- Japan

- /

- Electrical

- /

- TSE:6653

Seiko Electric Co., Ltd.'s (TSE:6653) P/E Is Still On The Mark Following 34% Share Price Bounce

Seiko Electric Co., Ltd. (TSE:6653) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.4% in the last twelve months.

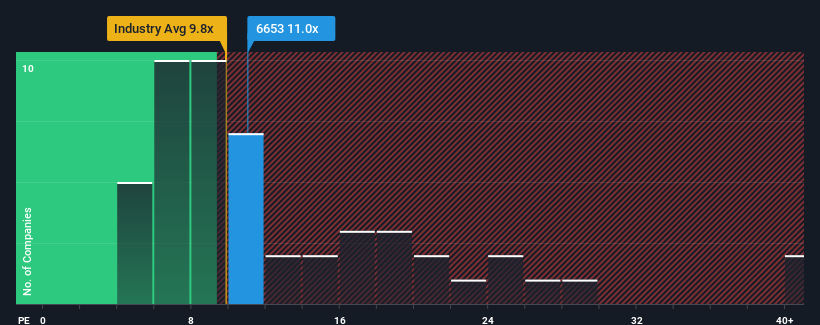

Although its price has surged higher, there still wouldn't be many who think Seiko Electric's price-to-earnings (or "P/E") ratio of 11x is worth a mention when the median P/E in Japan is similar at about 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

We've discovered 1 warning sign about Seiko Electric. View them for free.Seiko Electric could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is moderate because investors think this lacklustre earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Seiko Electric

How Is Seiko Electric's Growth Trending?

The only time you'd be comfortable seeing a P/E like Seiko Electric's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 6.7% last year. The solid recent performance means it was also able to grow EPS by 26% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 9.0% each year as estimated by the only analyst watching the company. With the market predicted to deliver 9.8% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that Seiko Electric's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Seiko Electric's P/E?

Seiko Electric appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Seiko Electric's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Seiko Electric.

Of course, you might also be able to find a better stock than Seiko Electric. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6653

Seiko Electric

Operates in the field of power system, and environmental energy and control system in Japan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives