- Japan

- /

- Trade Distributors

- /

- TSE:8001

Is ITOCHU’s Expanded Uranium Venture Shaping the Investment Case for TSE:8001?

Reviewed by Sasha Jovanovic

- Uzbekistan’s state-owned enterprise Navoiyuran, France’s Orano group, and Japan’s ITOCHU Corporation recently expanded their partnership in the "Nurlikum Mining" joint venture, advancing the industrial development of the South Djengeldi uranium deposit with an agreement signed in March 2025 in Paris and finalized last month.

- This collaboration marks a significant move for ITOCHU, leveraging existing infrastructure to enable stable uranium production and cost efficiencies over the next decade as part of broader efforts to strengthen its global resource portfolio.

- We'll now explore how ITOCHU’s deepening involvement in sustainable uranium production could influence its overall investment case.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

ITOCHU Investment Narrative Recap

To be a shareholder in ITOCHU, you need confidence in the company’s shift toward stable, higher-margin sectors and its ability to balance traditional resource exposure with expansion into sustainable initiatives. The expanded uranium venture in Uzbekistan strengthens ITOCHU’s resource portfolio, but does not immediately alter the most important near-term catalyst, continued progress in consumer and retail businesses, or lessen the key risk of earnings volatility tied to commodity markets or yen movements.

The recently completed share buyback program is particularly relevant, highlighting ITOCHU’s commitment to capital returns at a time when diversified growth and portfolio stability remain central to its investment story. While resource ventures like Nurlikum Mining offer longer-term potential, active portfolio management and shareholder returns continue to shape sentiment in the short term.

In contrast, investors should be alert to how recurring swings in resource prices or sudden yen appreciation could...

Read the full narrative on ITOCHU (it's free!)

ITOCHU's narrative projects ¥16,471.1 billion in revenue and ¥981.5 billion in earnings by 2028. This requires 3.9% yearly revenue growth and a ¥23.9 billion earnings increase from the current ¥957.6 billion.

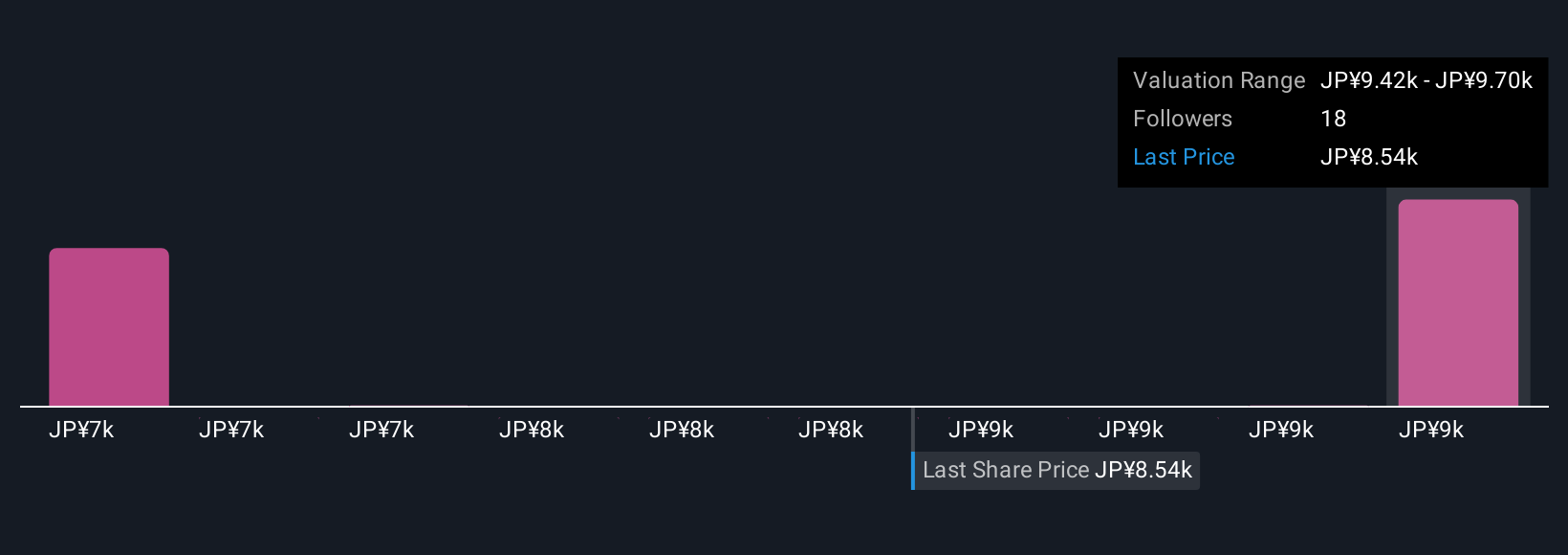

Uncover how ITOCHU's forecasts yield a ¥9696 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Four independent fair value estimates from the Simply Wall St Community put ITOCHU’s potential between ¥6,908 and ¥9,696. With varied market opinions, remember that resource price volatility remains a significant factor for future outcomes.

Explore 4 other fair value estimates on ITOCHU - why the stock might be worth as much as 12% more than the current price!

Build Your Own ITOCHU Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ITOCHU research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ITOCHU research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ITOCHU's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8001

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives