As global markets navigate a landscape marked by record highs in major indexes and a divergence between growth and value stocks, small-cap equities have shown mixed performance with the Russell 2000 Index experiencing a recent decline. Amidst these dynamics, identifying promising opportunities requires an understanding of how economic indicators such as job growth and interest rate expectations influence smaller companies. In this context, discovering undervalued stocks that possess strong fundamentals and resilience in fluctuating market conditions can be particularly rewarding for investors seeking to uncover hidden gems within the small-cap sector.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Jiangsu Cai Qin Technology (SHSE:688182)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Cai Qin Technology Co., Ltd specializes in the research, development, production, and sale of microwave dielectric ceramic components both in China and internationally, with a market capitalization of CN¥7.76 billion.

Operations: The primary revenue stream for Jiangsu Cai Qin Technology comes from the communication equipment manufacturing segment, generating CN¥376.27 million.

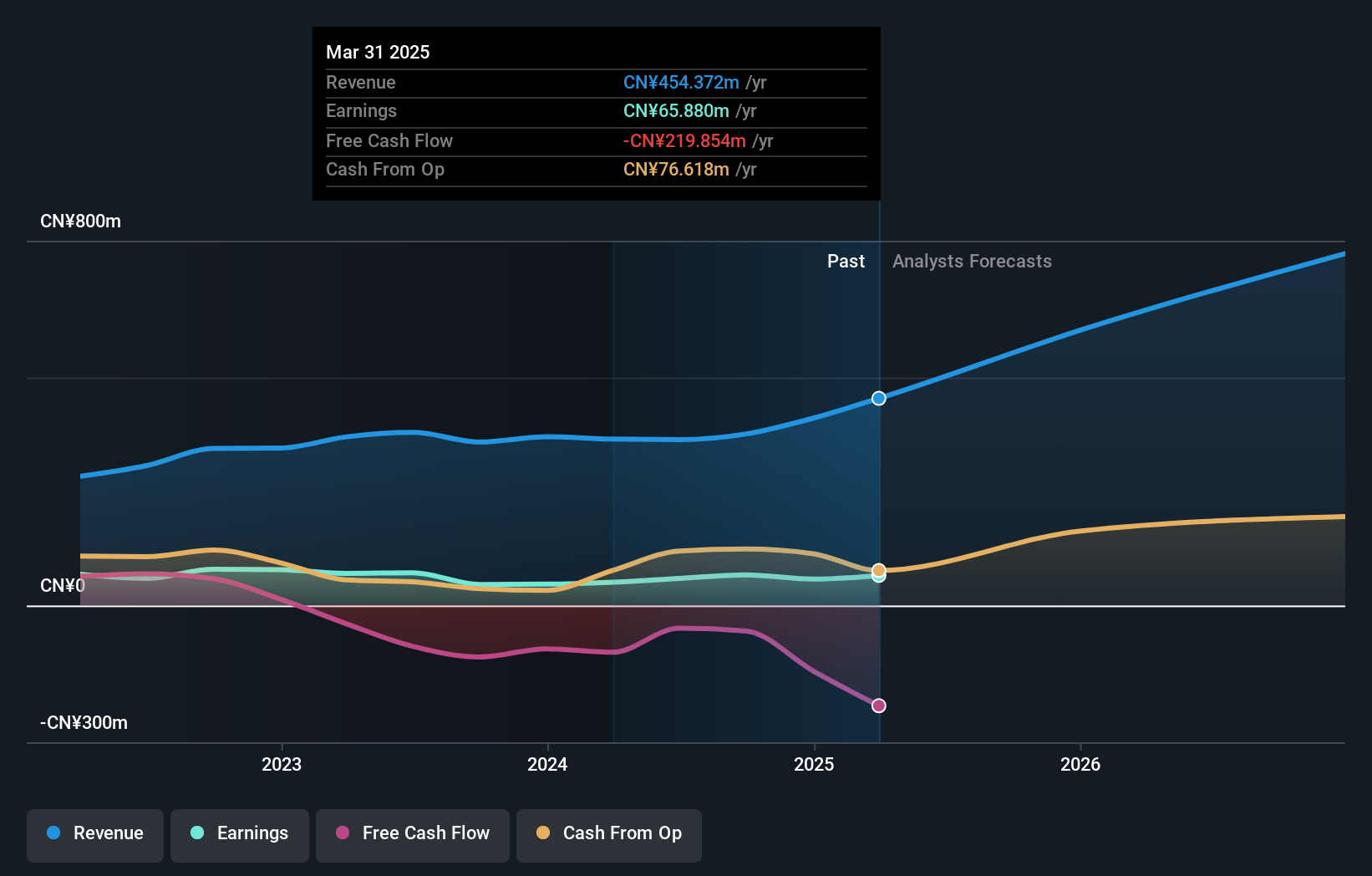

Jiangsu Cai Qin Technology, a smaller player in the electronics industry, has shown notable financial resilience. Over the past year, its earnings surged by 45.1%, outpacing the industry's 1.9% growth rate. Impressively, it operates debt-free now compared to a debt-to-equity ratio of 2.3% five years ago. For the first nine months of 2024, sales reached CNY 269 million from CNY 263 million last year, with net income climbing to CNY 50 million from CNY 30 million previously. Despite recent volatility in its share price and negative free cash flow trends, Jiangsu's solid earnings growth and quality position it well for future opportunities.

- Click to explore a detailed breakdown of our findings in Jiangsu Cai Qin Technology's health report.

Shanghai Shunho New Materials TechnologyLtd (SZSE:002565)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Shunho New Materials Technology Co., Ltd. operates in the new materials industry and has a market capitalization of CN¥3.95 billion.

Operations: The company generates revenue primarily from its operations in the new materials sector. Its financial performance is influenced by various cost structures, with a focus on optimizing operational efficiencies to impact its net profit margin.

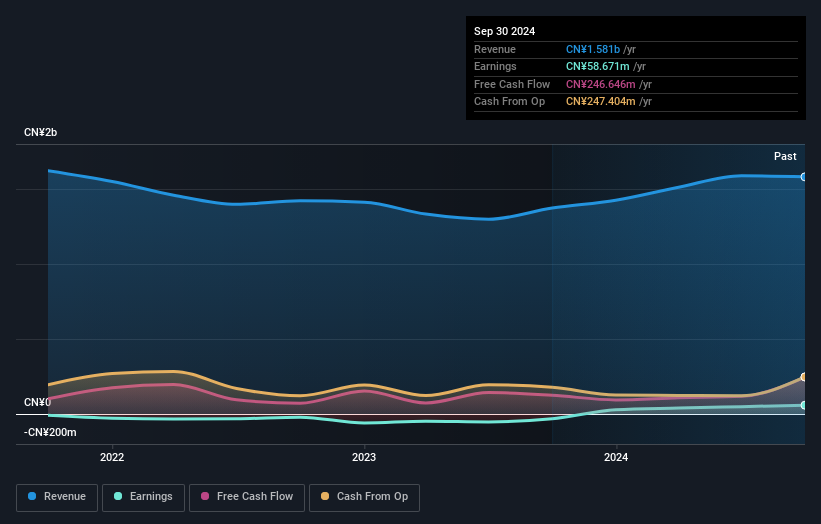

Shunho New Materials, a relatively small player in the industry, has shown promising growth with sales reaching CNY 1.13 billion for the first nine months of 2024, up from CNY 976 million last year. Net income climbed to CNY 55.96 million compared to CNY 25.69 million previously, reflecting its recent profitability and high-quality earnings. Trading at nearly 60% below estimated fair value suggests potential undervaluation. The company's debt-to-equity ratio improved significantly over five years from 21% to just over 5%, indicating effective debt management and a robust financial position with more cash than total debt obligations.

Kanematsu (TSE:8020)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kanematsu Corporation engages in the trading of commercial products both in Japan and internationally, with a market capitalization of ¥213.29 billion.

Operations: Kanematsu's revenue streams are derived from its trading operations in commercial products, both domestically and internationally. The company has a market capitalization of ¥213.29 billion.

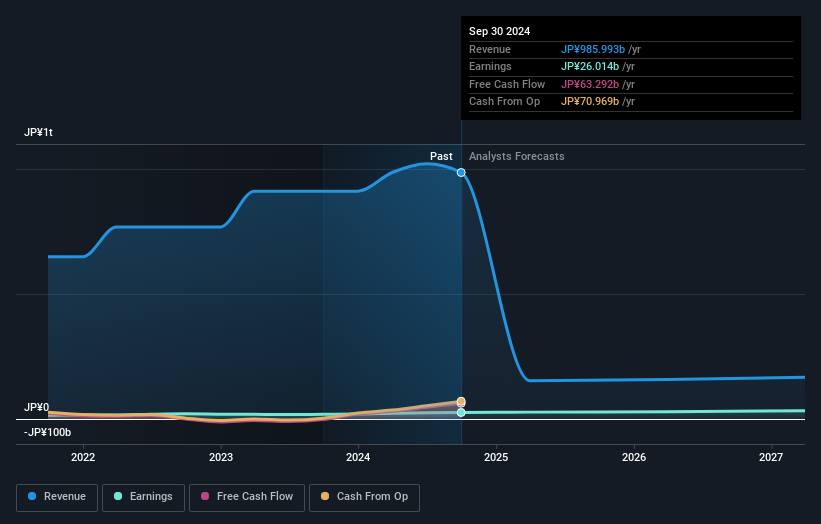

Kanematsu is making waves with its robust performance, showing earnings growth of 39.1% last year, which outpaced the Trade Distributors industry significantly. The company’s interest payments are well covered by EBIT at 9.4 times, indicating strong financial health despite a high net debt to equity ratio of 76.2%. Recently, Kanematsu raised its earnings guidance for fiscal year-end March 2025 and announced a dividend increase to ¥52.50 per share for Q2 2024 from ¥45 the previous year, reflecting confidence in future prospects and shareholder value enhancement strategies.

- Navigate through the intricacies of Kanematsu with our comprehensive health report here.

Understand Kanematsu's track record by examining our Past report.

Where To Now?

- Discover the full array of 4630 Undiscovered Gems With Strong Fundamentals right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Shanghai Shunho New Materials TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002565

Shanghai Shunho New Materials TechnologyLtd

Shanghai Shunho New Materials Technology Co.,Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives