- Japan

- /

- Electrical

- /

- TSE:7673

Daiko Tsusan Co.,Ltd. (TSE:7673) Shares Fly 25% But Investors Aren't Buying For Growth

Daiko Tsusan Co.,Ltd. (TSE:7673) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

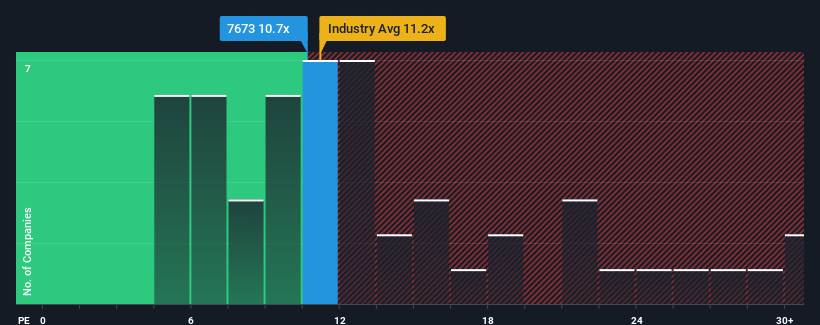

Although its price has surged higher, Daiko TsusanLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 10.7x, since almost half of all companies in Japan have P/E ratios greater than 14x and even P/E's higher than 22x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For instance, Daiko TsusanLtd's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Daiko TsusanLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Daiko TsusanLtd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.1%. This means it has also seen a slide in earnings over the longer-term as EPS is down 24% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 11% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Daiko TsusanLtd is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

The latest share price surge wasn't enough to lift Daiko TsusanLtd's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Daiko TsusanLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Daiko TsusanLtd that you need to take into consideration.

Of course, you might also be able to find a better stock than Daiko TsusanLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7673

Daiko TsusanLtd

Operates as a trading company in the fields of CATV and information and telecommunications in Japan and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives