JAC Recruitment And 2 Other High-Yield Dividend Stocks On The Japanese Exchange

Reviewed by Simply Wall St

Japan’s stock markets have experienced notable declines recently, with the Nikkei 225 Index down 5.8% and the broader TOPIX Index registering a 4.2% loss, driven by semiconductor stocks tracking a U.S.-led sell-off and yen strength posing a headwind for export-oriented companies. Amidst this backdrop, investors may find opportunities in high-yield dividend stocks that offer stability through regular income. In such volatile market conditions, dividend stocks can be appealing as they provide consistent returns even when capital gains are uncertain. This article will explore JAC Recruitment and two other high-yield dividend stocks on the Japanese exchange that could be of interest to investors seeking reliable income streams.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.27% | ★★★★★★ |

| Globeride (TSE:7990) | 4.37% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.87% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.92% | ★★★★★★ |

| Kondotec (TSE:7438) | 3.80% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.94% | ★★★★★★ |

| Innotech (TSE:9880) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.35% | ★★★★★★ |

Click here to see the full list of 469 stocks from our Top Japanese Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

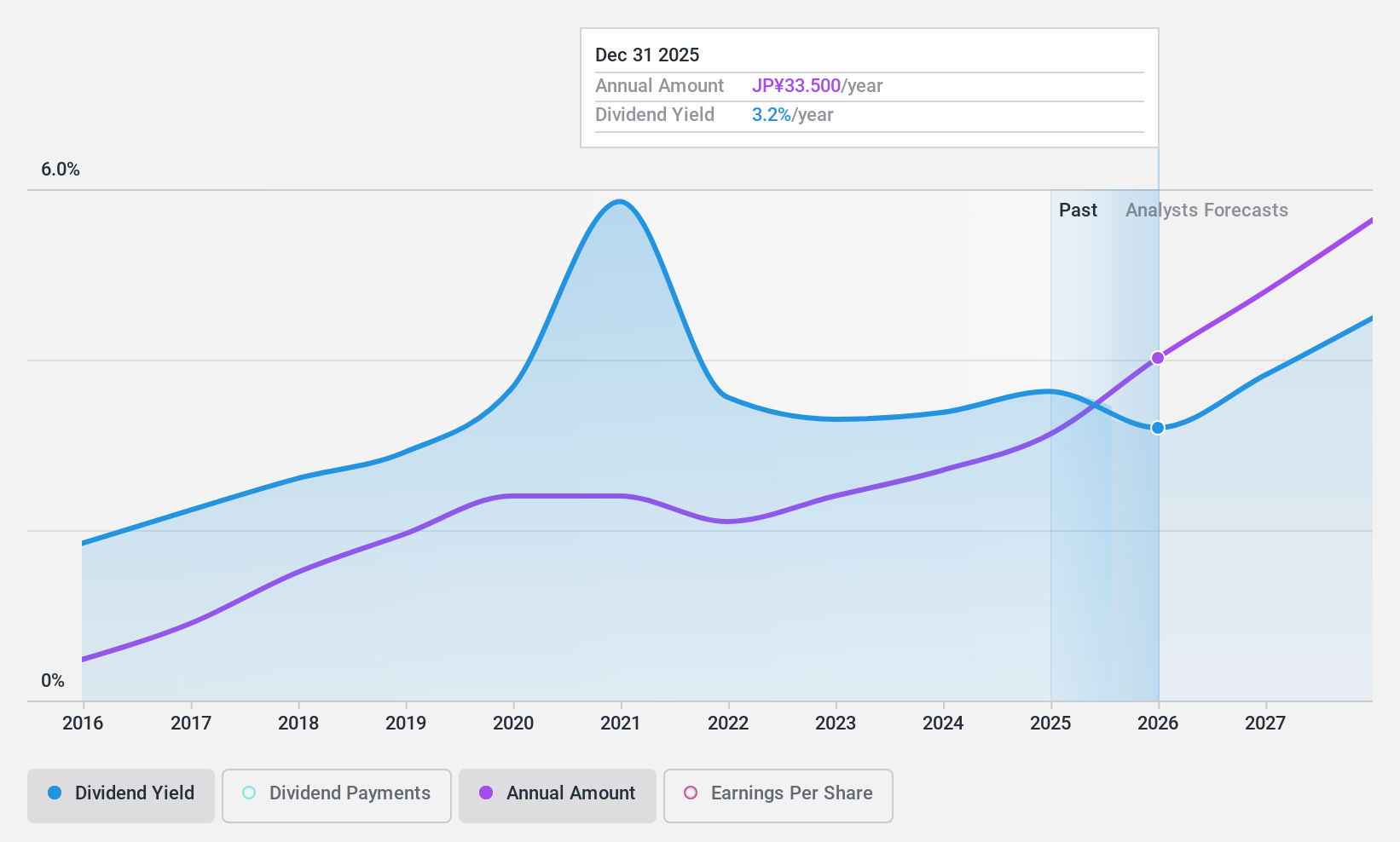

JAC Recruitment (TSE:2124)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JAC Recruitment Co., Ltd. operates as a recruitment consultancy business in Japan and has a market cap of ¥126.11 billion.

Operations: JAC Recruitment Co., Ltd. generates revenue primarily from its recruitment consultancy services in Japan, with a market cap of ¥126.11 billion.

Dividend Yield: 3.3%

JAC Recruitment offers a stable dividend history with consistent payments over the past decade, supported by a reasonable payout ratio of 61.6%. The company's dividends are well-covered by both earnings and free cash flow. Despite trading at 35% below its estimated fair value, JAC's recent lowered earnings guidance and share repurchase program highlight efforts to improve capital efficiency and shareholder returns amidst challenging market conditions. The current dividend yield stands at 3.29%, slightly below the top quartile in Japan.

- Get an in-depth perspective on JAC Recruitment's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of JAC Recruitment shares in the market.

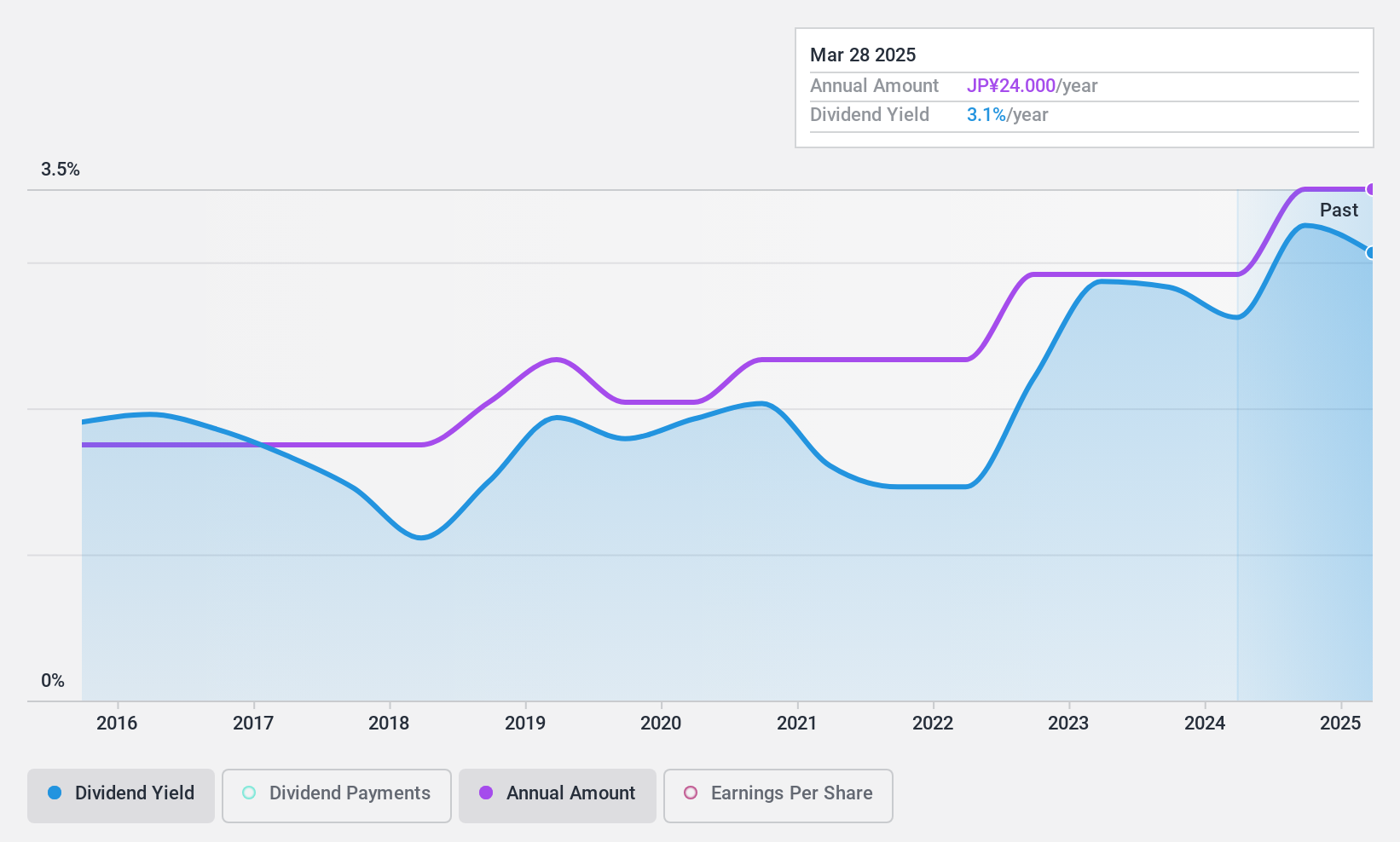

KOMATSU MATERELtd (TSE:3580)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KOMATSU MATERE Co., Ltd. manufactures and sells various fabrics in Japan and internationally, with a market cap of ¥29.56 billion.

Operations: The company's revenue segments include the Textile Business, which generated ¥36.82 billion.

Dividend Yield: 3.3%

Komatsu Matere Ltd. trades at 26.6% below its estimated fair value, offering dividend payments well-covered by earnings (32% payout ratio) and cash flows (71.8% cash payout ratio). However, the company's dividend history has been volatile over the past decade despite recent increases. The current yield of 3.25% is lower than Japan's top quartile payers, and large one-off items have impacted financial results despite a significant earnings growth of 127.5% last year.

- Click here to discover the nuances of KOMATSU MATERELtd with our detailed analytical dividend report.

- The valuation report we've compiled suggests that KOMATSU MATERELtd's current price could be quite moderate.

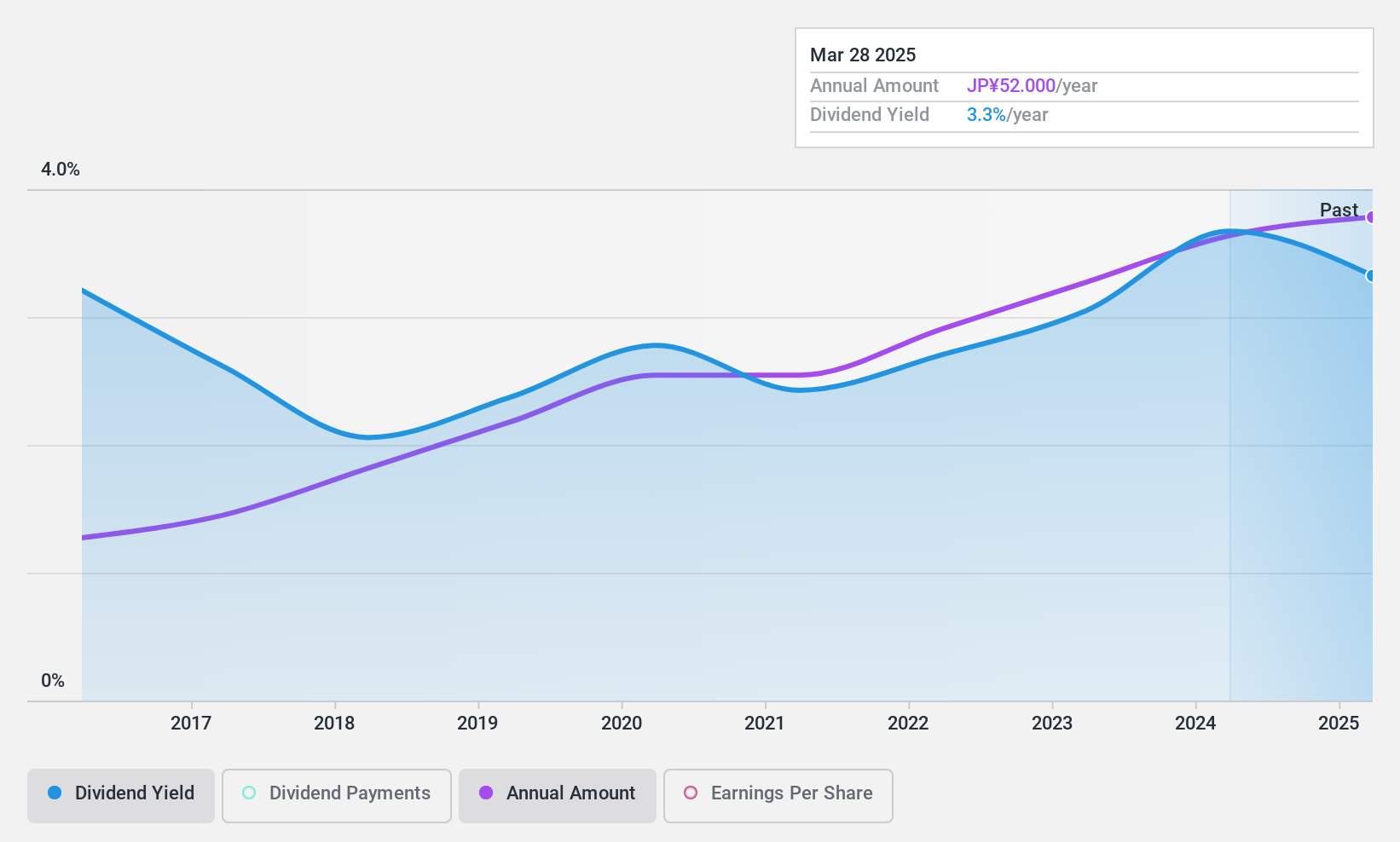

Pro-Ship (TSE:3763)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pro-Ship Incorporated develops, sells, consults on, and customizes solution packages for asset and sales management in Japan, with a market cap of ¥17.23 billion.

Operations: Pro-Ship Incorporated's revenue primarily comes from its Package Solutions segment, which generated ¥6.90 billion.

Dividend Yield: 3.7%

Pro-Ship offers a stable and growing dividend, with payments well-covered by earnings (41.4% payout ratio) and cash flows (51.8% cash payout ratio). The stock trades at 46.3% below its estimated fair value, making it an attractive option for value investors. Despite a reliable dividend history over the past decade, its current yield of 3.72% is slightly below Japan's top quartile payers at 3.79%. Recent earnings growth of 30% supports future payouts.

- Unlock comprehensive insights into our analysis of Pro-Ship stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Pro-Ship is priced lower than what may be justified by its financials.

Taking Advantage

- Take a closer look at our Top Japanese Dividend Stocks list of 469 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3763

Pro-Ship

Engages in the development, sale, consulting, and customization of solution packages for asset management, sales management, and others in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives