- Japan

- /

- Electrical

- /

- TSE:6652

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty with cautious Federal Reserve commentary and political tensions, investors are seeking stability amidst fluctuating indices. With U.S. stocks experiencing declines and central banks worldwide adjusting their monetary policies, dividend stocks can offer a more stable income stream in volatile times. A good dividend stock typically combines consistent payouts with strong financial health, making it an attractive choice for those looking to balance risk and reward in today's market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.20% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1935 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

TMBThanachart Bank (SET:TTB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TMBThanachart Bank Public Company Limited offers a range of commercial banking products and services to individuals, SMEs, and corporate clients mainly in Thailand, with a market cap of THB181.17 billion.

Operations: TMBThanachart Bank Public Company Limited generates revenue from its Retail Banking segment with THB45.42 billion and Commercial Banking segment with THB19.96 billion.

Dividend Yield: 6.5%

TMBThanachart Bank's dividend payments have been volatile over the past decade despite recent growth. With a payout ratio of 56.1%, dividends are covered by earnings and forecasted to remain so, though they are not top-tier in yield compared to peers. Earnings rose 19.2% last year, but a high level of bad loans (3.1%) poses risks. The stock trades at a significant discount to its estimated fair value, potentially appealing for value-focused investors despite an unstable dividend history.

- Click to explore a detailed breakdown of our findings in TMBThanachart Bank's dividend report.

- In light of our recent valuation report, it seems possible that TMBThanachart Bank is trading behind its estimated value.

Moriroku Holdings Company (TSE:4249)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Moriroku Holdings Company, Ltd. operates in Japan's resin-processed products and chemicals sectors, with a market cap of ¥29.08 billion.

Operations: Moriroku Holdings Company, Ltd. generates revenue from its Resin Processed Products Business and Chemical Business, with ¥124.25 billion and ¥28.40 billion respectively.

Dividend Yield: 5.2%

Moriroku Holdings Company's dividend payments have increased recently to JPY 52.5 per share, yet its six-year dividend history has been marked by volatility, including annual drops over 20%. Despite this, dividends are well-covered by earnings (67.6% payout ratio) and cash flows (27.3% cash payout ratio). The yield is in the top 25% of JP market payers at 5.21%, and the stock trades at a discount to estimated fair value, though reliability remains an issue.

- Get an in-depth perspective on Moriroku Holdings Company's performance by reading our dividend report here.

- Our valuation report here indicates Moriroku Holdings Company may be overvalued.

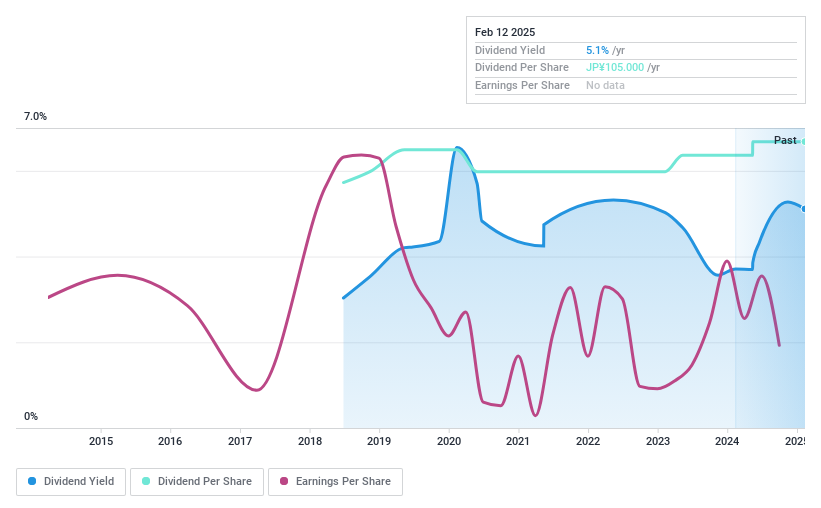

IDEC (TSE:6652)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IDEC Corporation develops human machine interfaces, industrial switches, control devices, and solutions for daily life scenes in Japan and internationally, with a market cap of ¥70.29 billion.

Operations: IDEC Corporation's revenue is primarily derived from its operations in Japan (¥34.33 billion), followed by the Europe, Middle East and Africa region (¥18.77 billion), Asia-Pacific (¥17.50 billion), and the Americas (¥14.49 billion).

Dividend Yield: 5.3%

IDEC Corporation's dividend yield of 5.35% is among the top 25% in Japan, but its sustainability is questionable due to a high payout ratio of 152.2%, indicating dividends are not well covered by earnings. Despite trading at a significant discount to fair value, profit margins have declined from last year, and dividend payments have been volatile with drops over 20%. However, cash flows reasonably cover the dividends with a cash payout ratio of 56.8%.

- Navigate through the intricacies of IDEC with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that IDEC is trading beyond its estimated value.

Taking Advantage

- Navigate through the entire inventory of 1935 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6652

IDEC

Engages in the development of human machine interfaces, industrial switches, control devices, and daily life scenes in Japan and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives