- Japan

- /

- Healthtech

- /

- TSE:4820

3 Dividend Stocks Yielding Up To 3.6%

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. stocks closing a strong year despite recent declines and European indices experiencing varied performances, investors are seeking stability amid economic uncertainties such as fluctuating PMI readings and GDP forecasts. In this environment, dividend stocks can offer a reliable income stream, providing potential resilience against market volatility while benefiting from the broader positive trends observed in major indices.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.60% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.88% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.40% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

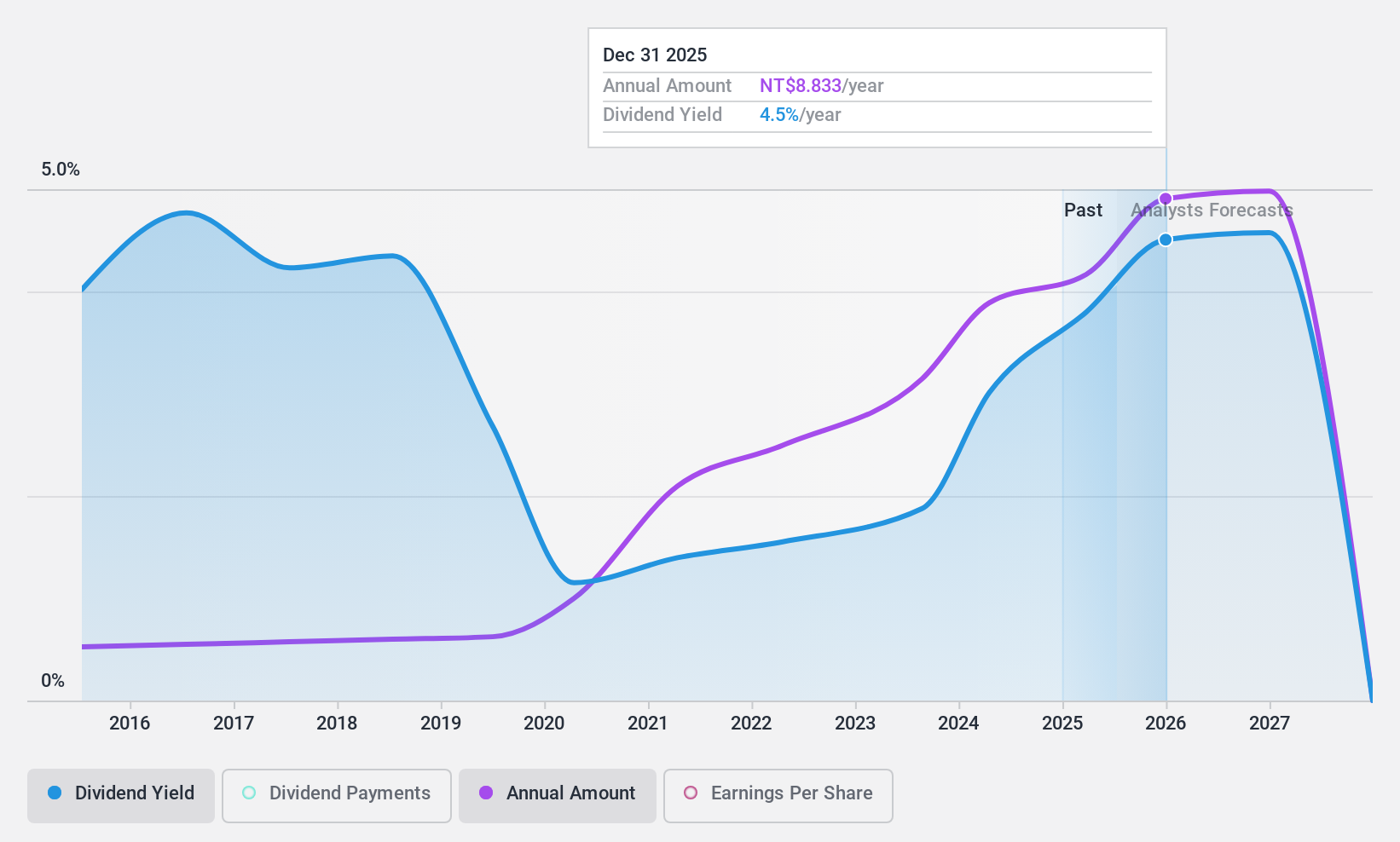

Universal Vision Biotechnology (TPEX:3218)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Universal Vision Biotechnology Co., Ltd. operates a chain of eye care clinics in Taiwan and China, with a market cap of NT$17.07 billion.

Operations: Universal Vision Biotechnology Co., Ltd. generates its revenue from operating eye care clinics across Taiwan and China.

Dividend Yield: 3.4%

Universal Vision Biotechnology maintains a reliable dividend history with stable payments over the past decade and consistent growth. While its current yield of 3.41% is below the top quartile in Taiwan, dividends are well-covered by earnings (payout ratio of 55%) and cash flows (cash payout ratio of 48.6%). Recent financials show modest revenue growth but a slight decline in quarterly net income, suggesting careful monitoring for potential impacts on future dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Universal Vision Biotechnology.

