- Japan

- /

- Trade Distributors

- /

- TSE:8031

Should Berkshire Hathaway’s Growing Stake Prompt Action from Mitsui (TSE:8031) Investors?

Reviewed by Simply Wall St

- Warren Buffett's Berkshire Hathaway recently increased its stake in Mitsui & Co. to above 10% on a voting-rights basis, with the potential to raise it further, signaling notable interest from a prominent long-term investor.

- This development stands out as an endorsement of Mitsui's business model and Japan's trading house sector, drawing broader market attention to the company’s evolving strategy amid its global investment initiatives.

- We'll examine how Berkshire Hathaway's expanded holding in Mitsui could reshape the company's investment case and long-term growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Mitsui Investment Narrative Recap

To be a Mitsui shareholder, you need to believe the company can successfully diversify its revenue streams beyond commodities, while capturing growth from the global energy transition. Berkshire Hathaway’s increased stake draws short-term attention but does not materially affect the most important near-term catalyst, continued execution on clean energy projects, or the significant risk that earnings remain tied to volatile commodity markets and slow portfolio transformation.

The recent decision with Olin Corporation to end the Blue Water Alliance joint venture stands out. This move reflects Mitsui's willingness to adjust partnerships in the chemicals sector, which ties directly to the company’s push toward more flexible, resilient business models, an important catalyst as it seeks to strengthen its position in industries less exposed to commodity swings.

However, investors should also be mindful that, in contrast, periods of lower commodity prices could lead to...

Read the full narrative on Mitsui (it's free!)

Mitsui's narrative projects ¥15,578.0 billion revenue and ¥878.2 billion earnings by 2028. This requires 3.3% yearly revenue growth and an increase of ¥62.3 billion in earnings from ¥815.9 billion today.

Uncover how Mitsui's forecasts yield a ¥3823 fair value, in line with its current price.

Exploring Other Perspectives

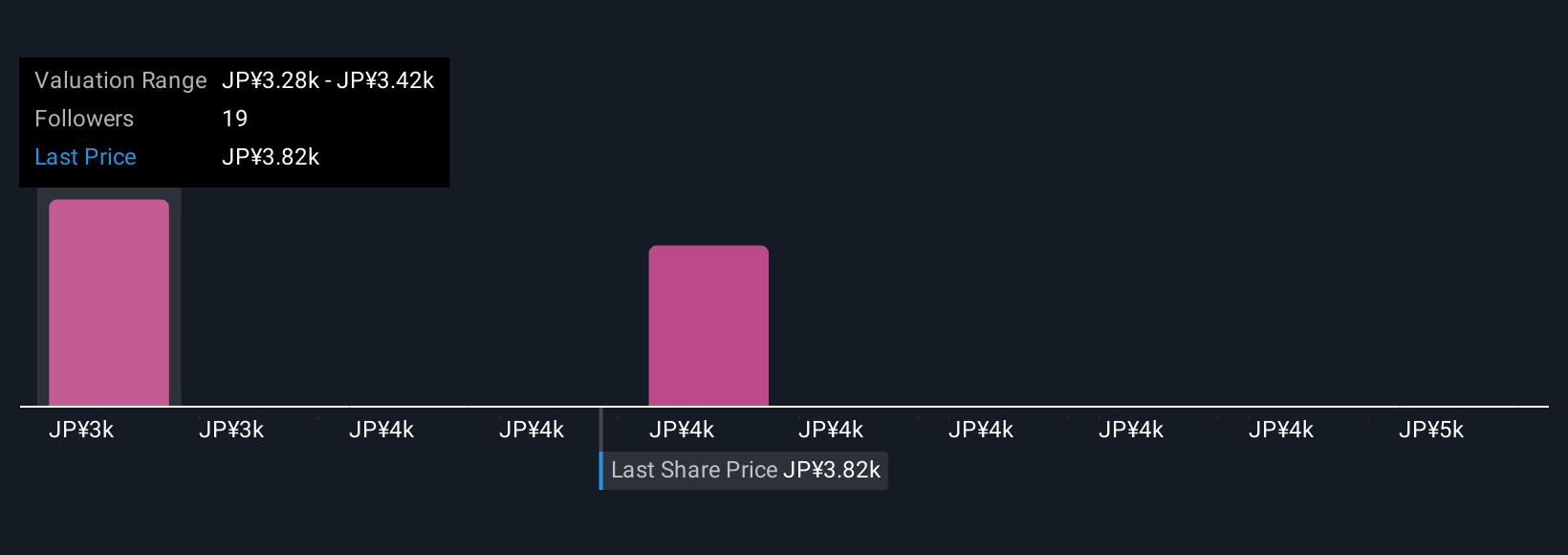

Four private investors in the Simply Wall St Community see Mitsui's fair value ranging widely from ¥3,260 to ¥4,700 per share. While opinions vary, many are focused on whether the company's transition away from core resources can cushion future earnings from commodity price pressure.

Explore 4 other fair value estimates on Mitsui - why the stock might be worth as much as 25% more than the current price!

Build Your Own Mitsui Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsui research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mitsui research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsui's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8031

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives