- Japan

- /

- Trade Distributors

- /

- TSE:8002

How Marubeni's New Power Trading Venture Might Reshape Its Energy Strategy (TSE:8002)

Reviewed by Sasha Jovanovic

- Marubeni Corp. recently established Marubeni Power Trading, a new joint venture with its subsidiary SmartestEnergy Ltd., to expand into Japan’s liberalized power market through spot and futures trading of electricity and fuels.

- This move highlights Marubeni’s intent to leverage growing power demand from artificial intelligence and data center expansion, as well as the region’s increasingly active derivatives markets.

- We’ll explore how establishing Marubeni Power Trading supports the company's investment narrative by enhancing its role in Japan’s evolving energy sector.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Marubeni's Investment Narrative?

For investors considering Marubeni, the big picture centers on the company’s efforts to remain relevant and competitive as Japan’s energy market undergoes rapid change. Initiatives like the just-launched Marubeni Power Trading joint venture mark an entry into active power and derivatives trading, supporting long-term ambitions to tap into fresh growth from data centers and AI-driven demand. In the short term, this move sharpens focus on energy, which could act as a modest catalyst but is unlikely to materially sway financial performance right away, given Marubeni’s vast and diversified operations. Previous catalysts, like consistent profit growth, recent buybacks, and dividend guidance, remain important. However, the joint venture adds risk exposure to power market price swings and heightened competition, two areas that could challenge execution if volatility spikes or margin pressure intensifies. While the venture aligns with Japan’s evolving power landscape, its impact on Marubeni’s near-term outlook will likely be gradual rather than immediate.

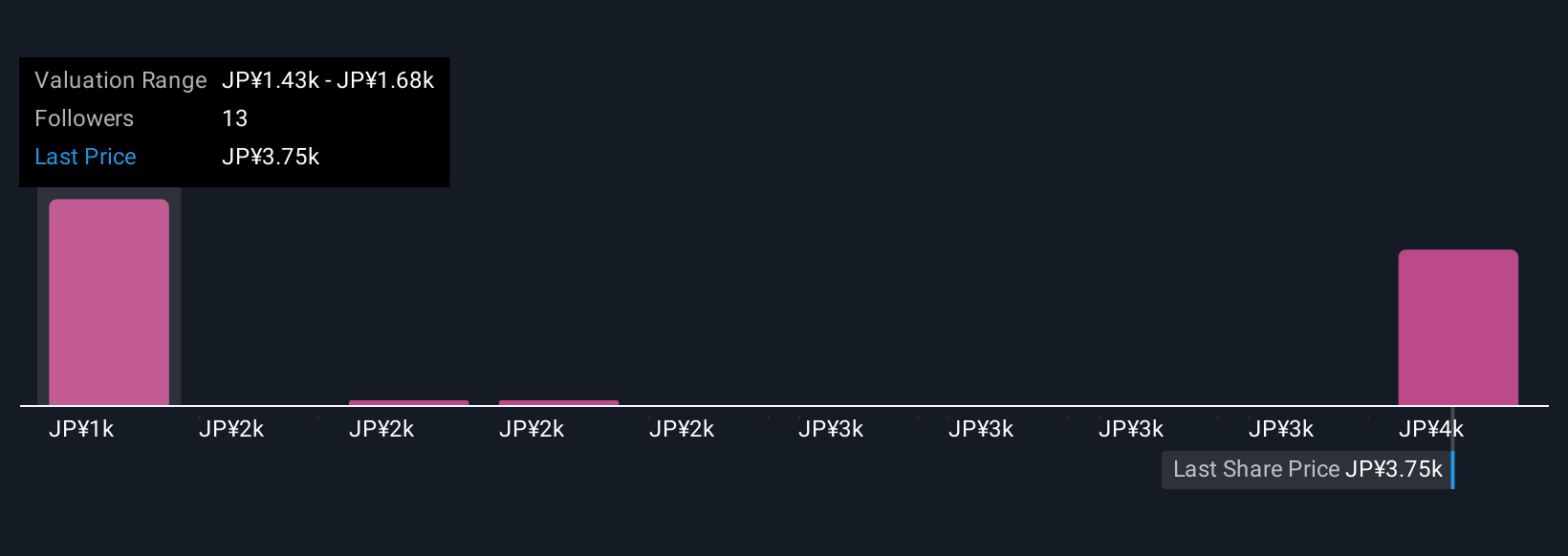

But increased exposure to market volatility in energy trading is a risk worth watching for all investors. Marubeni's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 5 other fair value estimates on Marubeni - why the stock might be worth as much as ¥3902!

Build Your Own Marubeni Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marubeni research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Marubeni research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marubeni's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8002

Marubeni

Marubeni Corporation purchases, distributes, and markets industrial and consumer goods.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives