- Japan

- /

- Trade Distributors

- /

- TSE:8031

Mitsui (TSE:8031) raises dividend to JPY 50 and revises profit forecast to JPY 920 billion for FY 2025

Reviewed by Simply Wall St

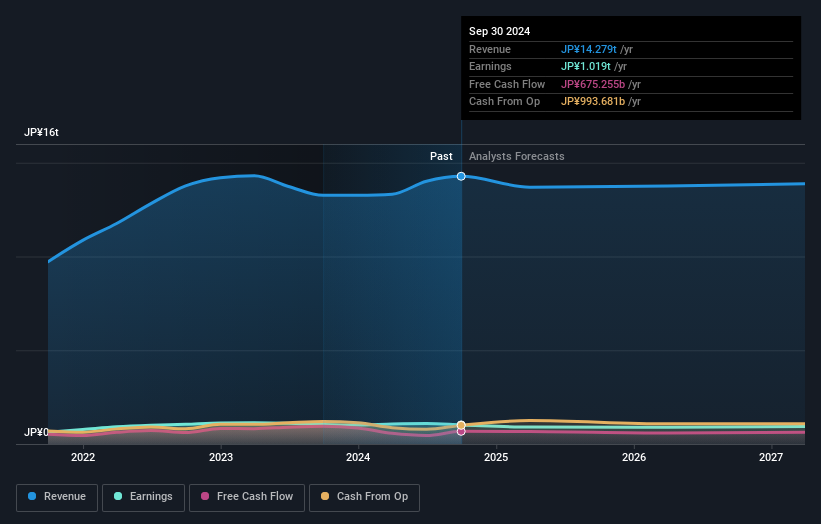

Mitsui (TSE:8031) has been making significant strides with a recent interim dividend increase to JPY 50 per share, reflecting its financial health and strategic foresight. The company has also raised its profit guidance for the fiscal year ending March 2025 to JPY 920 billion, showcasing adaptability to market conditions. However, challenges such as supply chain inefficiencies and rising operational costs continue to pressure margins, necessitating strategic cost management and debt handling. The following discussion will explore Mitsui's key financial metrics, growth prospects, and the impact of market volatility on its operations.

Click here and access our complete analysis report to understand the dynamics of Mitsui.

Key Assets Propelling Mitsui Forward

Recent developments highlight Mitsui's financial health, underscored by a strategic interim dividend increase to JPY 50 per share, reflecting confidence in its earnings stability. The company has consistently demonstrated high-quality past earnings with a 25.8% annual growth over the last five years. This financial strength is further supported by a prudent payout ratio of 27.1%, ensuring dividends are well covered by earnings. The raised corporate guidance for the fiscal year ending March 2025, now anticipating a profit of JPY 920 billion, underscores management's strategic foresight and adaptability to market conditions.

Internal Limitations Hindering Mitsui's Growth

Mitsui faces challenges, including operational inefficiencies noted by CFO Tetsuya Shigeta, who mentioned supply chain delays impacting demand fulfillment. Rising operational costs, increased by 10% due to inflation, have pressured margins, highlighting the need for enhanced cost management. The company's current net profit margin of 7.1% is lower than the previous year's 7.9%, reflecting these pressures. Additionally, a high net debt to equity ratio of 47.3% poses a significant financial challenge, necessitating careful debt management strategies.

Future Prospects for Mitsui in the Market

Opportunities abound as Mitsui explores expansion into emerging markets, which could diversify revenue streams and enhance market presence. CEO Kenichi Hori emphasized the potential for significant growth in these regions. The company's commitment to digital transformation, with investments in digital marketing and e-commerce, aims to tap into broader audiences and adapt to evolving consumer behaviors. Strategic partnerships are also on the horizon, with discussions underway to enhance product offerings and expand distribution channels, potentially creating beneficial synergies.

Market Volatility Affecting Mitsui's Position

Economic headwinds remain a concern, as management closely monitors indicators that could impact consumer spending. Regulatory challenges in key markets pose compliance risks, necessitating proactive measures to stay ahead of changes. Supply chain vulnerabilities persist, with ongoing efforts to mitigate risks and ensure uninterrupted customer demand fulfillment. The competitive pressures within the industry continue to challenge Mitsui's pricing strategies, requiring strategic agility to maintain its market position.

To learn about how Mitsui's valuation metrics are shaping its market position, check out our detailed analysis of Mitsui's Valuation.Conclusion

Mitsui's strategic moves, including an interim dividend increase and a forecasted profit of JPY 920 billion, demonstrate its confidence in navigating market conditions, supported by a strong financial foundation with a 25.8% annual earnings growth. However, challenges such as supply chain inefficiencies and rising costs necessitate improved cost management and debt strategies to maintain profitability, as evidenced by a net profit margin decline to 7.1% and a high net debt to equity ratio of 47.3%. The company's exploration of emerging markets and digital transformation initiatives signal potential for revenue diversification and market expansion, which, combined with strategic partnerships, could offset competitive pressures. With a Price-To-Earnings Ratio of 9.3x, Mitsui is trading below its estimated fair value, presenting an attractive investment opportunity as it leverages its strengths to address internal and external challenges, positioning itself for sustainable future growth.

Turning Ideas Into Actions

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:8031

Excellent balance sheet, good value and pays a dividend.