- Japan

- /

- Trade Distributors

- /

- TSE:8089

Top Dividend Stocks Including Komercní banka And Two Others

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and geopolitical tensions, investors are increasingly focused on the stability and potential of dividend stocks. In such an environment, selecting stocks that offer consistent dividend payouts can provide a measure of security and income, making them an attractive option for those looking to balance risk with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.81% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.99% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.28% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

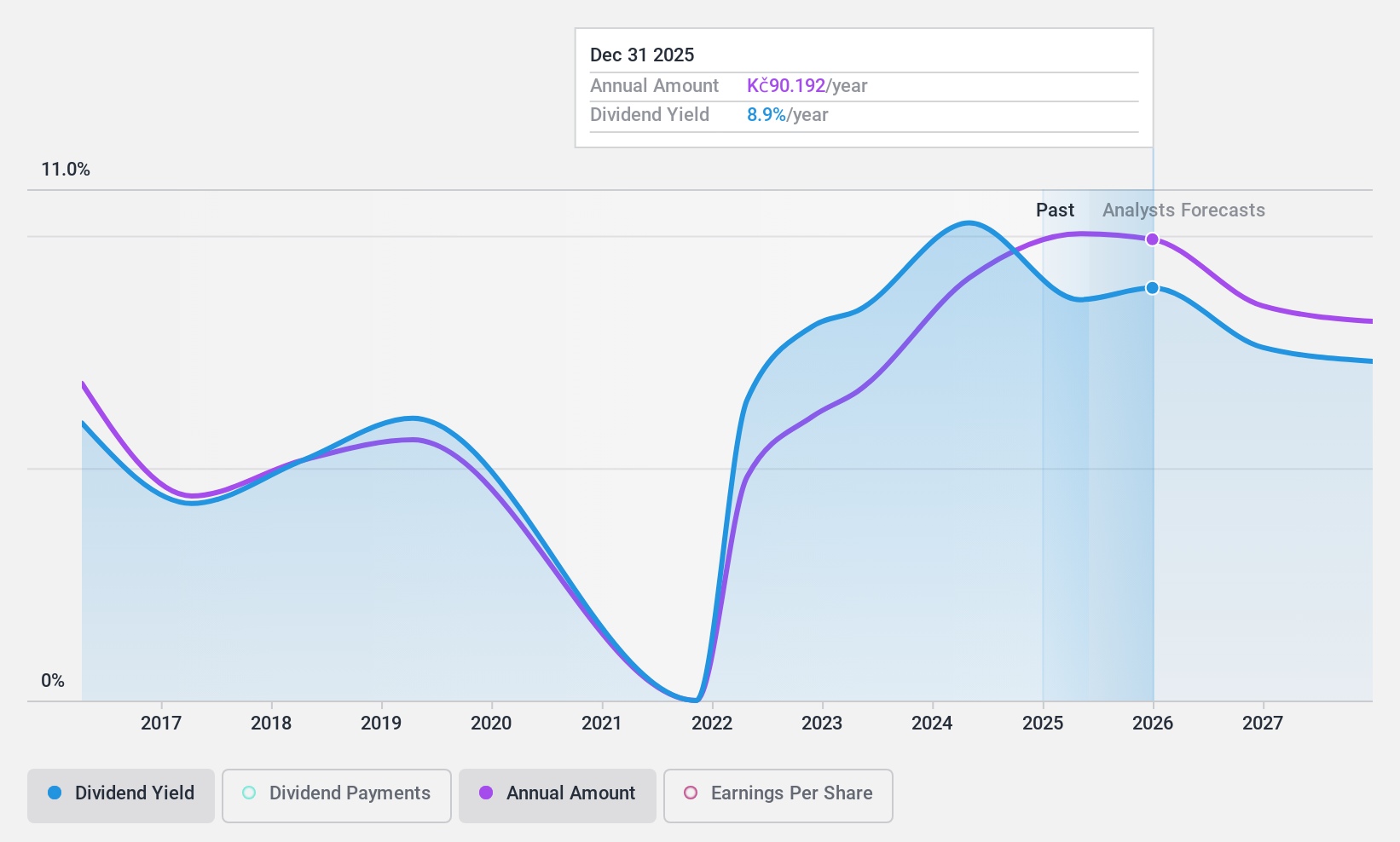

Komercní banka (SEP:KOMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Komercní banka, a.s. is a financial institution offering retail, corporate, and investment banking services in the Czech Republic and Central and Eastern Europe, with a market cap of CZK170.25 billion.

Operations: Komercní banka's revenue segments include retail banking services at CZK 18.25 billion, corporate banking services at CZK 7.50 billion, and investment banking services at CZK 3.75 billion.

Dividend Yield: 8.8%

Komercní banka's dividend yield of 8.84% ranks in the top 25% of Czech market payers, but its reliability is questionable due to volatility and a high payout ratio of 98.8%, indicating dividends are not well covered by earnings. Although future coverage is projected to improve, past payments have been unstable with significant annual drops. The bank trades at nearly 20% below estimated fair value, yet its low allowance for bad loans may pose risks.

- Take a closer look at Komercní banka's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Komercní banka shares in the market.

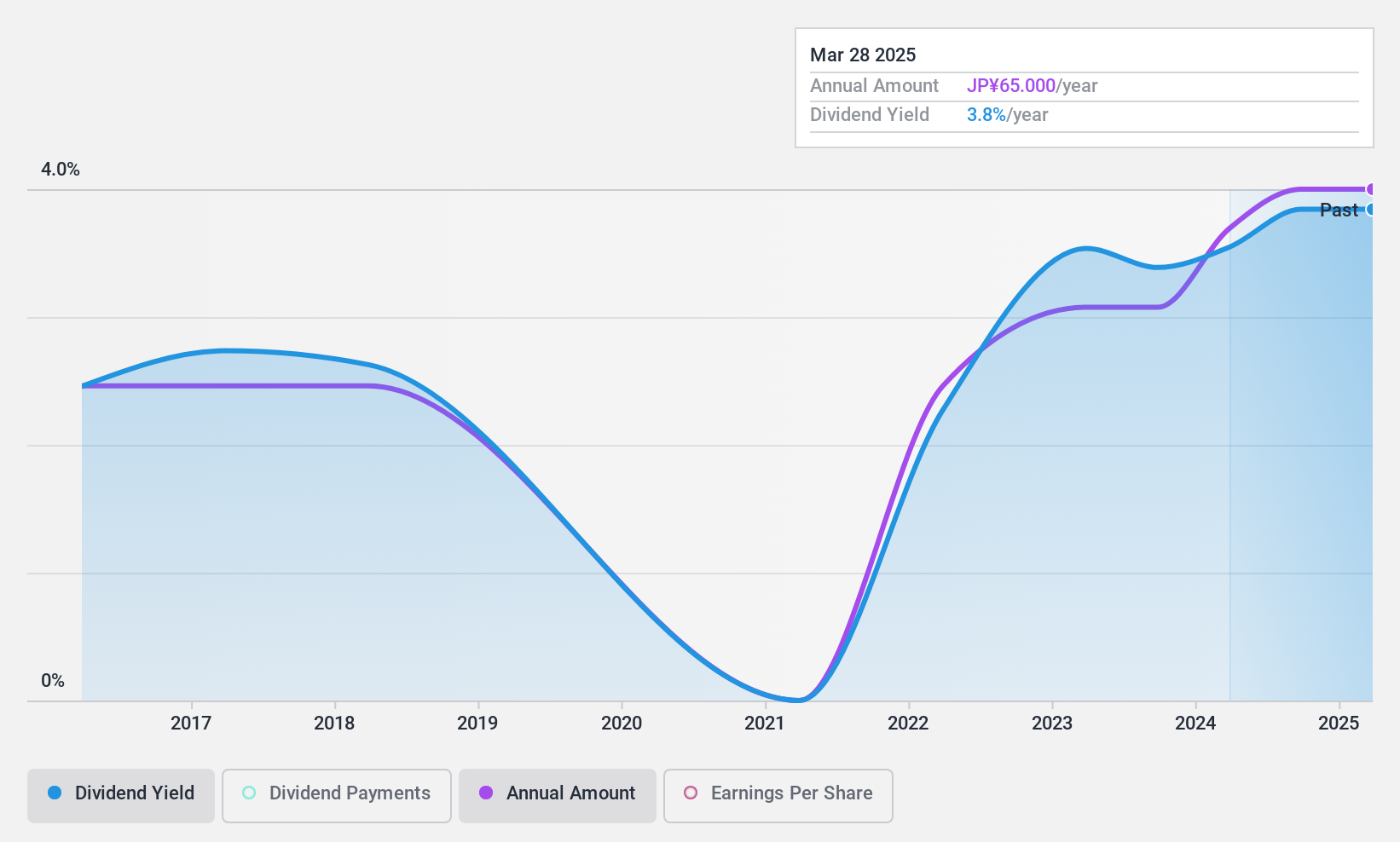

Nice (TSE:8089)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nice Corporation imports, distributes, and sells building materials for housing in Japan and internationally, with a market cap of ¥17.38 billion.

Operations: Nice Corporation's revenue primarily comes from its Building Materials segment, which generated ¥173.16 billion, followed by the Housing segment with ¥49.07 billion.

Dividend Yield: 4.4%

Nice Corporation's dividend yield of 4.44% places it among the top 25% of payers in the JP market, yet its reliability is compromised by volatility over the past decade. Despite a low payout ratio of 42.9%, dividends are not supported by free cash flows, raising sustainability concerns. Recent news highlights a dividend increase to JPY 25 per share for Q2 FY2025, up from JPY 20 last year, indicating some growth potential despite financial challenges.

- Click here to discover the nuances of Nice with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Nice is trading beyond its estimated value.

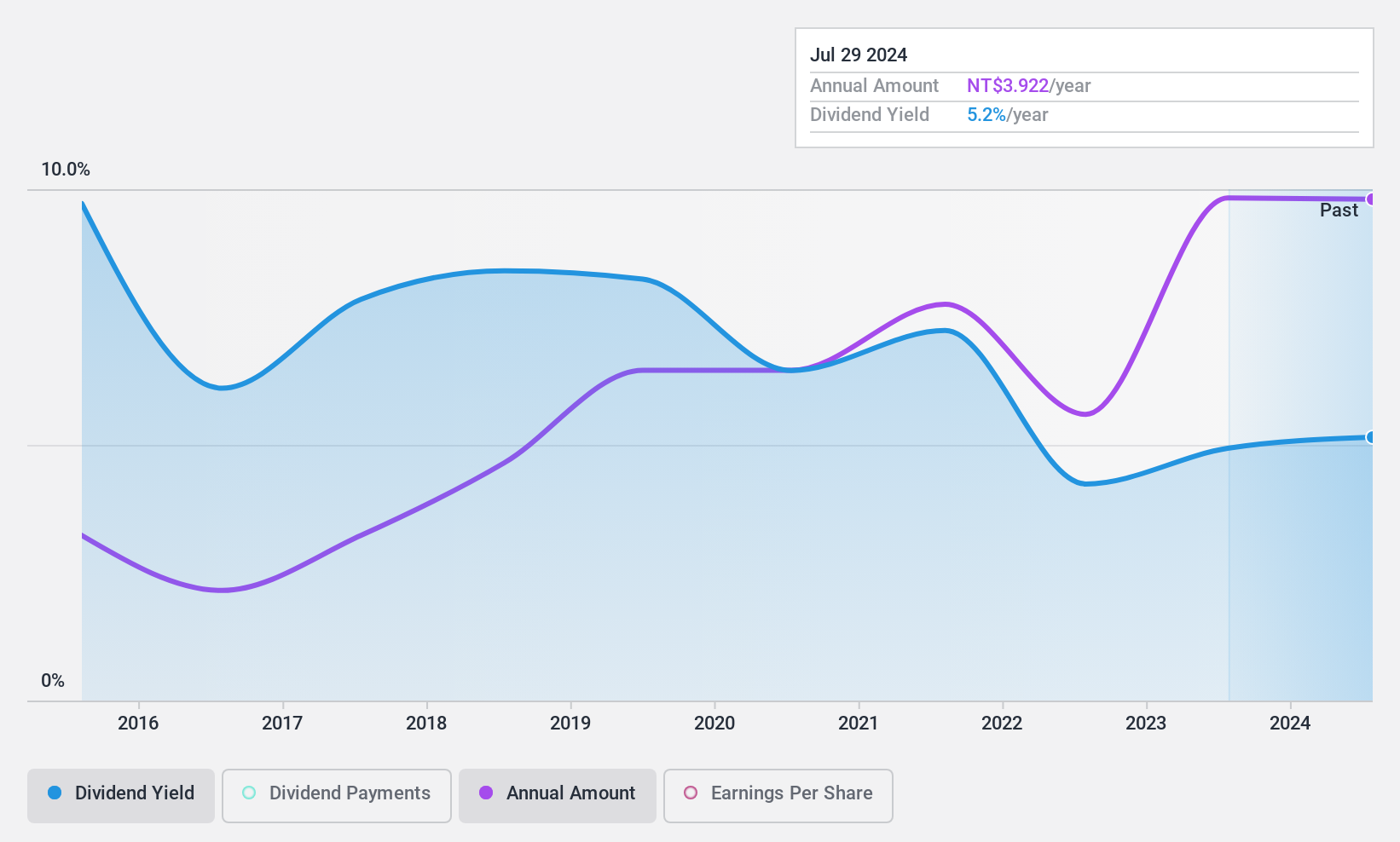

Kedge Construction (TWSE:2546)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kedge Construction Co., Ltd. engages in the construction, development, leasing, and sale of housing and building properties in Taiwan, with a market cap of NT$8.87 billion.

Operations: Kedge Construction Co., Ltd. generates revenue primarily from its construction segment, amounting to NT$13.98 billion.

Dividend Yield: 5.4%

Kedge Construction's dividend yield of 5.45% is among the top 25% in the TW market, but its track record shows volatility over the past decade. The payout ratio of 60.6% suggests dividends are covered by earnings, though cash flow coverage at an 88.5% payout ratio raises caution on sustainability. Recent earnings show increased quarterly net income to TWD 228.6 million, yet nine-month figures reflect a decline, indicating mixed financial stability for dividend continuity.

- Get an in-depth perspective on Kedge Construction's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Kedge Construction is priced higher than what may be justified by its financials.

Seize The Opportunity

- Discover the full array of 1959 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nice might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8089

Nice

Imports, distributes, and sells building materials for housing in Japan and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives