MITSUI E&S Co., Ltd.'s (TSE:7003) Share Price Boosted 34% But Its Business Prospects Need A Lift Too

Despite an already strong run, MITSUI E&S Co., Ltd. (TSE:7003) shares have been powering on, with a gain of 34% in the last thirty days. The annual gain comes to 217% following the latest surge, making investors sit up and take notice.

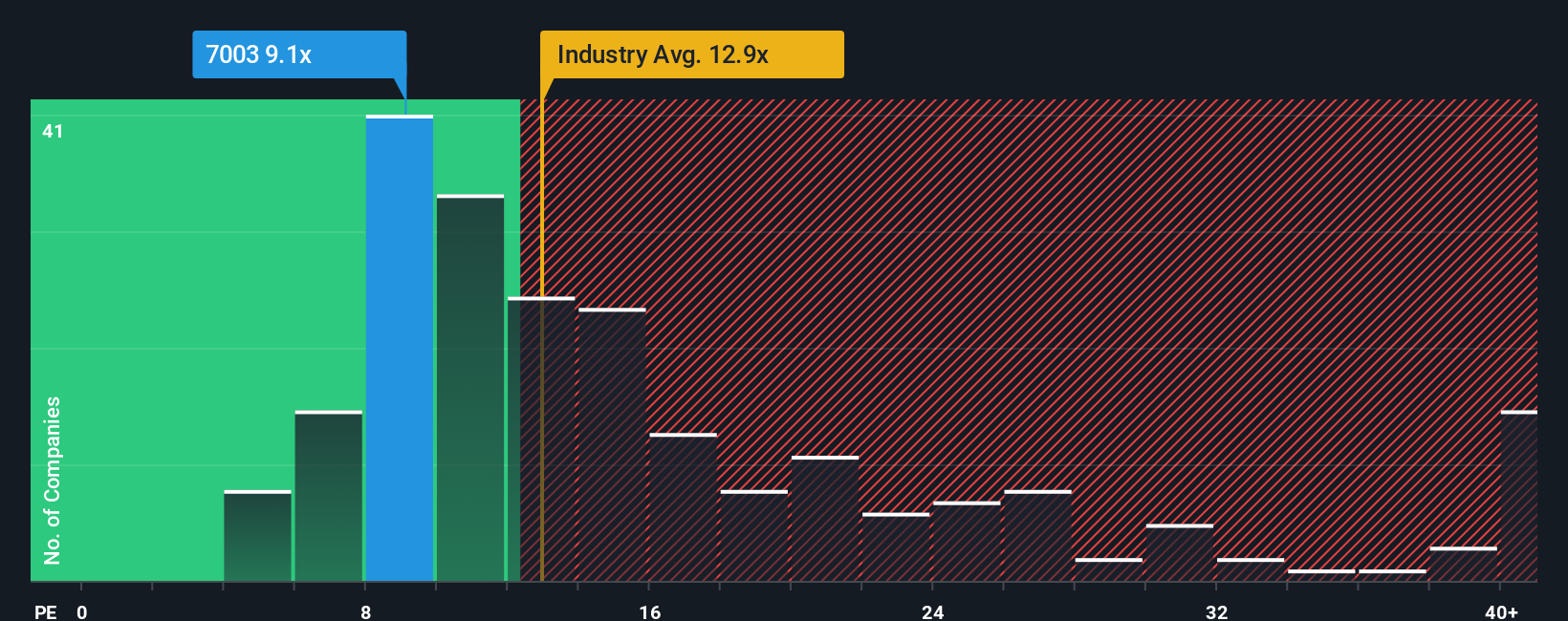

Although its price has surged higher, MITSUI E&S may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.1x, since almost half of all companies in Japan have P/E ratios greater than 15x and even P/E's higher than 23x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, MITSUI E&S has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for MITSUI E&S

Is There Any Growth For MITSUI E&S?

There's an inherent assumption that a company should underperform the market for P/E ratios like MITSUI E&S' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 51% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to slump, contracting by 18% per year during the coming three years according to the three analysts following the company. Meanwhile, the broader market is forecast to expand by 9.0% each year, which paints a poor picture.

In light of this, it's understandable that MITSUI E&S' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

The latest share price surge wasn't enough to lift MITSUI E&S' P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of MITSUI E&S' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for MITSUI E&S (2 don't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on MITSUI E&S, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7003

MITSUI E&S

Provides marine propulsion systems in Japan, rest of Asia, Europe, North America, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives