TOKYO KEIKI INC. (TSE:7721) Looks Just Right With A 25% Price Jump

TOKYO KEIKI INC. (TSE:7721) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. The annual gain comes to 134% following the latest surge, making investors sit up and take notice.

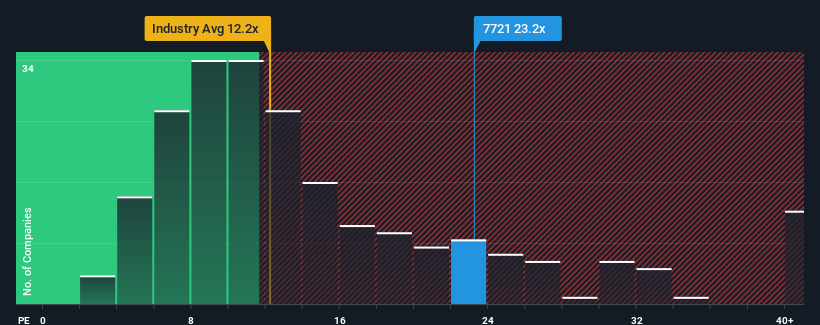

Since its price has surged higher, TOKYO KEIKI's price-to-earnings (or "P/E") ratio of 23.2x might make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 13x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, TOKYO KEIKI has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for TOKYO KEIKI

How Is TOKYO KEIKI's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like TOKYO KEIKI's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 190% last year. The strong recent performance means it was also able to grow EPS by 155% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 17% per annum over the next three years. That's shaping up to be materially higher than the 9.6% each year growth forecast for the broader market.

With this information, we can see why TOKYO KEIKI is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

TOKYO KEIKI's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of TOKYO KEIKI's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - TOKYO KEIKI has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if TOKYO KEIKI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7721

TOKYO KEIKI

Manufactures and sells measuring instruments in Japan and internationally.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives