- Japan

- /

- Construction

- /

- TSE:9161

Exploring AblePrint Technology And 2 Other Hidden Small Cap Treasures With Solid Foundations

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have experienced a mixed performance, with indices like the S&P 600 reflecting broader economic uncertainties and policy shifts under the new U.S. administration. Despite these challenges, opportunities remain for investors seeking companies with strong foundations amidst volatility. In this context, identifying stocks that demonstrate solid business models and resilience can be particularly rewarding for those looking to explore potential hidden gems like AblePrint Technology and other promising small-cap firms.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.20% | 7.84% | 27.00% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

AblePrint Technology (TPEX:7734)

Simply Wall St Value Rating: ★★★★★☆

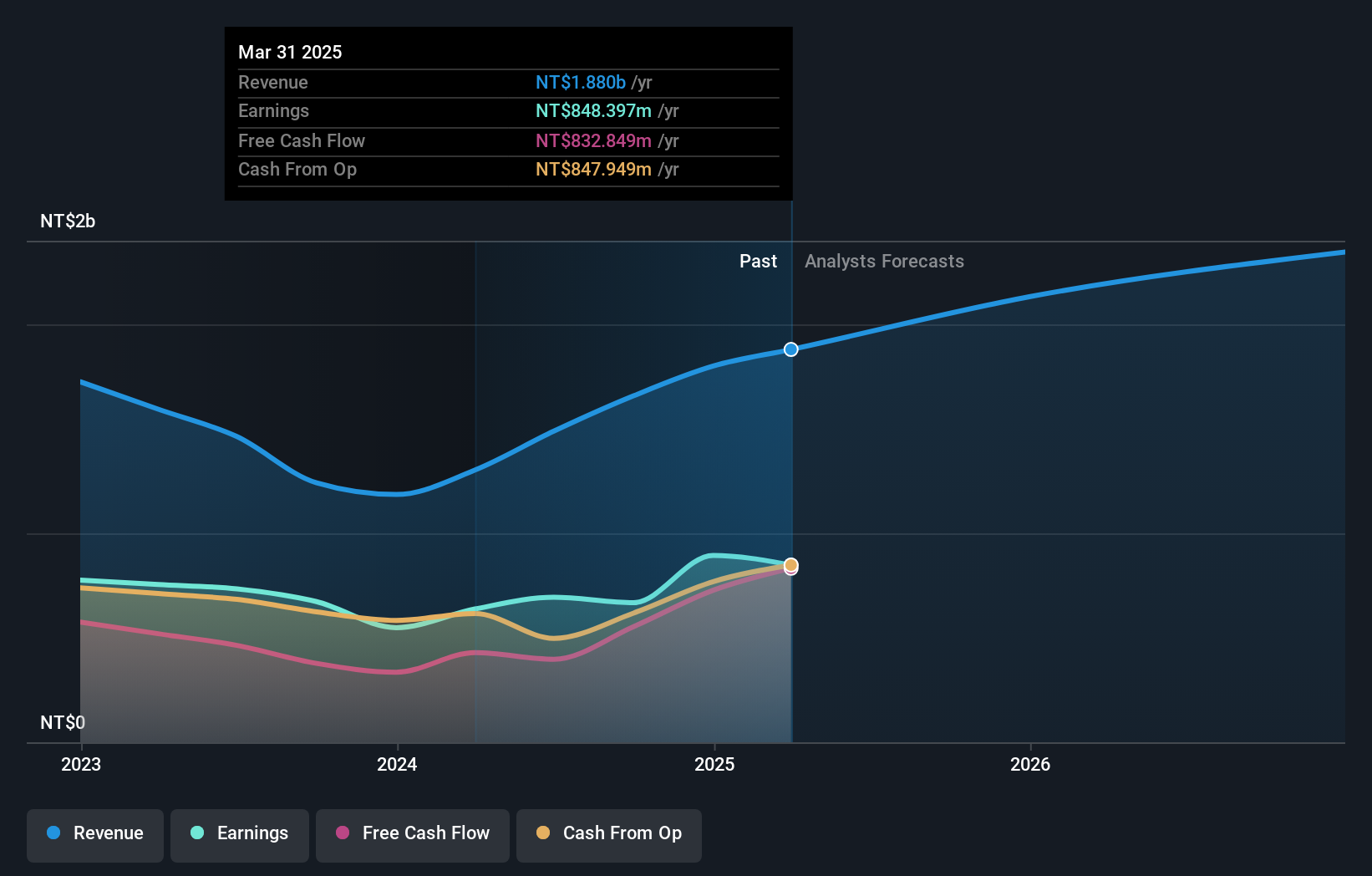

Overview: AblePrint Technology Co., Ltd. is a process solution provider addressing process issues across various industries in Taiwan and internationally, with a market cap of NT$32.94 billion.

Operations: AblePrint Technology generates revenue primarily from its process solutions services, with a focus on addressing industry-specific challenges. The company has seen fluctuations in its net profit margin, which was 12% in the most recent fiscal year.

AblePrint Technology, a dynamic player in the tech sector, has seen its earnings grow 14.1% annually over five years, although recent performance reveals mixed results. While the company reported third-quarter sales of TWD 394.15 million, up from TWD 225.21 million last year, net income dipped to TWD 97.88 million from TWD 123.92 million previously. Earnings per share also saw a decrease to TWD 4.87 from TWD 6.68 a year ago for basic and diluted shares alike. Despite these fluctuations, AblePrint's inclusion in the S&P Global BMI Index highlights its growing recognition within the industry landscape.

- Click to explore a detailed breakdown of our findings in AblePrint Technology's health report.

Understand AblePrint Technology's track record by examining our Past report.

Wacoal Holdings (TSE:3591)

Simply Wall St Value Rating: ★★★★★☆

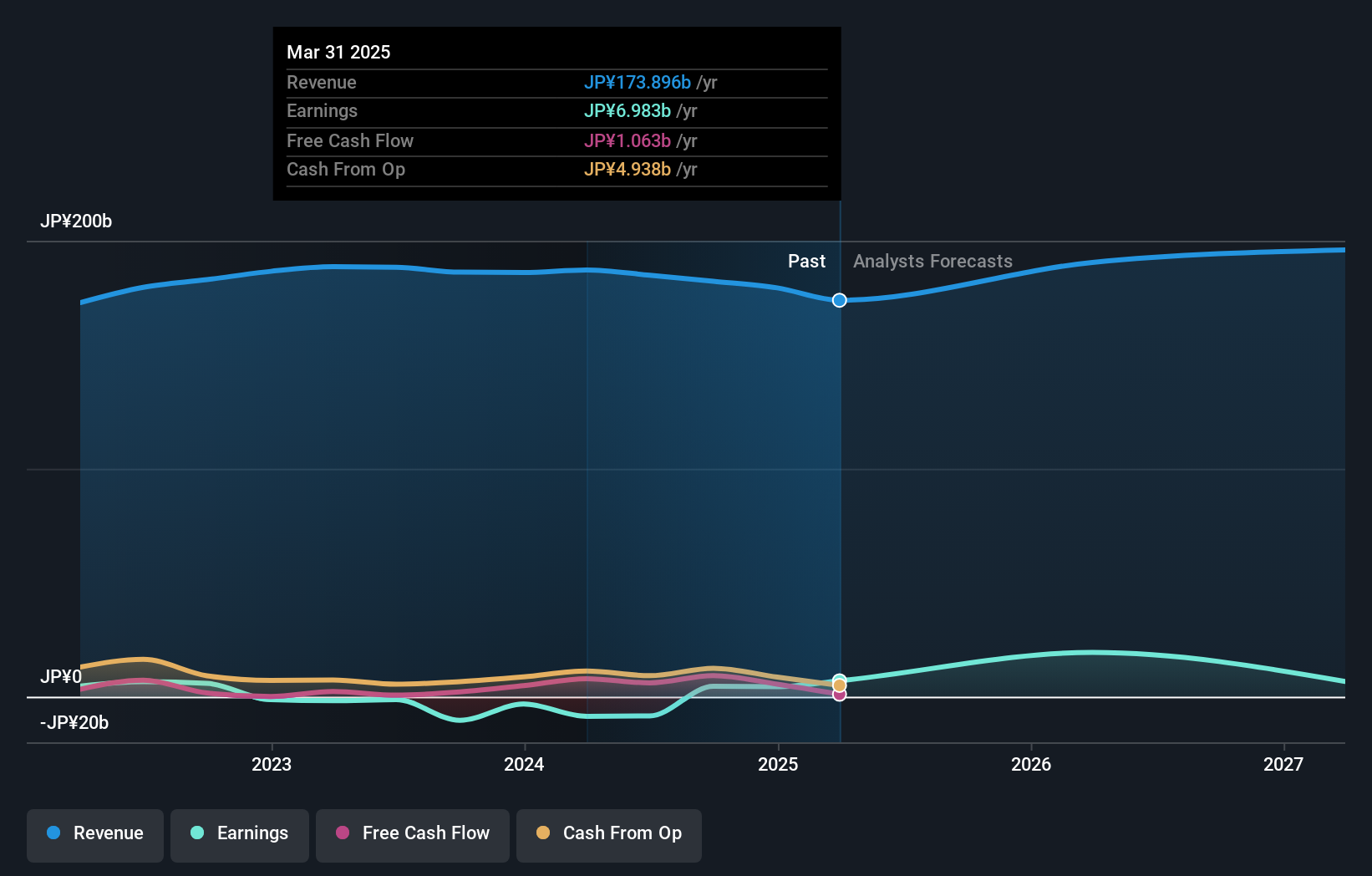

Overview: Wacoal Holdings Corp. is involved in the manufacturing, wholesale, and retail sale of intimate apparel, outerwear, sportswear, and other textile products across Japan, Asia, Oceania, the United States, and Europe with a market cap of ¥245.91 billion.

Operations: Wacoal Holdings generates revenue primarily from its domestic operations, which contribute ¥92.40 billion, and international operations, adding ¥79.01 billion. The company's net profit margin is a key financial metric to consider when evaluating its overall profitability and efficiency in managing costs relative to revenue generation.

Wacoal Holdings, a noteworthy player in the undergarment industry, has shown resilience despite its challenges. Recently, the company repurchased 920,000 shares for ¥3.99 billion between July and September 2024. This move likely reflects confidence in its valuation as it trades at 17% below estimated fair value. Wacoal's financial guidance for fiscal year ending March 2025 projects revenue of ¥181 billion with an operating profit of ¥4.8 billion and a net profit margin of approximately 2%. The company's dividend remains steady at JPY 50 per share, underscoring commitment to shareholder returns amidst strategic factory consolidations in Japan.

- Click here and access our complete health analysis report to understand the dynamics of Wacoal Holdings.

Evaluate Wacoal Holdings' historical performance by accessing our past performance report.

Integrated Design & Engineering HoldingsLtd (TSE:9161)

Simply Wall St Value Rating: ★★★★☆☆

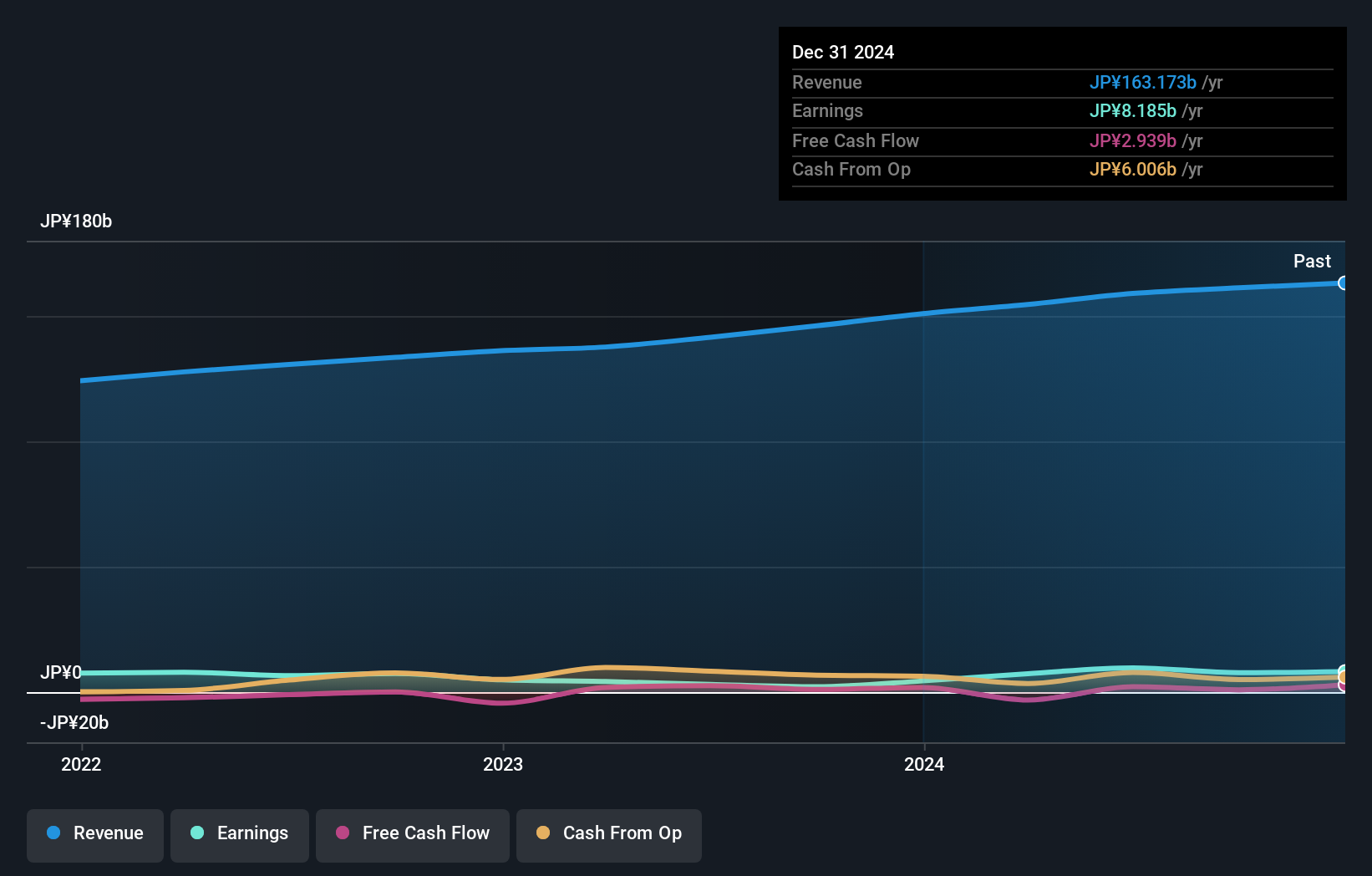

Overview: Integrated Design & Engineering Holdings Co., Ltd. is a company that, along with its subsidiaries, offers engineering consultation and power engineering services both in Japan and internationally, with a market capitalization of ¥60.07 billion.

Operations: Integrated Design & Engineering Holdings Co., Ltd. generates revenue primarily from its Consulting Business, which contributes ¥86.93 billion, followed by Urban & Spatial Development at ¥45.92 billion and Energy Business at ¥28.97 billion. The company's net profit margin is a key metric to consider when evaluating its financial performance over time.

Integrated Design & Engineering Holdings, a small player in its field, shows promising financial metrics with a price-to-earnings ratio of 9.1x, below the market average of 13.5x. The company's earnings have surged by an impressive 256%, outpacing the construction industry's growth rate of 20.8%. Despite an increased debt to equity ratio from 32% to 46% over five years, interest payments are comfortably covered by EBIT at a multiple of 20x. Recent developments include Tokio Marine Holdings' proposal to acquire it for ¥97.8 billion, which may influence future dividend policies and shareholder returns significantly.

- Dive into the specifics of Integrated Design & Engineering HoldingsLtd here with our thorough health report.

Learn about Integrated Design & Engineering HoldingsLtd's historical performance.

Make It Happen

- Click here to access our complete index of 4651 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9161

Integrated Design & Engineering HoldingsLtd

Provides engineering consultation, power engineering, and other services in Japan and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives