- Japan

- /

- Electrical

- /

- TSE:6932

Benign Growth For ENDO Lighting Corporation (TSE:6932) Underpins Stock's 28% Plummet

ENDO Lighting Corporation (TSE:6932) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The recent drop has obliterated the annual return, with the share price now down 6.3% over that longer period.

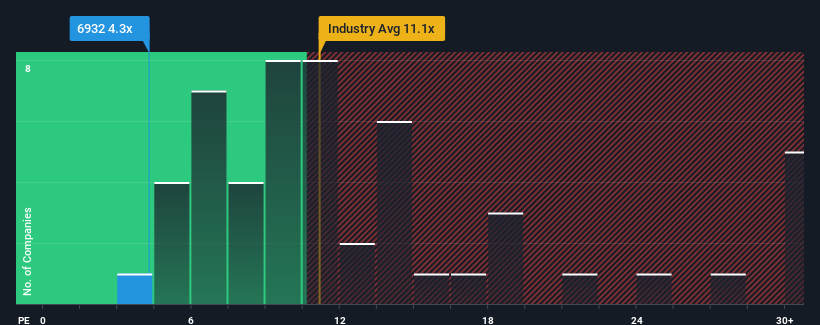

Although its price has dipped substantially, ENDO Lighting may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.3x, since almost half of all companies in Japan have P/E ratios greater than 15x and even P/E's higher than 22x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's superior to most other companies of late, ENDO Lighting has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for ENDO Lighting

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, ENDO Lighting would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 19% last year. Pleasingly, EPS has also lifted 107% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 2.9% each year as estimated by the one analyst watching the company. That's shaping up to be materially lower than the 9.6% each year growth forecast for the broader market.

In light of this, it's understandable that ENDO Lighting's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On ENDO Lighting's P/E

Shares in ENDO Lighting have plummeted and its P/E is now low enough to touch the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of ENDO Lighting's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with ENDO Lighting, and understanding them should be part of your investment process.

You might be able to find a better investment than ENDO Lighting. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade ENDO Lighting, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ENDO Lighting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6932

ENDO Lighting

Plans, designs, manufactures, and sells light fixtures in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives