Not Many Are Piling Into MITSUI E&S Co., Ltd. (TSE:7003) Stock Yet As It Plummets 27%

MITSUI E&S Co., Ltd. (TSE:7003) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 248% in the last twelve months.

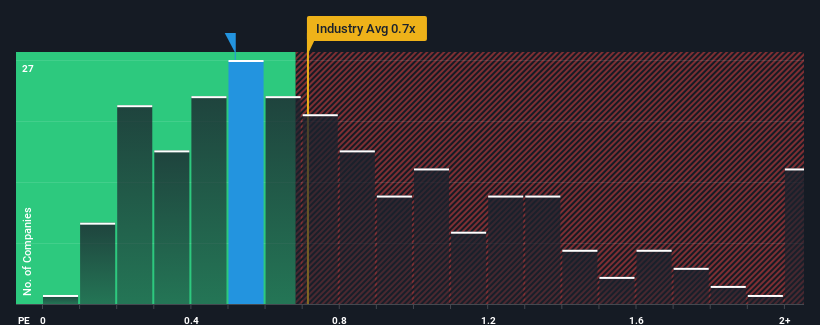

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about MITSUI E&S' P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Japan is also close to 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for MITSUI E&S

What Does MITSUI E&S' P/S Mean For Shareholders?

Recent times have been advantageous for MITSUI E&S as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on MITSUI E&S will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For MITSUI E&S?

The only time you'd be comfortable seeing a P/S like MITSUI E&S' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. Still, revenue has fallen 58% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 138% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 3.6%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that MITSUI E&S is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

With its share price dropping off a cliff, the P/S for MITSUI E&S looks to be in line with the rest of the Machinery industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that MITSUI E&S currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware MITSUI E&S is showing 3 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of MITSUI E&S' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7003

MITSUI E&S

Provides marine propulsion systems in Japan, rest of Asia, Europe, North America, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.