As global markets navigate a landscape marked by mixed index performances and ongoing trade discussions, investors are keenly observing the implications of economic policies and interest rate decisions on their portfolios. Amidst this backdrop, dividend stocks have garnered attention for their potential to provide steady income streams, particularly in times when market volatility is prevalent. In such an environment, a good dividend stock is often characterized by its ability to maintain consistent payouts and offer resilience against economic uncertainties.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Daito Trust ConstructionLtd (TSE:1878) | 4.26% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.04% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.38% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Chudenko (TSE:1941) | 4.01% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.13% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.78% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.22% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.60% | ★★★★★★ |

Click here to see the full list of 1535 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

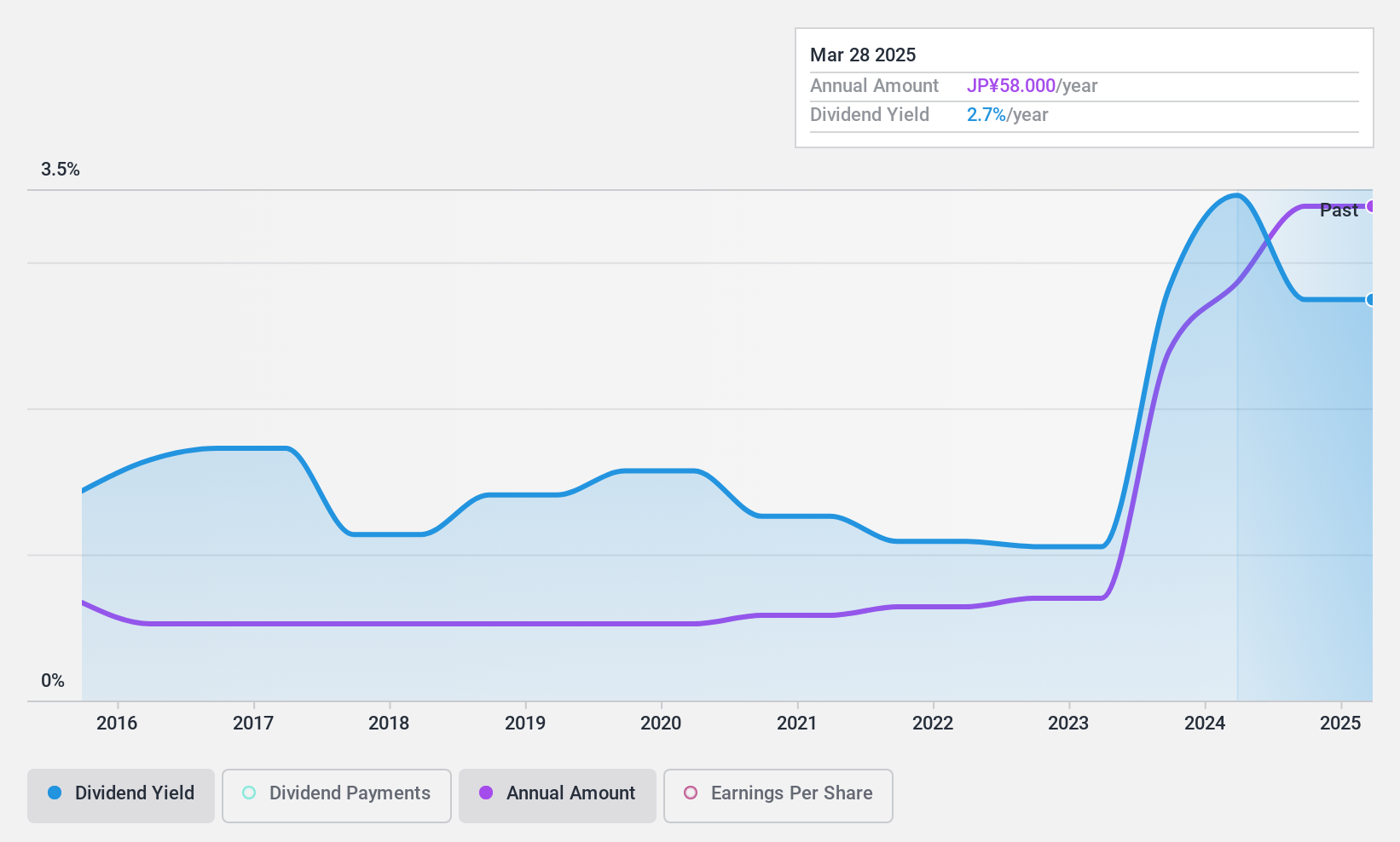

UT GroupLtd (TSE:2146)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UT Group Co., Ltd. operates in Japan, focusing on dispatch and outsourcing of permanent employees across manufacturing, design and development, construction, and other sectors with a market cap of ¥79.42 billion.

Operations: UT Group Co., Ltd.'s revenue segments include Area Business at ¥72.07 billion, Vietnam Business at ¥15.59 billion, and Solution Business at ¥21.06 billion.

Dividend Yield: 4.3%

UT Group Ltd.'s recent board meeting revealed plans to revise its dividend forecast upward, reflecting a commitment to rewarding shareholders. The company's dividend yield is in the top 25% of the Japanese market, but past payments have been volatile and not well covered by cash flows. Despite a reasonable payout ratio of 69.6%, high cash payout ratios raise sustainability concerns. Recent share buybacks totaling ¥1.62 billion could support stock value amid organizational restructuring efforts aimed at enhancing business efficiency and growth prospects.

- Unlock comprehensive insights into our analysis of UT GroupLtd stock in this dividend report.

- The analysis detailed in our UT GroupLtd valuation report hints at an deflated share price compared to its estimated value.

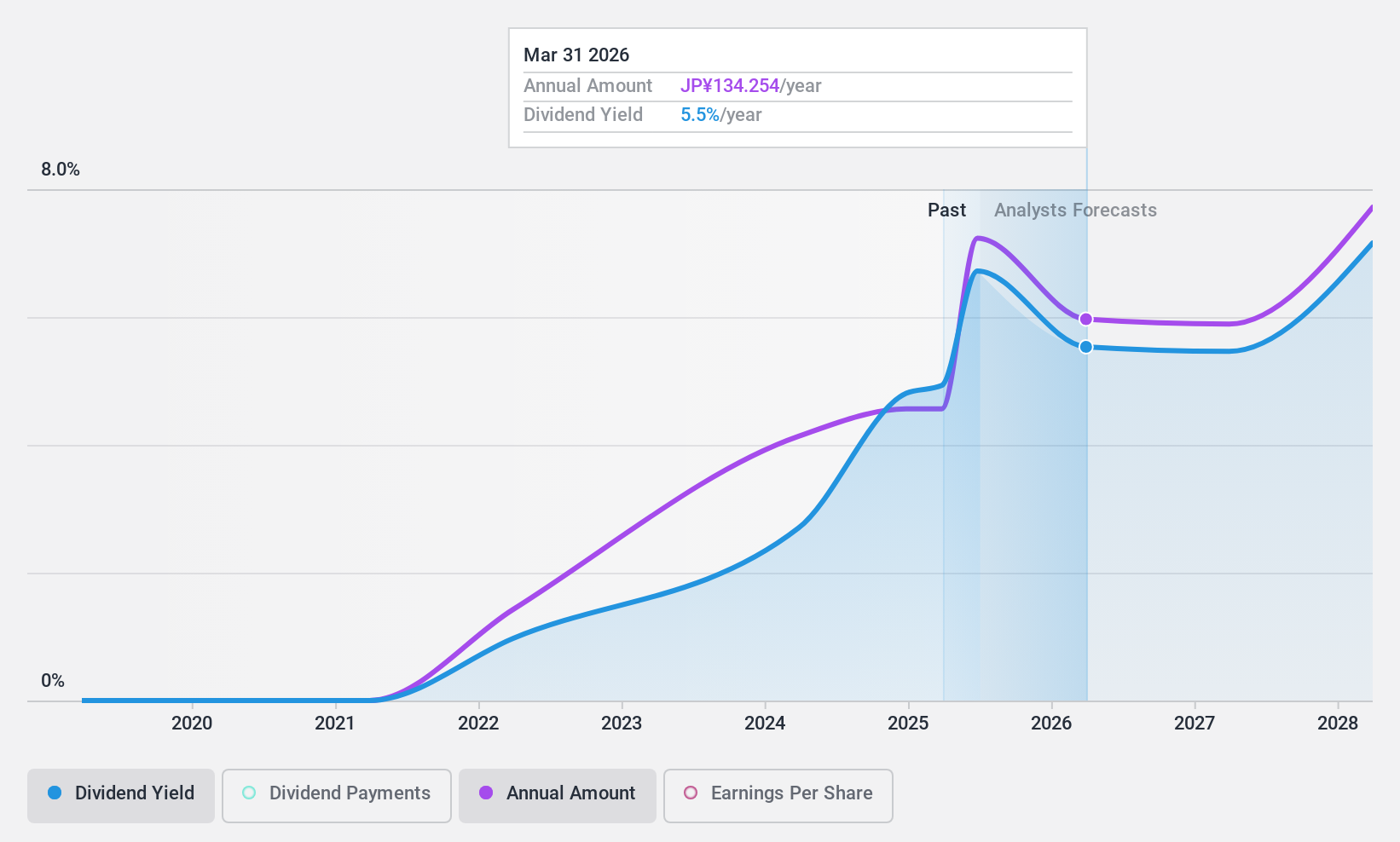

Startia HoldingsInc (TSE:3393)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Startia Holdings, Inc. operates in the IT sector both in Japan and internationally, with a market capitalization of ¥20.49 billion.

Operations: Startia Holdings, Inc. generates revenue from its Digital Marketing Related Business, amounting to ¥3.81 billion, and its IT Infrastructure Related Business (including business applications), which totals ¥17.62 billion.

Dividend Yield: 4.2%

Startia Holdings Inc.'s dividend yield ranks in the top 25% of the Japanese market, supported by a payout ratio of 41.1%, indicating earnings cover dividends well. However, cash flow coverage is tighter at a 76.5% cash payout ratio. While earnings grew by 47.8% last year, the company's dividend history has been volatile with significant annual drops over the past decade. A recent board meeting focused on revising full-year earnings forecasts for fiscal year ending March 2025 could impact future payouts.

- Click here to discover the nuances of Startia HoldingsInc with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Startia HoldingsInc's current price could be inflated.

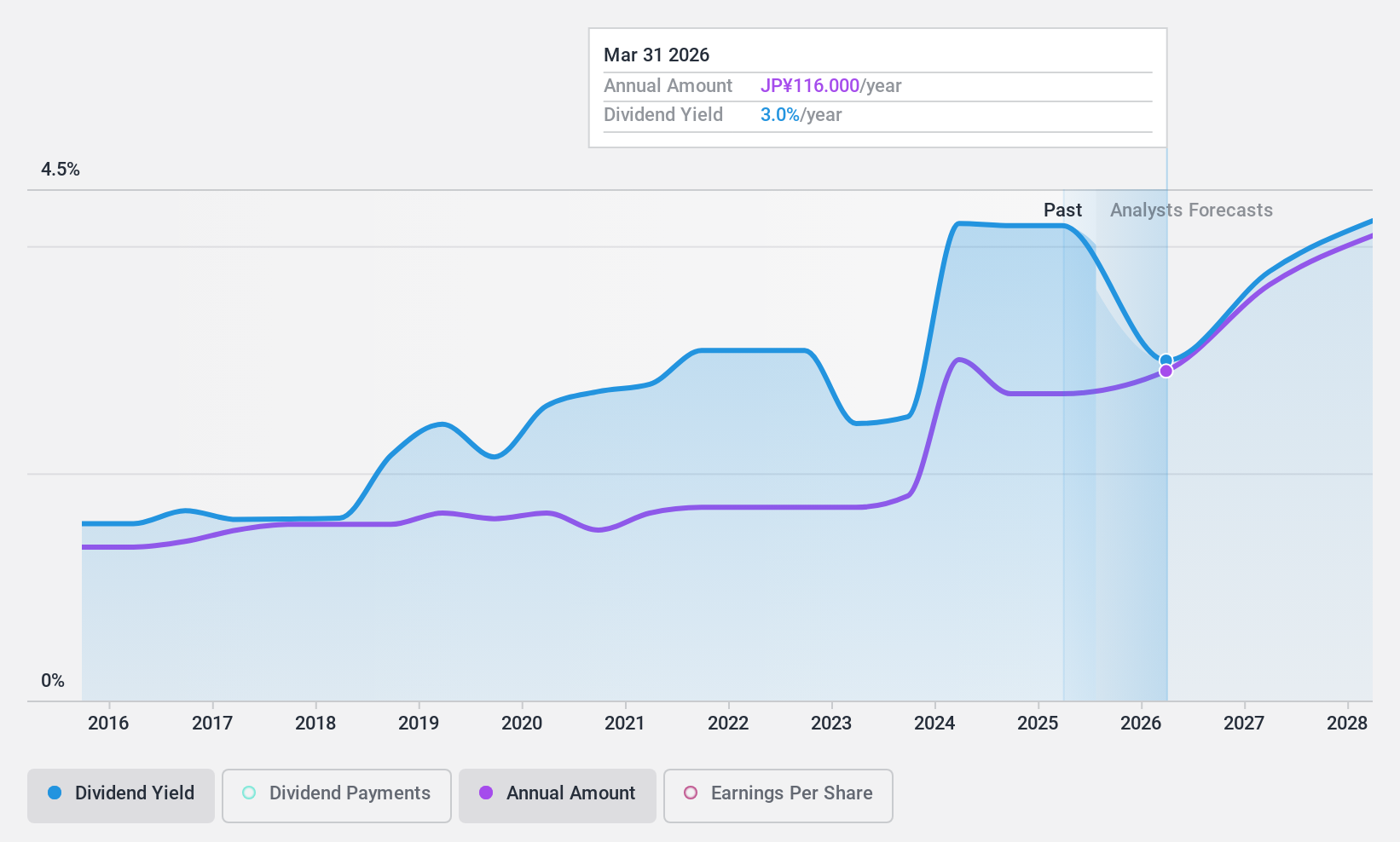

Glory (TSE:6457)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Glory Ltd. develops and manufactures cash handling machines and systems across Japan, the United States, Europe, and Asia with a market cap of ¥157.70 billion.

Operations: Glory Ltd.'s revenue segments include the development and production of cash handling machines and systems in various regions including Japan, the United States, Europe, and Asia.

Dividend Yield: 3.7%

Glory Ltd. demonstrates strong dividend coverage with a low payout ratio of 31.3% and cash payout ratio of 13.9%, ensuring dividends are well-supported by earnings and cash flows. However, its dividend history has been volatile, with past fluctuations exceeding 20%. Recent announcements include a share repurchase program worth ¥15 billion to enhance shareholder returns and plans for progressive dividends, aiming for a total return ratio exceeding 100% in upcoming fiscal years.

- Get an in-depth perspective on Glory's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Glory shares in the market.

Key Takeaways

- Unlock our comprehensive list of 1535 Top Global Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3393

Startia HoldingsInc

Engages in the IT business in Japan and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives