- China

- /

- Aerospace & Defense

- /

- SHSE:600184

Asian Market Gems: Three Companies Priced Below Estimated Value

Reviewed by Simply Wall St

As global markets grapple with heightened trade tensions and economic uncertainty, the Asian markets are not immune to these challenges. However, this environment can also present opportunities for investors seeking undervalued stocks that may offer potential value in the long term. In such volatile times, identifying companies priced below their estimated value can be a strategic approach for those looking to navigate the complexities of today's market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Suzhou TFC Optical Communication (SZSE:300394) | CN¥62.73 | CN¥125.35 | 50% |

| Consun Pharmaceutical Group (SEHK:1681) | HK$8.81 | HK$17.39 | 49.3% |

| Taiwan Semiconductor Manufacturing (TWSE:2330) | NT$785.00 | NT$1545.20 | 49.2% |

| Premium Group (TSE:7199) | ¥1814.00 | ¥3627.27 | 50% |

| Mandom (TSE:4917) | ¥1245.00 | ¥2472.90 | 49.7% |

| ULS Group (TSE:3798) | ¥4365.00 | ¥8519.47 | 48.8% |

| Cosel (TSE:6905) | ¥971.00 | ¥1933.76 | 49.8% |

| BuySell TechnologiesLtd (TSE:7685) | ¥2537.00 | ¥4998.16 | 49.2% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.27 | CN¥42.20 | 49.6% |

| Kyushu Financial Group (TSE:7180) | ¥556.90 | ¥1091.65 | 49% |

Let's explore several standout options from the results in the screener.

North Electro-OpticLtd (SHSE:600184)

Overview: North Electro-Optic Co., Ltd. engages in the research, development, production, and sale of optoelectronic materials and devices both in China and internationally, with a market cap of CN¥6.28 billion.

Operations: North Electro-Optic Co., Ltd. generates revenue through the research, development, production, and sale of optoelectronic materials and devices both domestically and internationally.

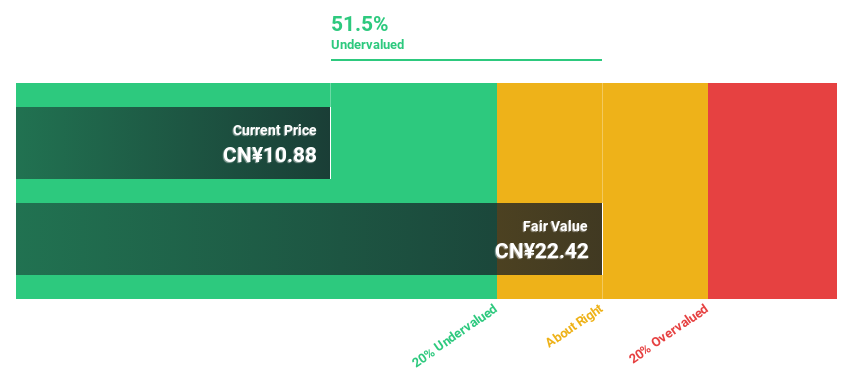

Estimated Discount To Fair Value: 43.8%

North Electro-Optic Ltd. is trading at CN¥12.35, significantly undervalued compared to its estimated fair value of CN¥21.97, representing a 43.8% discount. Despite lower profit margins this year (1.5% vs last year's 2.6%), earnings are projected to grow at a robust annual rate of 46%, outpacing the Chinese market's average growth of 23.8%. However, the company's return on equity is expected to remain low at 3.4% over three years.

- In light of our recent growth report, it seems possible that North Electro-OpticLtd's financial performance will exceed current levels.

- Dive into the specifics of North Electro-OpticLtd here with our thorough financial health report.

Medley (TSE:4480)

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States, with a market cap of ¥93.70 billion.

Operations: The company generates revenue from its platforms focused on recruitment and medical services across Japan and the United States.

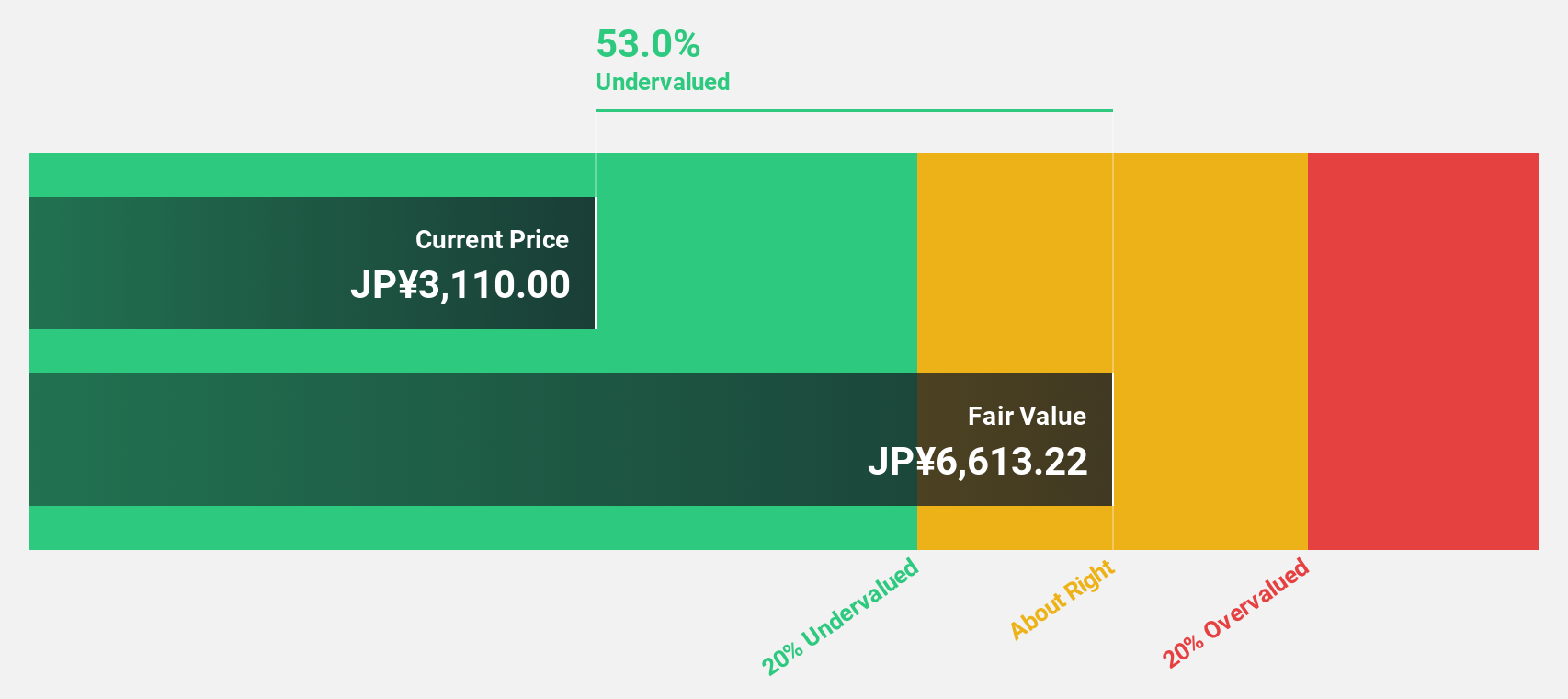

Estimated Discount To Fair Value: 33.2%

Medley, Inc. is trading at ¥2,917, approximately 33.2% below its estimated fair value of ¥4,368.74, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 23% annually over the next three years, surpassing Japan's market average growth rate of 7.8%. Despite recent share buyback announcements totaling up to ¥1 billion by September 2025 to stabilize share price volatility and return profits to shareholders, the stock remains highly volatile.

- According our earnings growth report, there's an indication that Medley might be ready to expand.

- Get an in-depth perspective on Medley's balance sheet by reading our health report here.

Cosel (TSE:6905)

Overview: Cosel Co., Ltd. manufactures and sells electrical components and EMI filters both in Japan and internationally, with a market cap of ¥39.94 billion.

Operations: The company's revenue segments include ¥2.81 billion from the Asian Sales Business, ¥2.01 billion from the China Production Business, ¥1.90 billion from the North American Sales Business, ¥23.61 billion from the Japan Production and Sales Business, and ¥6.52 billion from the Europe Production and Sales Business.

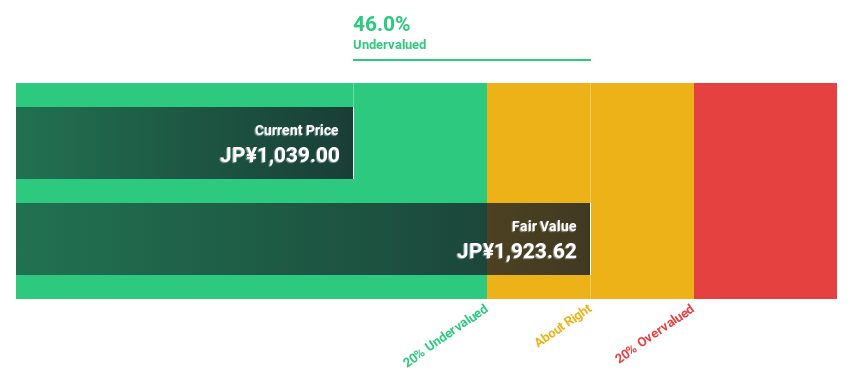

Estimated Discount To Fair Value: 49.8%

Cosel is trading at ¥971, significantly below its estimated fair value of ¥1,933.76, suggesting undervaluation based on cash flows. Earnings are projected to grow robustly at 56.26% annually over the next three years, outpacing Japan's market average growth rate of 7.8%. However, profit margins have decreased from last year and a planned capital alliance with LITE-ON TECHNOLOGY CORPORATION may lead to shareholder dilution through new share issuance and treasury share disposal.

- Insights from our recent growth report point to a promising forecast for Cosel's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Cosel.

Summing It All Up

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 272 more companies for you to explore.Click here to unveil our expertly curated list of 275 Undervalued Asian Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North Electro-OpticLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600184

North Electro-OpticLtd

Researches, develops, produces, and sells optoelectronic materials and devices in China and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives