- Japan

- /

- Electrical

- /

- TSE:6504

Fuji Electric Co., Ltd. (TSE:6504) Stocks Pounded By 32% But Not Lagging Market On Growth Or Pricing

The Fuji Electric Co., Ltd. (TSE:6504) share price has fared very poorly over the last month, falling by a substantial 32%. The recent drop has obliterated the annual return, with the share price now down 5.5% over that longer period.

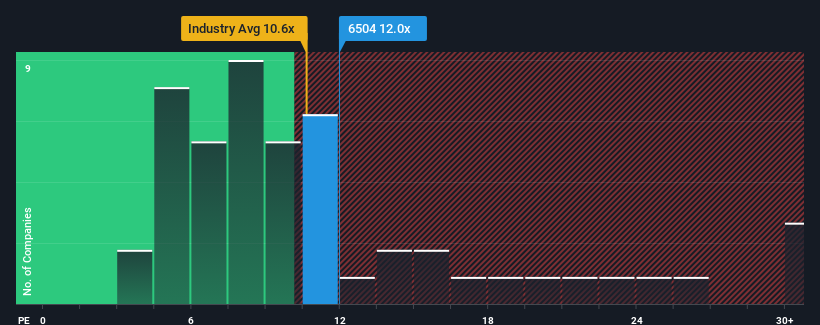

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Fuji Electric's P/E ratio of 12x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 13x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Fuji Electric certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Fuji Electric

Is There Some Growth For Fuji Electric?

The only time you'd be comfortable seeing a P/E like Fuji Electric's is when the company's growth is tracking the market closely.

Taking a look back first, we see that the company grew earnings per share by an impressive 17% last year. The strong recent performance means it was also able to grow EPS by 64% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 10% per year over the next three years. That's shaping up to be similar to the 9.6% per annum growth forecast for the broader market.

In light of this, it's understandable that Fuji Electric's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

With its share price falling into a hole, the P/E for Fuji Electric looks quite average now. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Fuji Electric's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 2 warning signs for Fuji Electric that you need to take into consideration.

If these risks are making you reconsider your opinion on Fuji Electric, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6504

Fuji Electric

Develops power semiconductors and electronics solutions in Japan and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives