- Japan

- /

- Electrical

- /

- TSE:6592

Mabuchi Motor (TSE:6592): Assessing Valuation After Launching Engineering Subsidiary to Drive Internal Growth

Reviewed by Kshitija Bhandaru

Mabuchi Motor (TSE:6592) is expanding its capabilities by setting up Mabuchi Motor Engineering Co., Ltd., a fully owned subsidiary focused on production equipment and mold design. This step supports ongoing growth and strengthens internal expertise.

See our latest analysis for Mabuchi Motor.

Momentum has clearly picked up for Mabuchi Motor, with a 90-day share price return of 18.91% and one-year total shareholder return of 16.60%. This reflects renewed investor confidence after the recent buyback completion and new steps to strengthen engineering capabilities.

If Mabuchi Motor’s steady gains have you curious about what else could be on the move, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying and the company taking strides to boost internal capabilities, is Mabuchi Motor still undervalued in light of its long-term growth plans, or is the market already reflecting these advances in its valuation?

Price-to-Earnings of 33.7x: Is it justified?

Mabuchi Motor’s shares are currently trading at a price-to-earnings (P/E) ratio of 33.7x, which is significantly higher than both its industry and peer averages. The last close price was ¥2,534.5, placing the stock in the “expensive” territory compared to similar companies.

The price-to-earnings ratio compares a company’s current share price to its per-share earnings, serving as a basic gauge of how much investors are paying for each unit of profit. For manufacturing firms like Mabuchi Motor, a higher P/E can sometimes signal investor optimism about future earnings growth. However, it may also raise red flags about overvaluation if profits do not keep pace.

In this case, the company’s P/E ratio of 33.7x is above the Japanese Electrical industry average of 13.3x and the peer group average of 26.9x. Even when compared to an estimated fair P/E of 16.9x, the current valuation appears stretched. This suggests the market is pricing in more aggressive growth or assigning a premium that may be difficult to justify based on current fundamentals.

Explore the SWS fair ratio for Mabuchi Motor

Result: Price-to-Earnings of 33.7x (OVERVALUED)

However, if revenue growth slows or the company is unable to sustain its current net income gains, the recent optimism surrounding Mabuchi Motor’s valuation could be challenged.

Find out about the key risks to this Mabuchi Motor narrative.

Another View: SWS DCF Model Offers a Contrasting Perspective

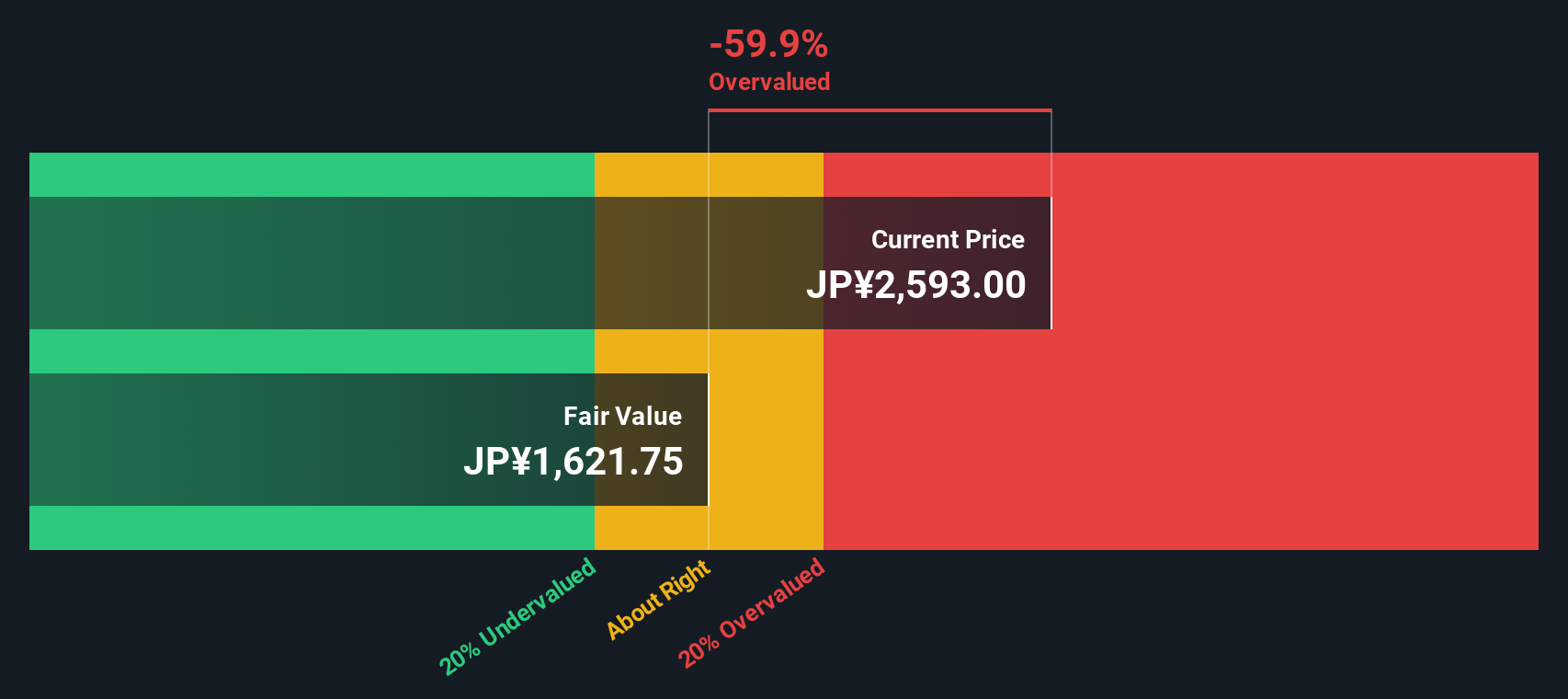

Taking a different approach, our SWS DCF model suggests that Mabuchi Motor’s current share price sits above its estimated fair value of ¥1,627.52. This implies the stock may be overvalued from a long-term cash flows perspective and challenges the optimism reflected in its P/E ratio. Could this mean the recent rally has gone too far, or is there more upside ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mabuchi Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mabuchi Motor Narrative

If you want to take a hands-on approach or see things from a different angle, you can shape your own story in just a few minutes: Do it your way

A great starting point for your Mabuchi Motor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great investors never limit their search to a single company. Use the Simply Wall Street Screener to uncover stocks you might otherwise miss and give your portfolio a true edge.

- Boost your income, starting today, by tapping into these 19 dividend stocks with yields > 3% with attractive yields above 3% and strong payout histories.

- Ride the cutting edge of healthcare innovation and seize opportunities within these 33 healthcare AI stocks, where AI is rapidly transforming patient care and diagnostics.

- Seize growth you can see in the numbers by reviewing these 892 undervalued stocks based on cash flows, offering stocks with robust cash flows at bargain prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6592

Mabuchi Motor

Manufactures and sells of small electric motors Japan, Europe, and North America.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives