- Japan

- /

- Trade Distributors

- /

- TSE:8078

Hanwa Co., Ltd. (TSE:8078) Looks Inexpensive After Falling 28% But Perhaps Not Attractive Enough

Hanwa Co., Ltd. (TSE:8078) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The recent drop has obliterated the annual return, with the share price now down 7.7% over that longer period.

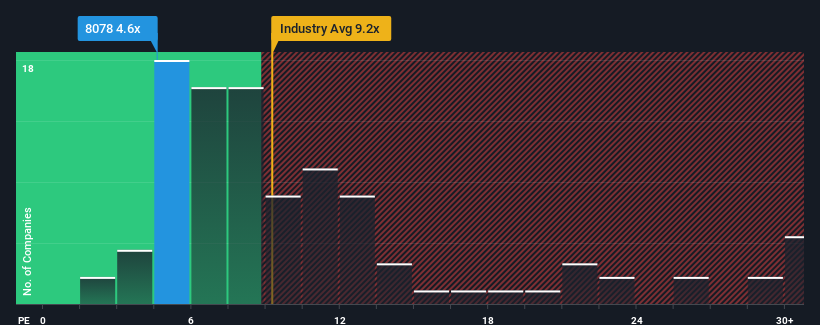

In spite of the heavy fall in price, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 14x, you may still consider Hanwa as a highly attractive investment with its 4.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, Hanwa's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Hanwa

What Are Growth Metrics Telling Us About The Low P/E?

Hanwa's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 97% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 3.6% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 9.6% per year, which is noticeably more attractive.

In light of this, it's understandable that Hanwa's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Shares in Hanwa have plummeted and its P/E is now low enough to touch the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Hanwa maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Hanwa (1 shouldn't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Hanwa's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hanwa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8078

Hanwa

Trades in steel, metals and alloys, nonferrous metals, food products, petroleum and chemicals, lumber, machinery, and other products in Japan and internationally.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives