- Japan

- /

- Trade Distributors

- /

- TSE:8015

JinGuan Electric And 2 Other Leading Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In the wake of recent global market shifts, including a notable rally in U.S. stocks driven by expectations of favorable fiscal policies following a political "red sweep," investors are increasingly focused on strategies that can offer stability and growth. As markets respond to these dynamic conditions, dividend stocks like JinGuan Electric present an attractive option for those looking to enhance their portfolios with reliable income streams and potential capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.45% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.77% | ★★★★★☆ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

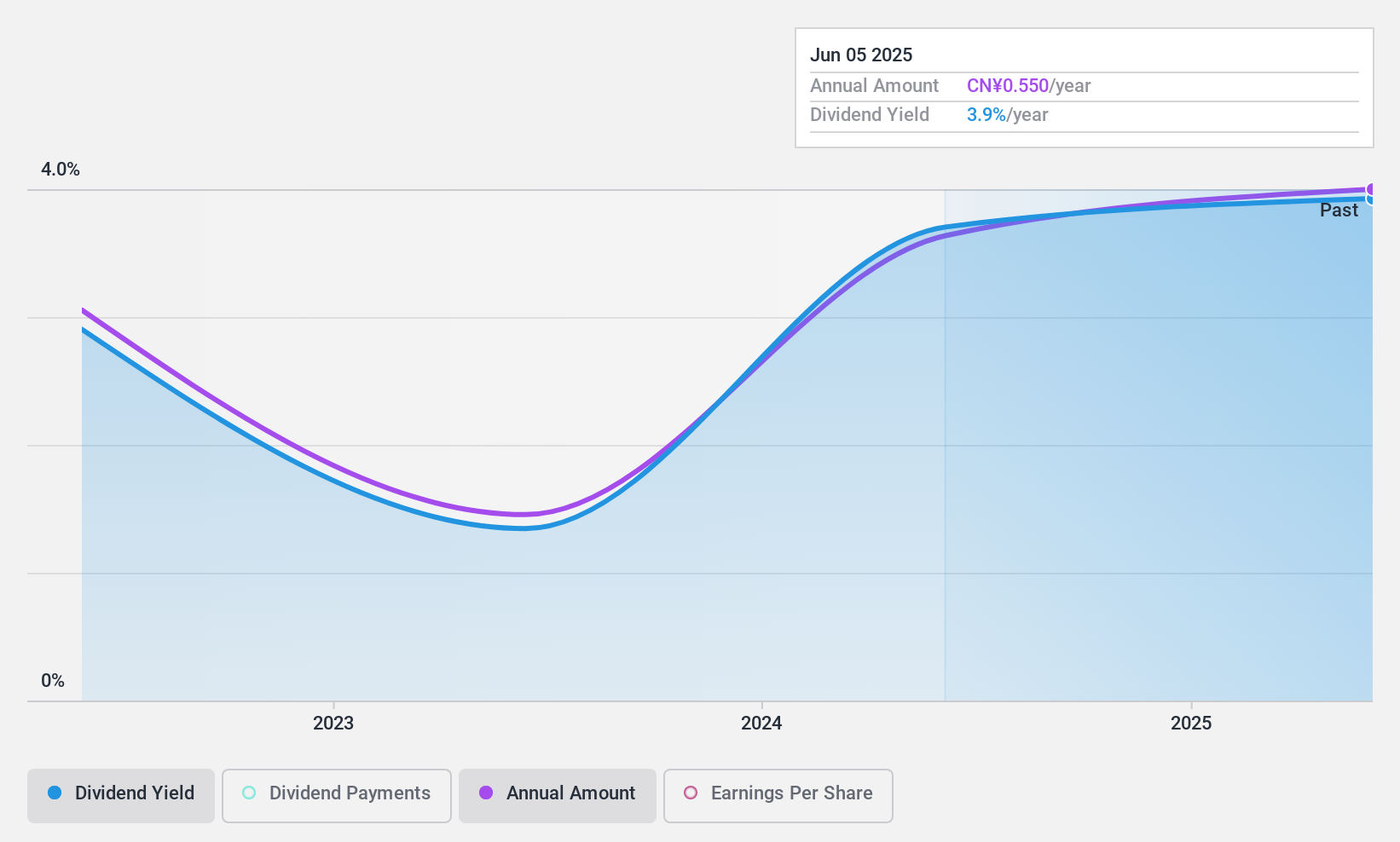

JinGuan Electric (SHSE:688517)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jinguan Electric Co., Ltd. is involved in the research, development, and manufacturing of lightning arresters in China, with a market cap of CN¥2.04 billion.

Operations: Jinguan Electric Co., Ltd. generates its revenue primarily from the Electric Equipment segment, amounting to CN¥681.61 million.

Dividend Yield: 3.3%

JinGuan Electric's dividend yield of 3.31% ranks it among the top 25% of CN market payers, though its two-year dividend history is marked by volatility and unreliable growth. Despite this, dividends are supported by a reasonable payout ratio of 68.3%, with coverage from both earnings and cash flows. Recent financials show net income growth to CNY 66.23 million for nine months ended September 2024, indicating potential for future stability in payouts amidst ongoing buyback activities totaling CNY 20.03 million.

- Click here and access our complete dividend analysis report to understand the dynamics of JinGuan Electric.

- Our valuation report here indicates JinGuan Electric may be undervalued.

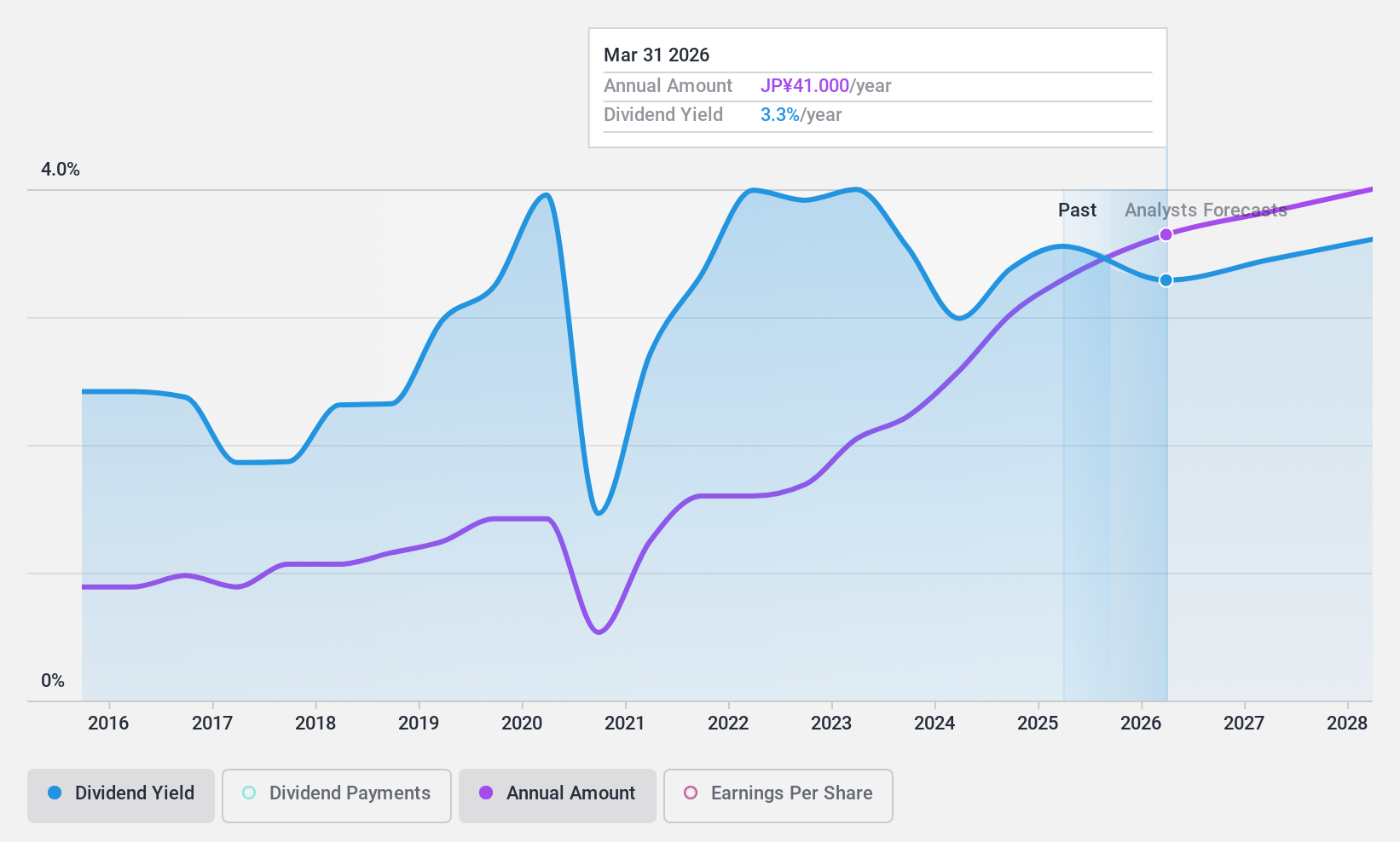

Riken Technos (TSE:4220)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Riken Technos Corporation operates in the compound, film, and food wrapping film sectors both in Japan and internationally, with a market capitalization of ¥57.93 billion.

Operations: Riken Technos Corporation's revenue segments include compound, film, and food wrapping film businesses.

Dividend Yield: 3.1%

Riken Technos has demonstrated a strong ability to cover dividends with both earnings and cash flows, maintaining a low payout ratio of 25.6% and a cash payout ratio of 18.7%. Despite this, its dividend history is marked by volatility over the past decade. The company recently completed share buybacks totaling ¥2.43 billion, potentially enhancing shareholder value. However, its current dividend yield of 3.1% falls short compared to top-tier Japanese market payers at 3.78%.

- Delve into the full analysis dividend report here for a deeper understanding of Riken Technos.

- Our comprehensive valuation report raises the possibility that Riken Technos is priced lower than what may be justified by its financials.

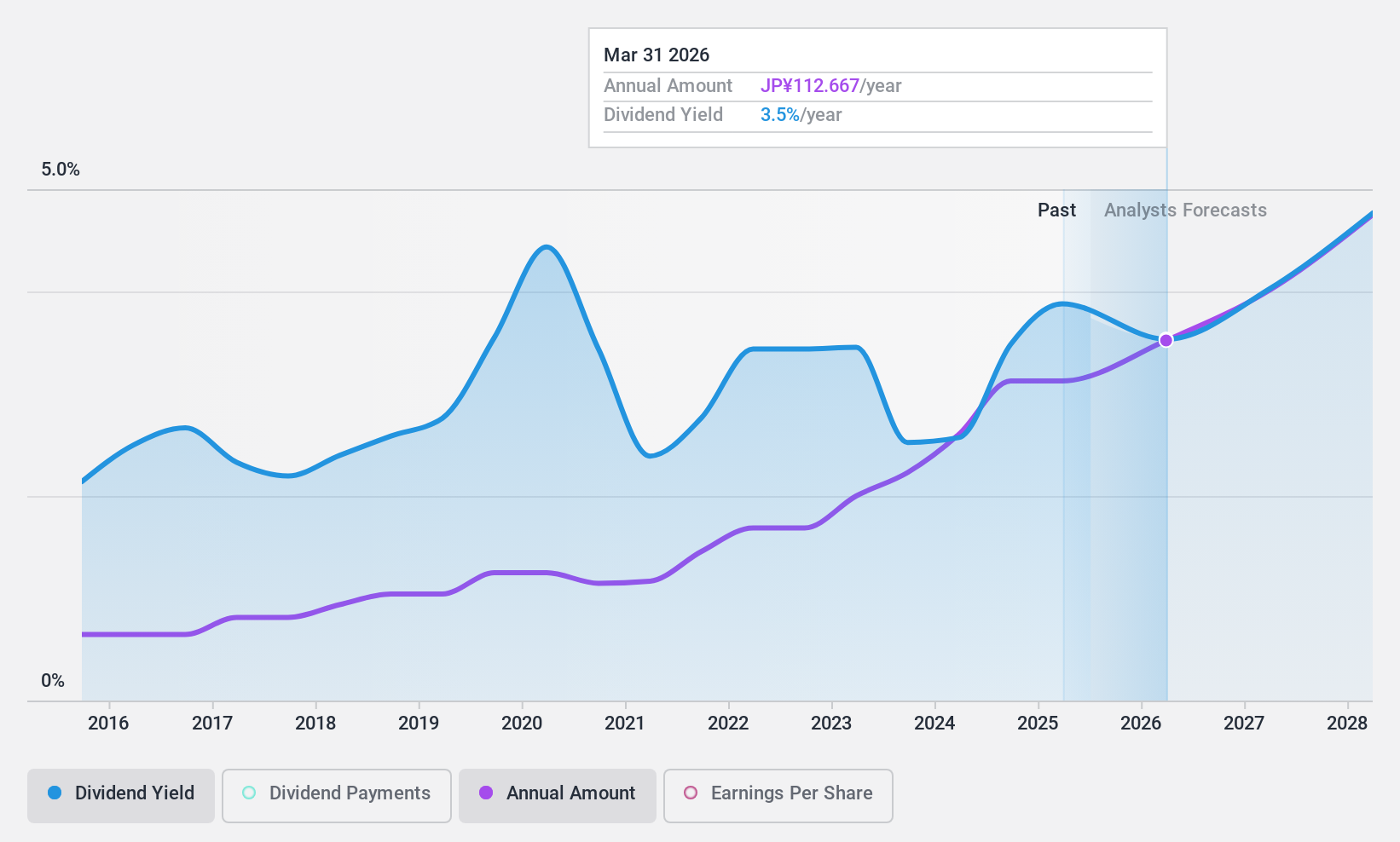

Toyota Tsusho (TSE:8015)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyota Tsusho Corporation operates globally across various sectors including metals, parts and logistics, mobility, machinery, energy and projects, chemicals and electronics, as well as food and consumer services with a market cap of ¥2.87 trillion.

Operations: Toyota Tsusho Corporation's revenue is derived from its diverse business segments, which include metals (¥2.95 trillion), parts and logistics (¥1.44 trillion), mobility (¥1.22 trillion), machinery, energy and project (¥1.92 trillion), chemicals and electronics (¥2.38 trillion), as well as food and consumer services (¥1.12 trillion).

Dividend Yield: 3.7%

Toyota Tsusho's dividend yield of 3.67% is slightly below the top quartile in Japan, with a history of volatility over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios at 45.1% and 35.3%, respectively. The company's price-to-earnings ratio of 8.6x suggests good value relative to peers, though its high debt level is a concern for stability in dividend reliability moving forward.

- Dive into the specifics of Toyota Tsusho here with our thorough dividend report.

- According our valuation report, there's an indication that Toyota Tsusho's share price might be on the cheaper side.

Summing It All Up

- Explore the 1937 names from our Top Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Tsusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8015

Toyota Tsusho

Engages in the metals, parts and logistics, mobility, machinery, energy and project, chemicals and electronics, and food and consumer services businesses worldwide.

Excellent balance sheet with proven track record and pays a dividend.