- According our valuation report, there's an indication that Universal Vision Biotechnology's share price might be on the cheaper side.

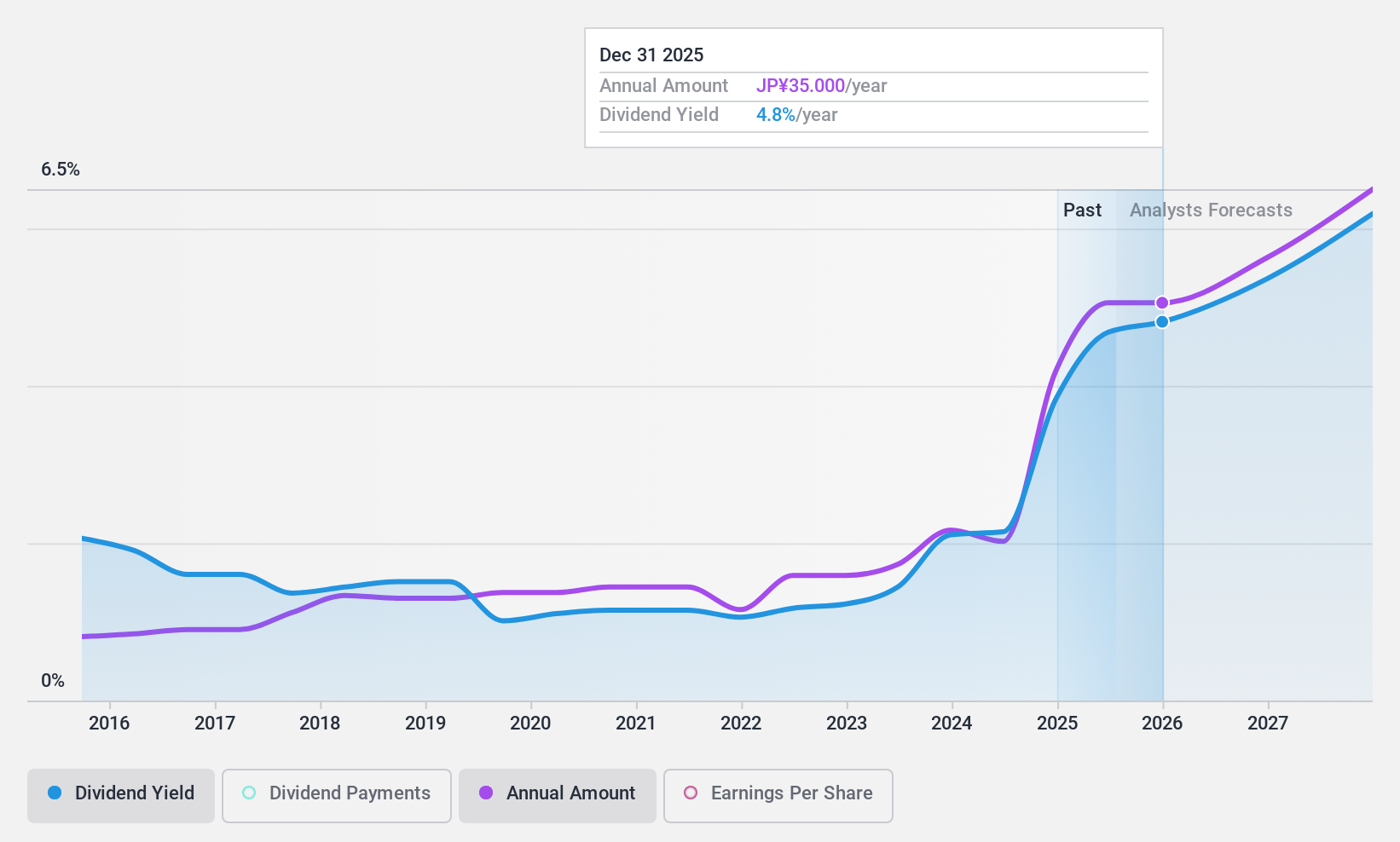

EM Systems (TSE:4820)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EM Systems Co., Ltd. develops and sells IT systems for pharmacies, clinics, and care/welfare businesses in Japan, with a market cap of ¥54.20 billion.

Operations: EM Systems Co., Ltd. generates revenue primarily from its Dispensing System Business at ¥18.94 billion, followed by the Medical System Business at ¥2.39 billion, and the Nursing/Welfare System Business at ¥581 million.

Dividend Yield: 3.6%

EM Systems offers a stable dividend history with consistent growth over the past decade. Despite a yield of 3.63% falling short of Japan's top quartile, dividends are reliably covered by earnings (payout ratio of 53.2%) and cash flows (cash payout ratio of 86.2%). Recent buyback completion, involving ¥999.25 million for 1.6 million shares, supports shareholder value amid volatile share prices and large one-off items affecting financial results this year.

- Navigate through the intricacies of EM Systems with our comprehensive dividend report here.

- Our valuation report here indicates EM Systems may be overvalued.

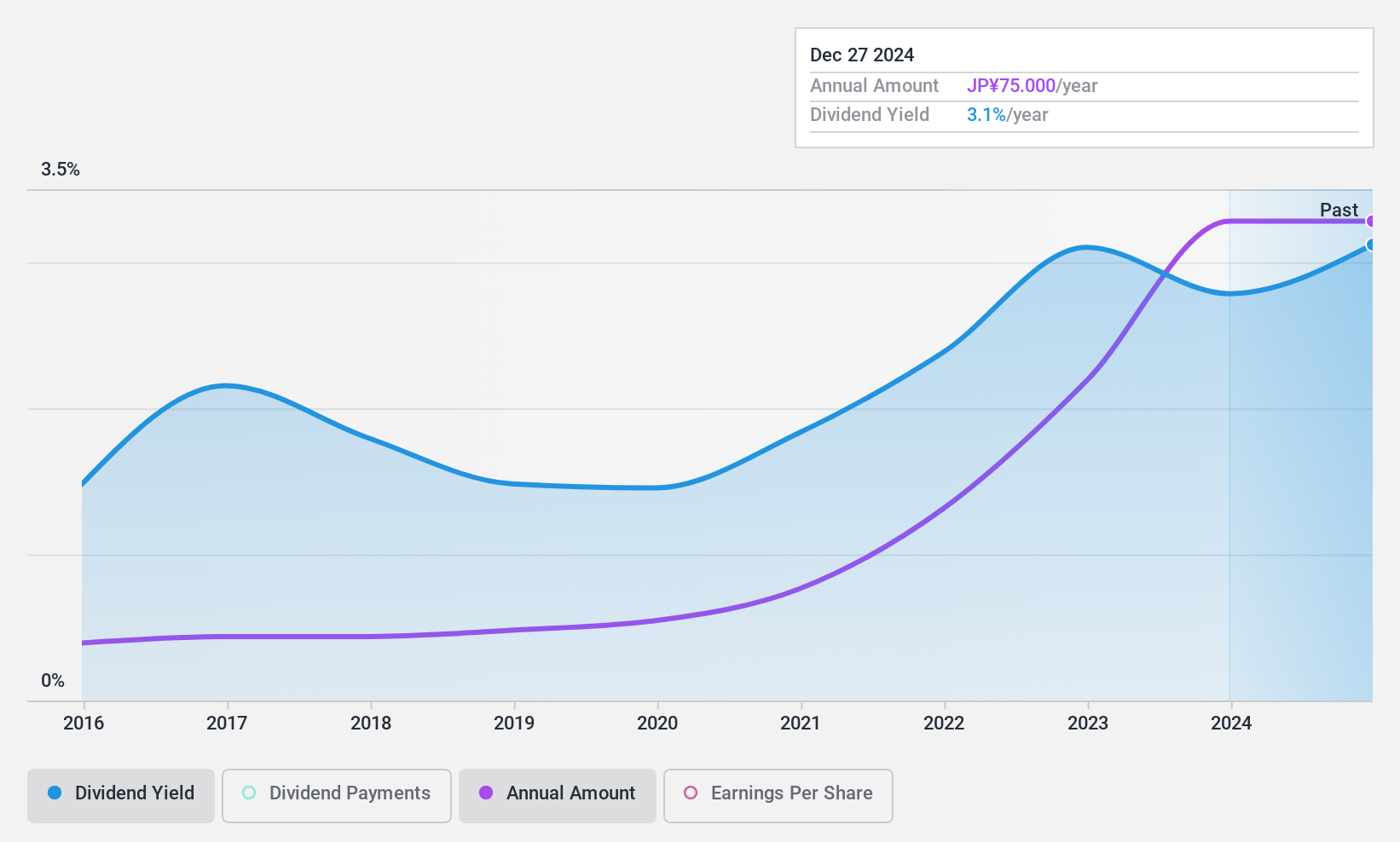

CTI Engineering (TSE:9621)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CTI Engineering Co., Ltd. is a consulting engineering company that operates both in Japan and internationally, with a market cap of ¥68.62 billion.

Operations: CTI Engineering Co., Ltd.'s revenue is derived from its consulting engineering services provided domestically and internationally.

Dividend Yield: 3%

CTI Engineering's dividend yield of 2.96% is below Japan's top quartile, but dividends have grown consistently over the past decade with a stable payout ratio of 31.2%. However, dividends are not covered by free cash flows despite being well-covered by earnings. The company plans a 2:1 stock split in December 2024 and anticipates net income of ¥6.9 billion for the fiscal year ending December 31, 2024, supporting its ongoing dividend strategy.

- Click here to discover the nuances of CTI Engineering with our detailed analytical dividend report.

- According our valuation report, there's an indication that CTI Engineering's share price might be on the expensive side.

Seize The Opportunity

- Click this link to deep-dive into the 1980 companies within our Top Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4820

EM Systems

Develops and sells various IT systems for pharmacies, clinics, and care/welfare other business in Japan.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives