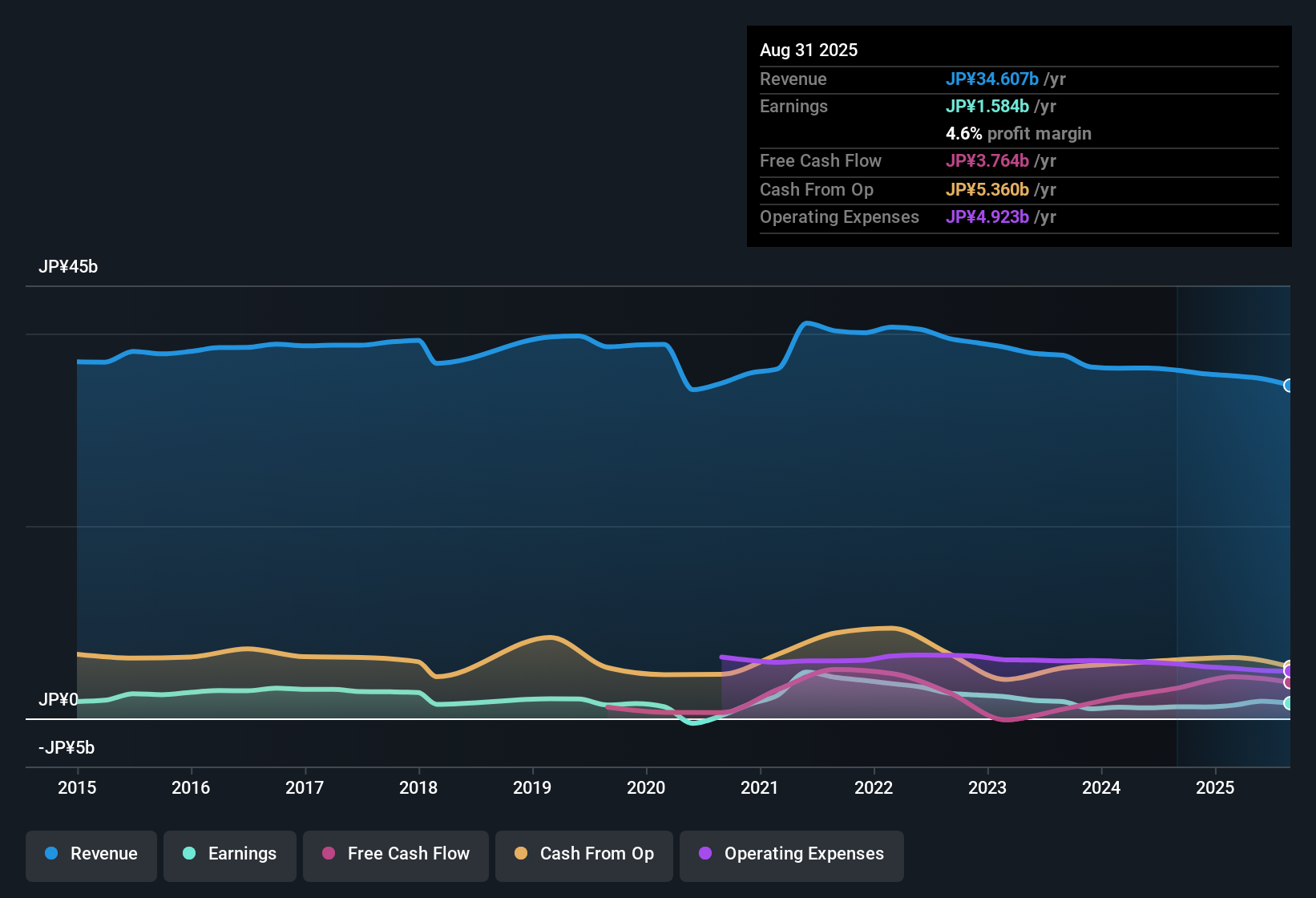

STUDIO ALICELtd (TSE:2305) posted a net profit margin of 4.6%, improving over last year’s 3.3%, while earnings grew 31.5% this year compared to a five-year average annual decline of 16.7%. The stock trades at a Price-To-Earnings Ratio of 21.8x, which is notably above both immediate peers (12.5x) and the broader JP Commercial Services industry (12.6x). Margin improvement and a return to earnings growth distinguish this release as a positive step for the company, even as the multi-year earnings trend remains negative and valuation runs high against sector benchmarks.

See our full analysis for STUDIO ALICELtd.Up next, we will weigh these headline figures against the narratives that dominate investor discussions. This will highlight the areas where the numbers support or disrupt market expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Holds Steady at 4.6%

- Net profit margin improved to 4.6% from last year’s 3.3%, with earnings growing 31.5% after five years of an average annual decline of 16.7%.

- While the recent margin boost would typically back a bullish narrative that sees STUDIO ALICELtd as a turnaround story,

- The five-year annual earnings decline rate of 16.7% sits in sharp contrast to this year’s robust growth. This raises the bar for anyone claiming SA’s profits are now on a permanently higher footing.

- The significant short-term improvement makes it harder to predict whether the margin lift is lasting or just a positive blip within a broader negative trend.

Dividend Stability in the Spotlight

- Present risk disclosures flag open questions around dividend sustainability, despite margin and profit growth in the most recent period.

- Bears highlight that although STUDIO ALICELtd’s net profit margin rebounded, concerns about how reliably these profits can support future dividend payments remain prominent,

- especially given the multi-year backdrop of earnings decline that could limit flexibility in maintaining or growing payouts to shareholders.

- The positive shift in this year’s earnings does not automatically resolve the sustainability risk. As a result, income-oriented investors may seek firmer signals before committing.

Valuation Premium and DCF Fair Value Gap

- The stock is trading at a Price-To-Earnings Ratio of 21.8x, far above peers (12.5x) and the JP Commercial Services industry average (12.6x), yet sits well below its DCF fair value estimate of 4,614.08 yen compared to the current share price of 2,033.00 yen.

- Despite the premium PE multiple, what stands out is the simultaneous presence of both sector-relative expensiveness and a sizable DCF fair value “discount”,

- This creates a classic valuation tension where the market pays up for recent growth, while some investors may see a greater upside if the fair value estimate is realized.

- This duality challenges any simplistic narrative and prompts deeper consideration on whether a rerating upward or a pullback toward sector multiples is more justified in the coming quarters.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on STUDIO ALICELtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite margin recovery, STUDIO ALICELtd still faces doubts about sustainable earnings and its ability to maintain reliable dividend payments given a history of profit declines.

Seeking greater income reliability? Discover these 2020 dividend stocks with yields > 3% offering stronger yields and companies that are better positioned to deliver consistent payouts even in tougher years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2305

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives