- Japan

- /

- Trade Distributors

- /

- TSE:8031

Is Mitsui (TSE:8031) Using Exclusive Biodiesel Rights to Quietly Redefine Its Energy Transition Strategy?

Reviewed by Sasha Jovanovic

- In late November 2025, Optimus Technologies announced it had signed an MOU granting Mitsui & Co. exclusive rights to distribute its Vector System and related 100% biodiesel solutions across Japan, India, and ASEAN markets, aiming to support decarbonization of existing diesel fleets.

- This exclusive access to biodiesel conversion technology could deepen Mitsui’s role in low-carbon infrastructure, reinforcing its broader energy transition and infrastructure investment ambitions.

- We’ll now examine how Mitsui’s exclusive biodiesel distribution rights might reshape its investment narrative and long-term clean energy positioning.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Mitsui Investment Narrative Recap

To own Mitsui, you need to believe it can keep turning a diversified global portfolio into resilient earnings while gradually reducing its dependence on fossil-fuel-linked commodities. The new exclusive biodiesel distribution MOU with Optimus Technologies fits Mitsui’s energy transition story, but it does not change the near term focus on execution, commodity price exposure, and the risk that earnings growth stays modest despite recent guidance upgrades.

The most relevant recent development alongside this MOU is Mitsui’s ongoing share buyback program of up to 40,000,000 shares for ¥200,000 million, with planned cancellation. For investors, this capital return program sits next to new low carbon initiatives as a key near term catalyst, but it also heightens the importance of Mitsui not becoming overextended across too many parallel investment themes at once.

Yet investors should be aware that Mitsui’s broad expansion raises the risk of overextension and...

Read the full narrative on Mitsui (it's free!)

Mitsui's narrative projects ¥15,578.0 billion revenue and ¥878.2 billion earnings by 2028. This requires 3.3% yearly revenue growth and about a ¥62.3 billion earnings increase from ¥815.9 billion today.

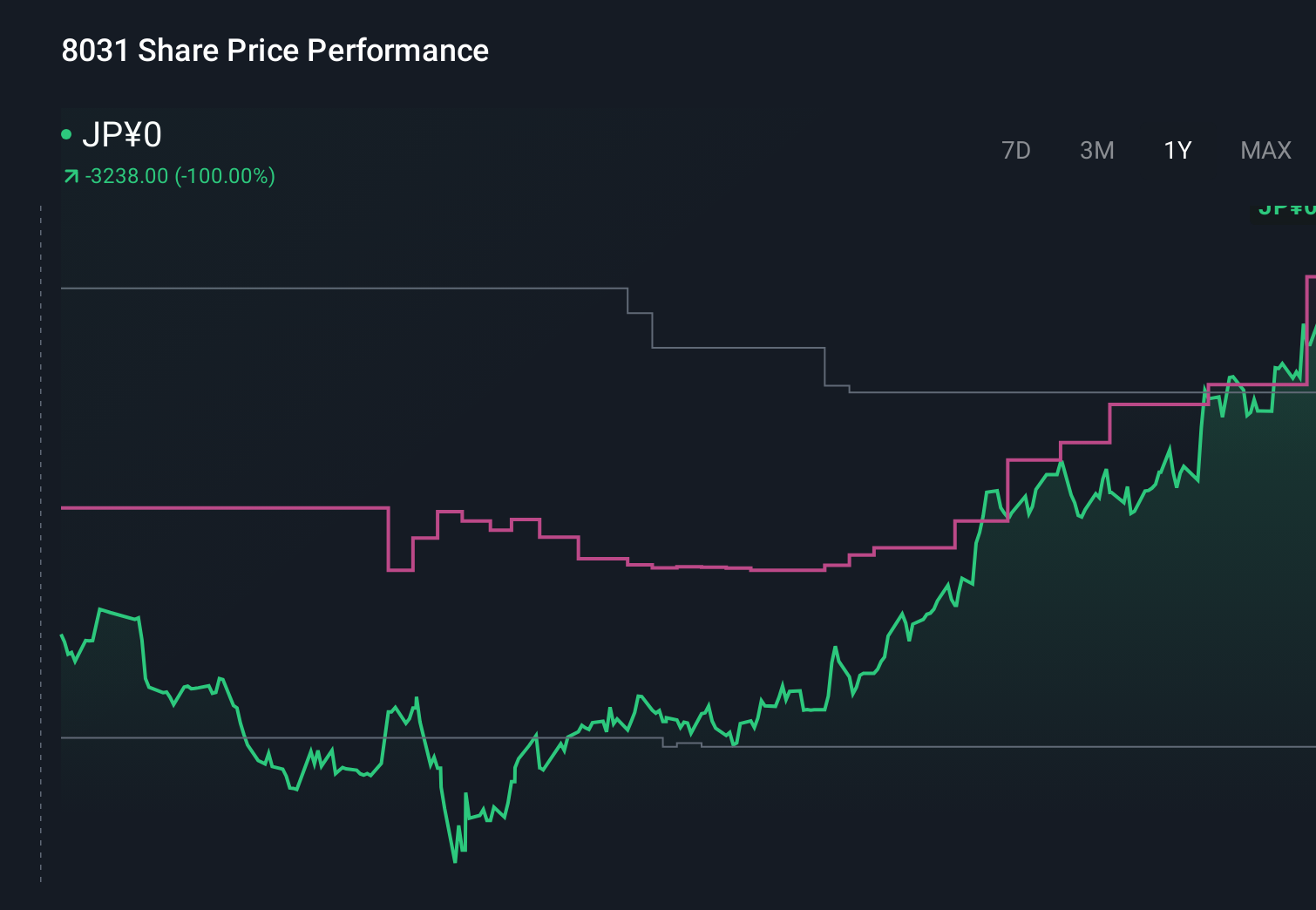

Uncover how Mitsui's forecasts yield a ¥4438 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community span roughly ¥3,610 to ¥4,700, showing how far opinions can stretch. Set against Mitsui’s push into biodiesel and ongoing buybacks, this spread underlines why you may want to compare several views before deciding how much earnings volatility you are comfortable with.

Explore 4 other fair value estimates on Mitsui - why the stock might be worth 22% less than the current price!

Build Your Own Mitsui Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsui research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Mitsui research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsui's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8031

Mitsui

Operates as trading company in Japan, Singapore, the United States, Australia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)