- Japan

- /

- Diversified Financial

- /

- TSE:7187

J-LeaseLtd Leads Three Premier Dividend Stocks In Japan

Reviewed by Simply Wall St

Amidst a backdrop of mixed performances in global markets, Japan's stock market has shown resilience with the Nikkei 225 Index registering a slight gain. This stability makes it an opportune time to consider the merits of dividend stocks, which can offer investors potential income in addition to capital appreciation opportunities.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.71% | ★★★★★★ |

| Koei Tecmo Holdings (TSE:3635) | 3.70% | ★★★★★★ |

| Globeride (TSE:7990) | 3.65% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.65% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.46% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.74% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.18% | ★★★★★★ |

| Innotech (TSE:9880) | 4.08% | ★★★★★★ |

Click here to see the full list of 387 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

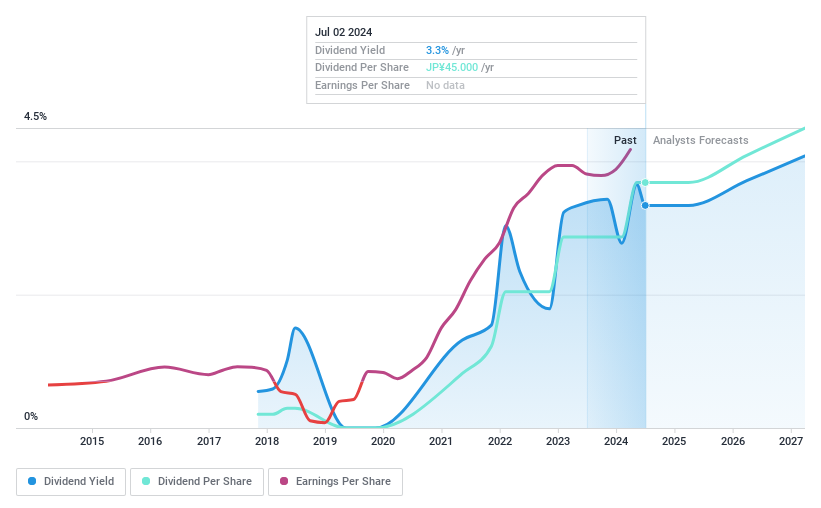

J-LeaseLtd (TSE:7187)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J-Lease Co., Ltd. operates primarily in the guarantor-related business and has a market capitalization of approximately ¥22.63 billion.

Operations: J-Lease Co., Ltd. primarily generates its revenue from guarantor-related activities.

Dividend Yield: 3.5%

J-Lease Co., Ltd. recently reduced its annual dividend from JPY 35.00 to JPY 22.50 per share, maintaining this level for the upcoming quarter despite a challenging history of unstable and volatile dividend payments over the past seven years. Despite these fluctuations, dividends are currently supported by a payout ratio of 57.1% and a cash payout ratio of 69.3%, indicating coverage by both earnings and cash flows. The company forecasts modest growth with expected net sales reaching ¥16.21 billion and profits attributable to owners at ¥1.89 billion for FY ending March 2025, suggesting potential stability ahead.

- Navigate through the intricacies of J-LeaseLtd with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of J-LeaseLtd shares in the market.

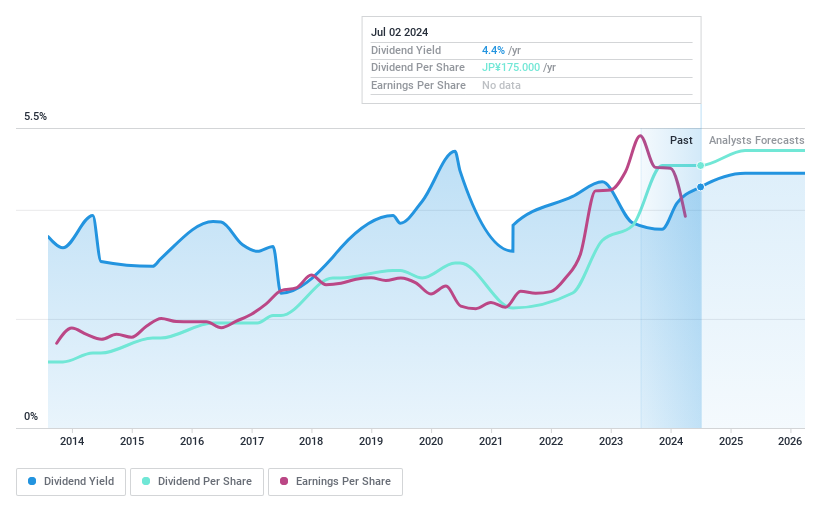

Hagiwara Electric Holdings (TSE:7467)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hagiwara Electric Holdings Co., Ltd. operates in the sale of electronic devices and equipment across Japan, North America, Europe, and Asia, with a market capitalization of approximately ¥41.89 billion.

Operations: Hagiwara Electric Holdings Co., Ltd. generates its revenues from the sale of electronic devices and equipment across various regions including Japan, North America, Europe, and Asia.

Dividend Yield: 4.2%

Hagiwara Electric Holdings has shown a commitment to increasing dividends over the last decade, with a current yield of 4.16%, ranking in the top quartile of Japanese dividend stocks. However, its dividend history is marked by volatility and shareholder dilution within the past year. Despite this, dividends are well-supported by a payout ratio of 33.8% and a cash payout ratio of 37.7%. The company's earnings are projected to grow by 16.36% annually, indicating potential for sustained dividend payments amidst its challenges with reliability and recent market valuation at 76.3% below estimated fair value as discussed in their May earnings call.

- Click here and access our complete dividend analysis report to understand the dynamics of Hagiwara Electric Holdings.

- According our valuation report, there's an indication that Hagiwara Electric Holdings' share price might be on the cheaper side.

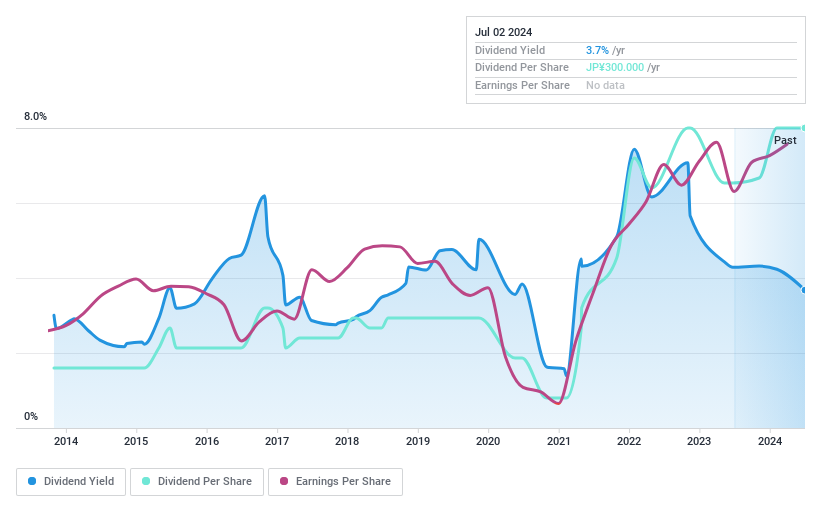

Shinsho (TSE:8075)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinsho Corporation, operating globally, engages in the import, export, and trade of iron and steel products, ferrous raw materials, nonferrous metals, machinery, information industry products, and welding items with a market capitalization of approximately ¥66.00 billion.

Operations: Shinsho Corporation's business includes the global trade of a diverse range of products, such as iron and steel, ferrous raw materials, nonferrous metals, various machinery, technology-related items, and welding equipment.

Dividend Yield: 4%

Shinsho Corporation recently increased its year-end dividend for FY 2024 to ¥190 per share but projected a decrease to ¥150 for FY 2025, reflecting a pattern of inconsistent dividends over the past decade. Despite trading at 51.2% below its estimated fair value, suggesting potential undervaluation, concerns about dividend reliability persist due to volatile historical payments and insufficient coverage by operating cash flow. However, both earnings and cash flows currently cover the dividends well, with payout ratios of 44.5% and 32.2%, respectively.

- Click here to discover the nuances of Shinsho with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Shinsho is trading behind its estimated value.

Summing It All Up

- Investigate our full lineup of 387 Top Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7187

Flawless balance sheet and good value.

Market Insights

Community Narratives