- Switzerland

- /

- Specialty Stores

- /

- SWX:MOZN

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, with U.S. stocks climbing on the back of cooling inflation and strong bank earnings, investors are turning their attention to dividend stocks as a potential source of steady income amidst fluctuating economic conditions. With value stocks outperforming growth shares and financials posting significant gains, identifying reliable dividend-paying companies can be an attractive strategy for those seeking stability and income in their investment portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.30% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.63% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

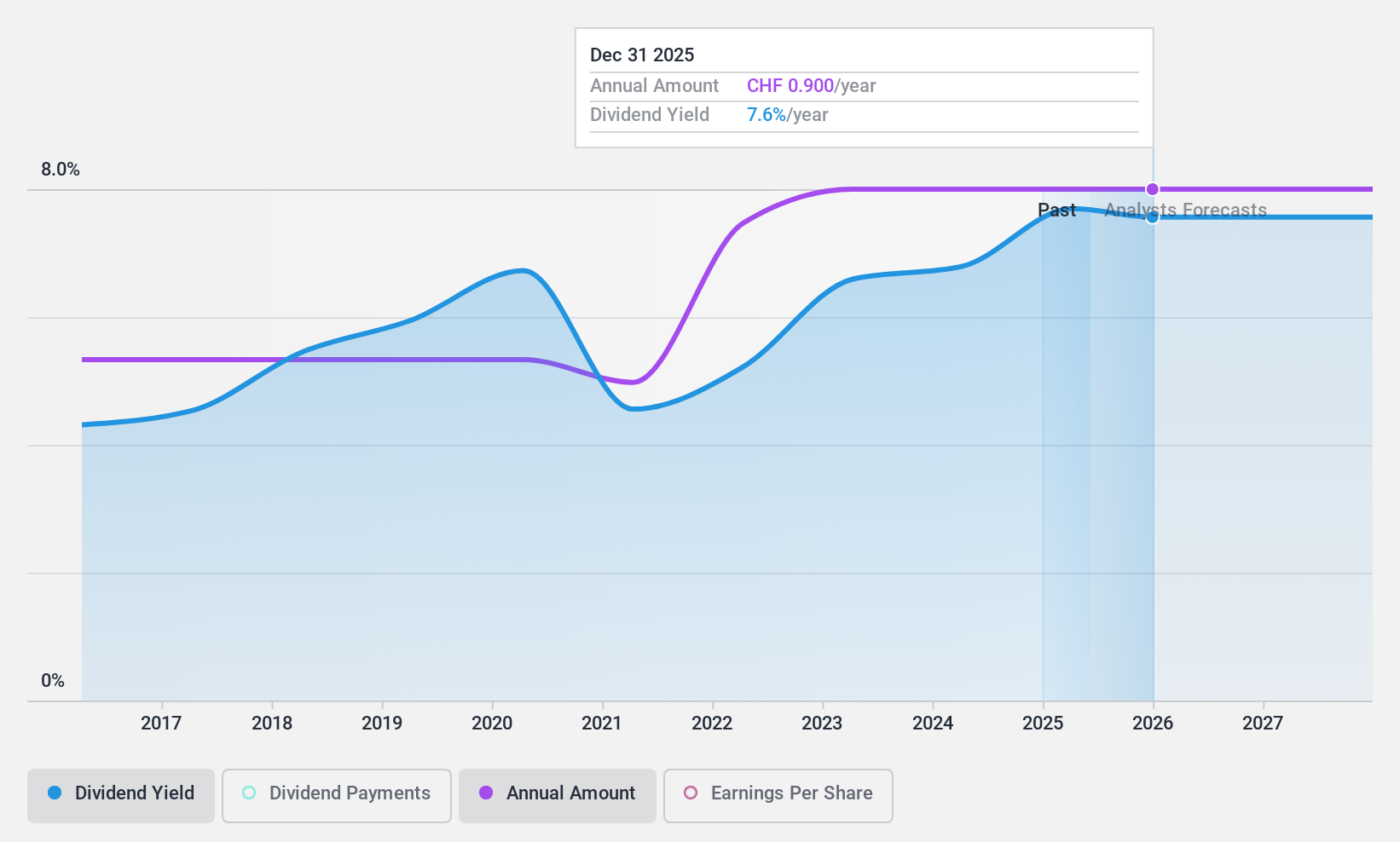

mobilezone holding ag (SWX:MOZN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mobilezone Holding AG, along with its subsidiaries, offers mobile and fixed-line telephony, television, and internet services for various network operators in Germany and Switzerland, with a market cap of CHF485.75 million.

Operations: Mobilezone Holding AG generates revenue from its operations in Germany, amounting to CHF727.71 million, and in Switzerland, totaling CHF291.80 million.

Dividend Yield: 4.4%

Mobilezone Holding AG offers a stable dividend yield of 4.41%, placing it in the top 25% of Swiss dividend payers. Despite a volatile share price and unreliable past dividend growth, its dividends are covered by both earnings and cash flows with payout ratios around 79-81%. The company maintains a favorable Price-To-Earnings ratio of 9.9x compared to the Swiss market, though debt coverage by operating cash flow remains weak. Recent guidance confirms consistent dividends for 2024 at CHF 0.90 per share.

- Delve into the full analysis dividend report here for a deeper understanding of mobilezone holding ag.

- The analysis detailed in our mobilezone holding ag valuation report hints at an deflated share price compared to its estimated value.

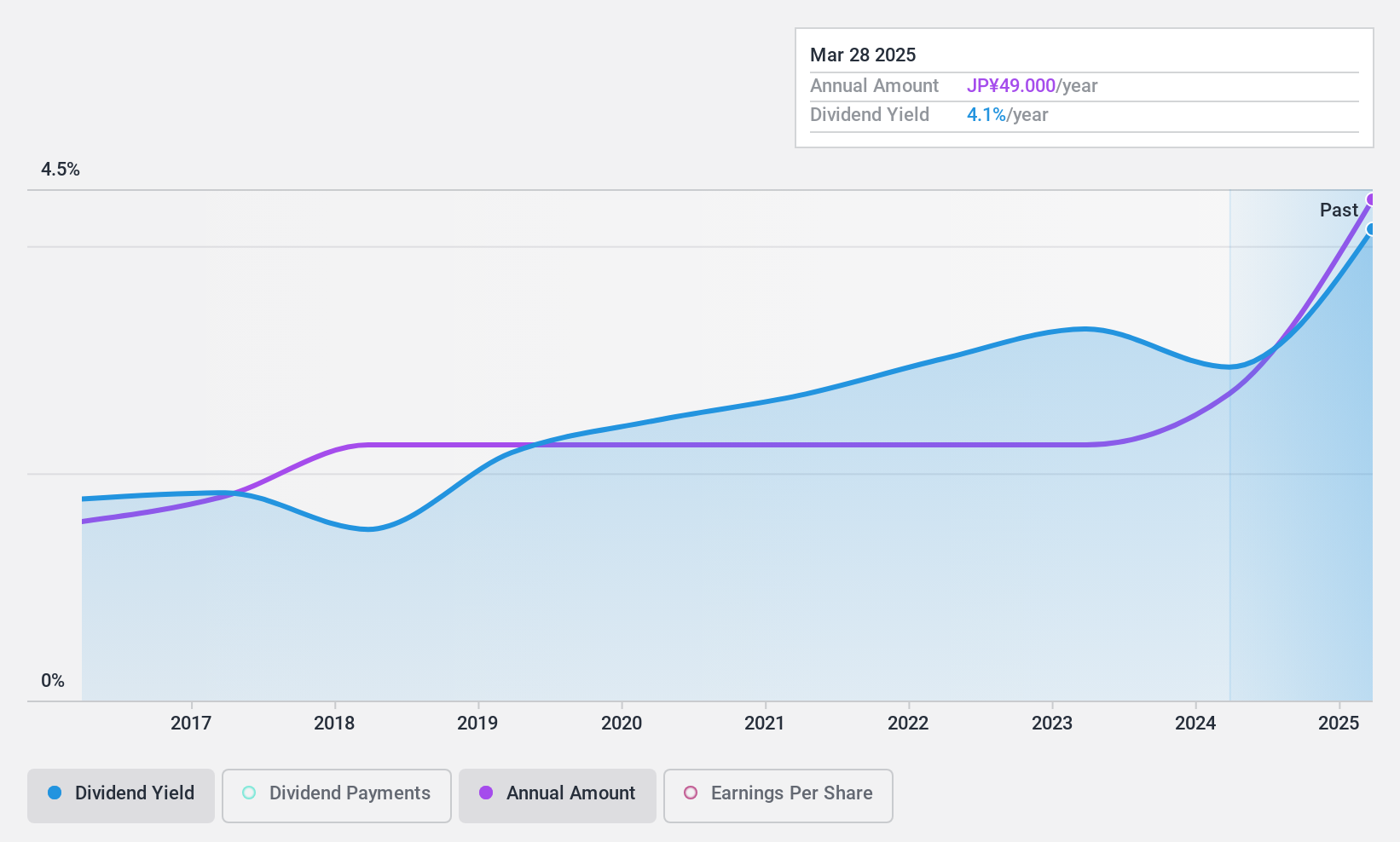

Dai Nippon Toryo Company (TSE:4611)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dai Nippon Toryo Company, Limited, along with its subsidiaries, is engaged in the manufacturing and sale of coatings and jet inks both in Japan and internationally, with a market capitalization of ¥340.01 billion.

Operations: Dai Nippon Toryo Company generates revenue from its Domestic Coatings segment at ¥51.41 billion, Overseas Coatings at ¥8.43 billion, Lighting at ¥9.98 billion, and Fluorescent Color Materials at ¥1.21 billion.

Dividend Yield: 4.1%

Dai Nippon Toryo Company offers a dividend yield of 4.1%, ranking in the top 25% of Japanese dividend payers, with dividends consistently growing over the past decade. Despite stable and reliable payments, the high cash payout ratio (142.1%) indicates dividends are not well covered by free cash flow, though they are covered by earnings with a low payout ratio (18.6%). Recent guidance projects an increased year-end dividend to ¥49 per share for fiscal 2025.

- Click here to discover the nuances of Dai Nippon Toryo Company with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Dai Nippon Toryo Company's current price could be quite moderate.

IDEC (TSE:6652)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IDEC Corporation develops human machine interfaces, industrial switches, control devices, and daily life scenes in Japan and internationally with a market cap of ¥75.33 billion.

Operations: IDEC Corporation's revenue is segmented as follows: ¥34.33 billion from Japan, ¥14.49 billion from the Americas, ¥17.50 billion from Asia-Pacific, and ¥18.77 billion from Europe, Middle East and Africa (EMEA).

Dividend Yield: 5.1%

IDEC's dividend yield of 5.09% places it in the top 25% of Japanese dividend payers, but its sustainability is questionable due to a high payout ratio (152.2%) not covered by earnings or cash flows. While dividends have increased over the past decade, they have been volatile and unreliable, with recent profit margins declining from 9.7% to 3.7%. The stock trades at a significant discount to estimated fair value, potentially appealing for value-focused investors despite these concerns.

- Get an in-depth perspective on IDEC's performance by reading our dividend report here.

- The valuation report we've compiled suggests that IDEC's current price could be inflated.

Taking Advantage

- Unlock our comprehensive list of 1983 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MOZN

mobilezone holding ag

Provides mobile and fixed-line telephony, television, and Internet services for various network operators in Germany and Switzerland.

Established dividend payer with moderate risk.

Similar Companies

Market Insights

Community Narratives