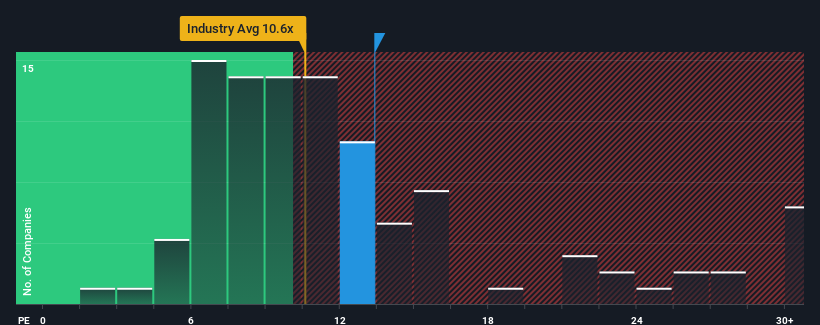

There wouldn't be many who think ITOCHU Corporation's (TSE:8001) price-to-earnings (or "P/E") ratio of 13.4x is worth a mention when the median P/E in Japan is similar at about 15x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

While the market has experienced earnings growth lately, ITOCHU's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for ITOCHU

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like ITOCHU's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 10%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 72% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 9.1% per annum over the next three years. With the market predicted to deliver 11% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that ITOCHU's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From ITOCHU's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that ITOCHU maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

You always need to take note of risks, for example - ITOCHU has 1 warning sign we think you should be aware of.

You might be able to find a better investment than ITOCHU. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8001

ITOCHU

Engages in trading and importing/exporting various products worldwide.

Solid track record with excellent balance sheet and pays a dividend.