MISUMI Group's (TSE:9962) Share Buyback Completion: A Sign of Hidden Value or Limited Alternatives?

Reviewed by Sasha Jovanovic

- Between July 25 and September 30, 2025, MISUMI Group repurchased 3,052,800 shares, equivalent to 1.11% of its issued shares, for ¥6,895.4 million, completing its earlier-announced buyback program.

- The completion of this share repurchase highlights MISUMI Group's active approach to capital management and potential confidence in its long-term outlook.

- We'll explore how the buyback completion enhances the company's investment narrative by signaling management’s confidence in its underlying value.

Find companies with promising cash flow potential yet trading below their fair value.

What Is MISUMI Group's Investment Narrative?

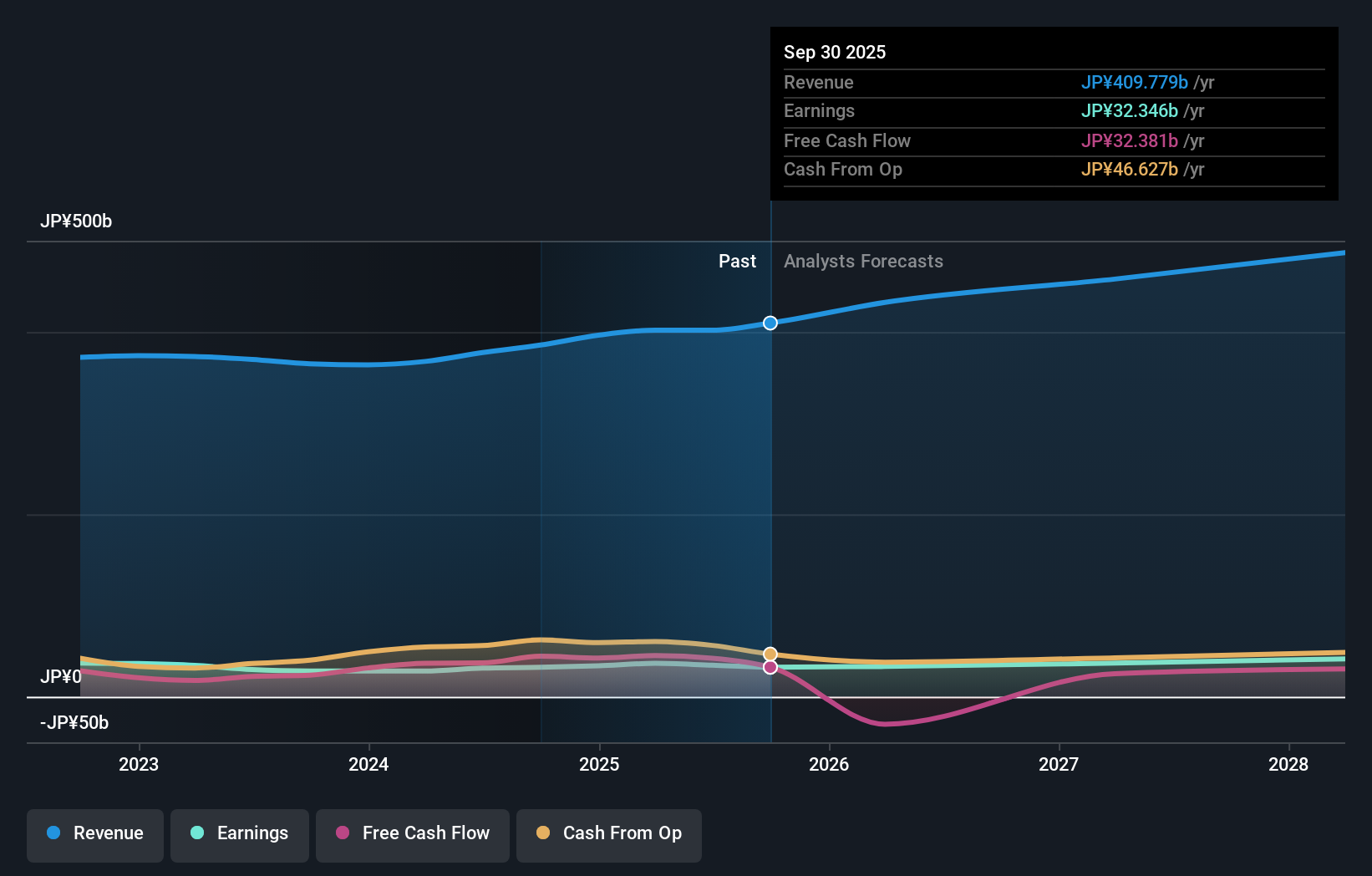

To be a shareholder in MISUMI Group, you have to believe in the company's ability to deploy capital efficiently and pursue long-term growth, even as recent returns have lagged the broader market. The swift completion of MISUMI’s latest share buyback signals active capital management and could be taken as a vote of confidence from management, but it's unlikely to materially shift the key short-term catalysts or risks. The company’s main near-term catalyst remains its upcoming Q2 2026 earnings release and whether projected revenue and profit targets are met, given demand trends and integration progress with Fictiv. Meanwhile, the biggest current risk continues to be the lackluster total returns for shareholders over recent years and the impact of declining dividends, neither of which the buyback alone appears to address.

But, those dividend changes are something investors should absolutely keep on their radar. MISUMI Group's shares have been on the rise but are still potentially undervalued by 18%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on MISUMI Group - why the stock might be worth just ¥2928!

Build Your Own MISUMI Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MISUMI Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free MISUMI Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MISUMI Group's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9962

MISUMI Group

Engages in the factory automation (FA) and die component businesses in Japan, China, rest of Asia, the Americas, Europe, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives