- Japan

- /

- Professional Services

- /

- TSE:2170

Link and Motivation Plus Two More Stocks Estimated To Be Undervalued On The Japanese Exchange

Reviewed by Simply Wall St

Amid rising concerns about tighter U.S. restrictions on semiconductor exports affecting Japanese technology stocks, Japan's stock markets experienced a downturn last week. This context sets the stage for exploring potentially undervalued stocks, like Link and Motivation, which may present interesting opportunities in such market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Persol HoldingsLtd (TSE:2181) | ¥254.20 | ¥492.30 | 48.4% |

| Hibino (TSE:2469) | ¥2704.00 | ¥5231.07 | 48.3% |

| West Holdings (TSE:1407) | ¥2135.00 | ¥4140.75 | 48.4% |

| Micronics Japan (TSE:6871) | ¥5930.00 | ¥11713.77 | 49.4% |

| Visional (TSE:4194) | ¥7720.00 | ¥15165.83 | 49.1% |

| Macromill (TSE:3978) | ¥874.00 | ¥1682.37 | 48% |

| Tri Chemical Laboratories (TSE:4369) | ¥3685.00 | ¥7024.02 | 47.5% |

| Bushiroad (TSE:7803) | ¥383.00 | ¥725.27 | 47.2% |

| PeptiDream (TSE:4587) | ¥2743.50 | ¥5337.24 | 48.6% |

| Atrae (TSE:6194) | ¥894.00 | ¥1716.66 | 47.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Link and Motivation (TSE:2170)

Overview: Link and Motivation Inc. operates in Japan, offering consulting and cloud services, with a market capitalization of approximately ¥54.04 billion.

Operations: The firm operates primarily in consulting and cloud services within Japan.

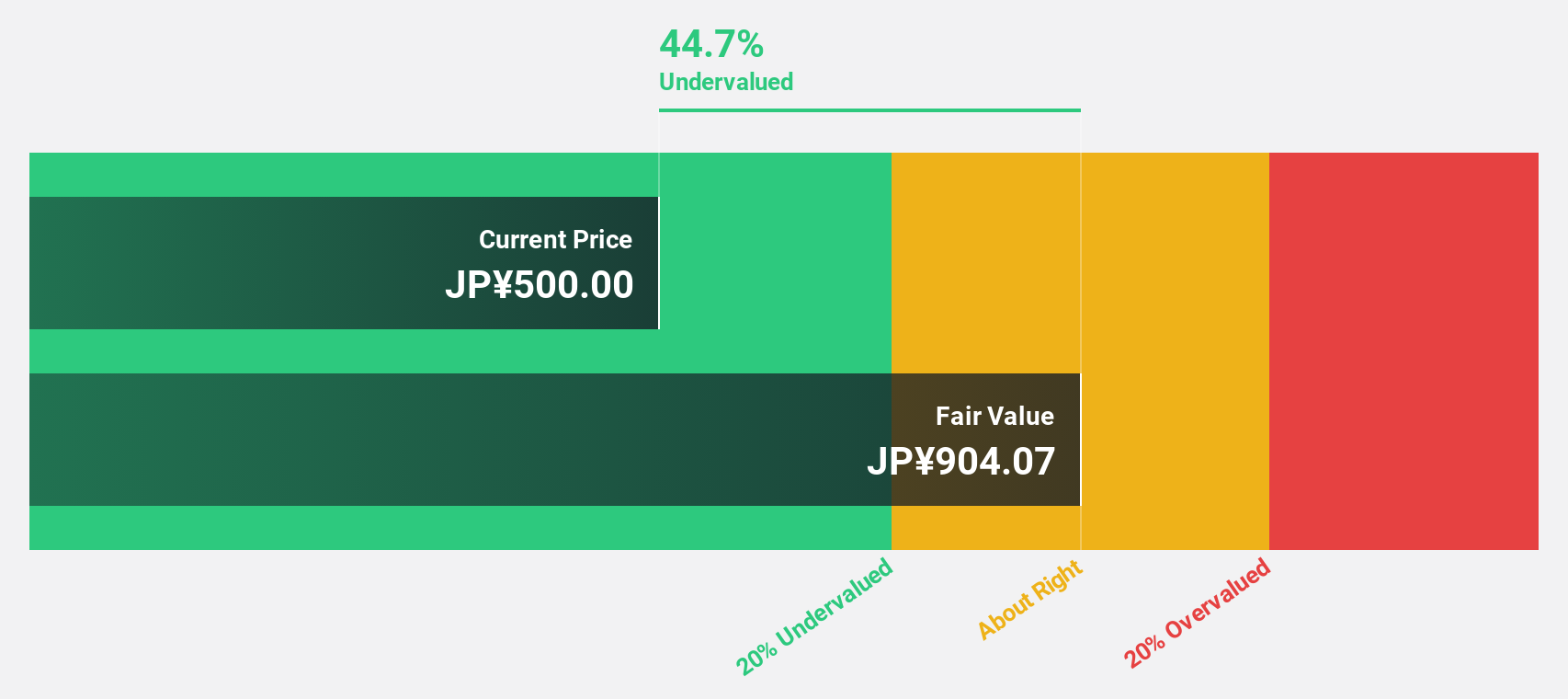

Estimated Discount To Fair Value: 45.4%

Link and Motivation, trading at ¥504, is significantly undervalued based on a discounted cash flow estimate of ¥923.1. The company's earnings have increased by 44.4% over the past year and are expected to grow by 18.38% annually, outpacing the Japanese market forecast of 8.9%. Additionally, its revenue growth projection of 10.4% annually also exceeds the market expectation of 4.3%. Recent strategic share buybacks underline management's confidence in value, repurchasing shares worth ¥428.63 million to enhance shareholder value.

- Insights from our recent growth report point to a promising forecast for Link and Motivation's business outlook.

- Click to explore a detailed breakdown of our findings in Link and Motivation's balance sheet health report.

en-japan (TSE:4849)

Overview: en-japan inc. operates in providing human resources services both domestically and internationally, with a market capitalization of approximately ¥112.70 billion.

Operations: The company generates revenue from its human resources services across both domestic and international markets.

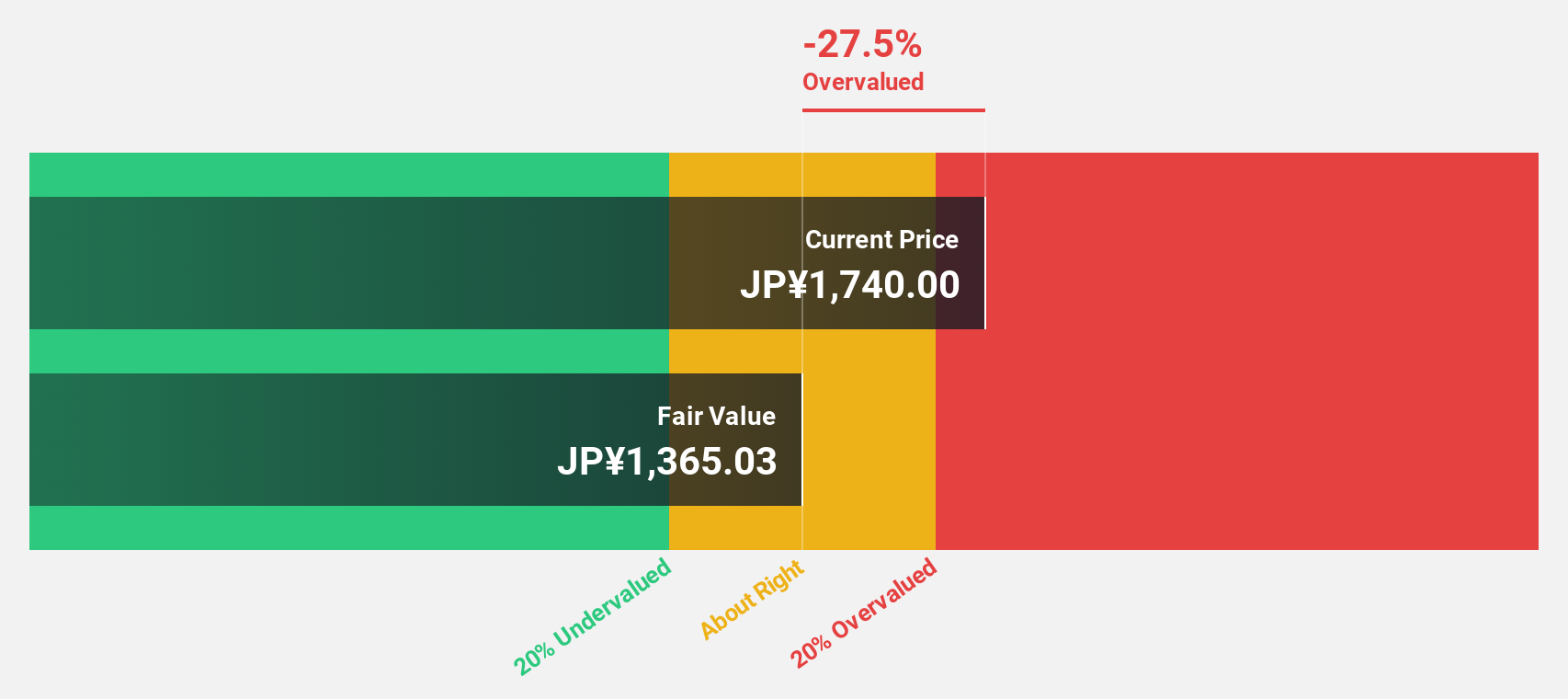

Estimated Discount To Fair Value: 42.4%

En-japan, priced at ¥2760, is deemed undervalued with a fair value estimate of ¥4789.54 based on discounted cash flows. Its earnings are expected to grow by 17% annually, surpassing the Japanese market's 8.9%. Despite slower revenue growth projections of 8% annually, this still outpaces the market forecast of 4.3%. However, its dividend coverage is weak, not well-supported by earnings or free cash flow. Recently, en-japan reaffirmed its dividend at JPY 70.10 per share and provided a positive earnings guidance for FY2025.

- Our earnings growth report unveils the potential for significant increases in en-japan's future results.

- Delve into the full analysis health report here for a deeper understanding of en-japan.

LITALICO (TSE:7366)

Overview: LITALICO Inc. operates schools for learning and preschools in Japan, with a market capitalization of approximately ¥61.34 billion.

Operations: The firm focuses on educational services in Japan, specifically operating schools for learning and preschools.

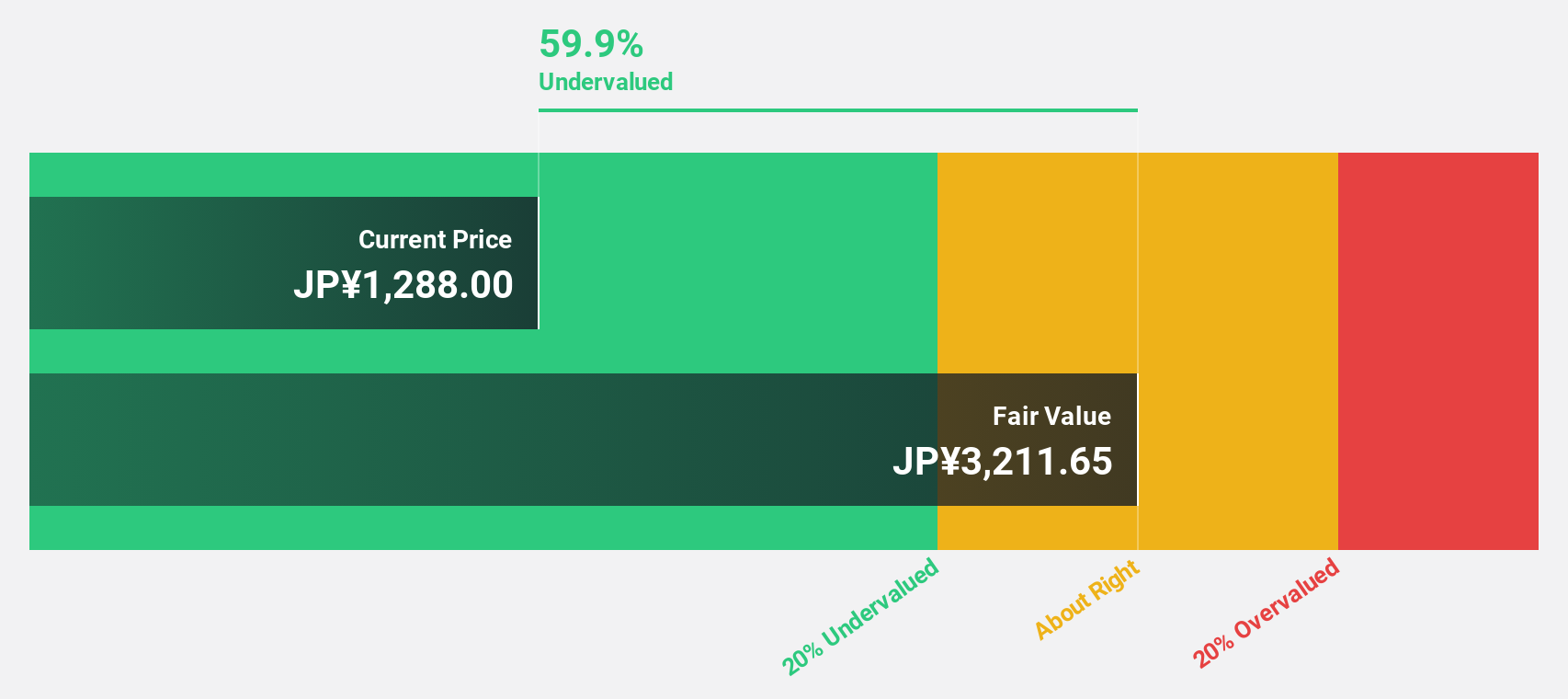

Estimated Discount To Fair Value: 35.6%

LITALICO, trading at ¥1718, is valued below its estimated fair value of ¥2667.49, indicating a significant undervaluation based on cash flows. Its earnings are expected to grow by 12.56% annually, outpacing the Japanese market forecast of 8.9%. Despite strong past earnings growth of 115.6%, quality concerns arise from large one-off items affecting financial results. Recently, LITALICO announced a private placement expected to raise approximately ¥26.57 million in gross proceeds, enhancing its financial flexibility for future growth initiatives.

- Upon reviewing our latest growth report, LITALICO's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of LITALICO stock in this financial health report.

Taking Advantage

- Get an in-depth perspective on all 91 Undervalued Japanese Stocks Based On Cash Flows by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2170

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion