- Japan

- /

- Electrical

- /

- TSE:6503

Will Mitsubishi Electric’s New High‑Isolation HVIGBT Modules Redefine Its Power Role (TSE:6503)?

Reviewed by Sasha Jovanovic

- Mitsubishi Electric recently announced it will launch new standard‑isolation (6.0kVrms) and high‑isolation (10.2kVrms) 4.5kV/1,200A HVIGBT modules on December 9, offering higher moisture resistance, lower switching loss, and improved reliability for inverters in large industrial equipment, including railcars used outdoors.

- By shrinking chip termination regions, greatly boosting moisture resistance, and improving switching efficiency, these modules reinforce Mitsubishi Electric’s power semiconductor capabilities and support its carbon‑neutrality ambitions across infrastructure and transportation markets.

- We’ll now examine how this moisture‑resistant, efficiency‑enhancing HVIGBT launch could influence Mitsubishi Electric’s broader investment narrative and growth drivers.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Mitsubishi Electric Investment Narrative Recap

To own Mitsubishi Electric, you need to believe it can compound value by marrying its industrial hardware strength with more efficient, electrified infrastructure and transport. The new moisture resistant HVIGBT modules look supportive of this thesis but do not obviously change the key short term catalyst, which is execution in higher margin automation and energy systems, or the biggest risk, which is pricing and margin pressure from lower cost Asian competitors in commoditizing hardware lines.

Among recent developments, the launch of the LV100 type 1.2 kV IGBT module for renewable energy power supply systems stands out as closely related to the new HVIGBT announcement. Together, these products highlight Mitsubishi Electric’s effort to strengthen its power semiconductor portfolio around electrification and energy efficiency, feeding into growth drivers in infrastructure, renewables and transportation, while still leaving execution risks in digital offerings and services very much in view.

Yet investors should be aware that rising low cost competition in core hardware segments could...

Read the full narrative on Mitsubishi Electric (it's free!)

Mitsubishi Electric's narrative projects ¥6,044.2 billion revenue and ¥423.4 billion earnings by 2028. This requires 2.9% yearly revenue growth and about a ¥57.5 billion earnings increase from ¥365.9 billion today.

Uncover how Mitsubishi Electric's forecasts yield a ¥4090 fair value, a 6% downside to its current price.

Exploring Other Perspectives

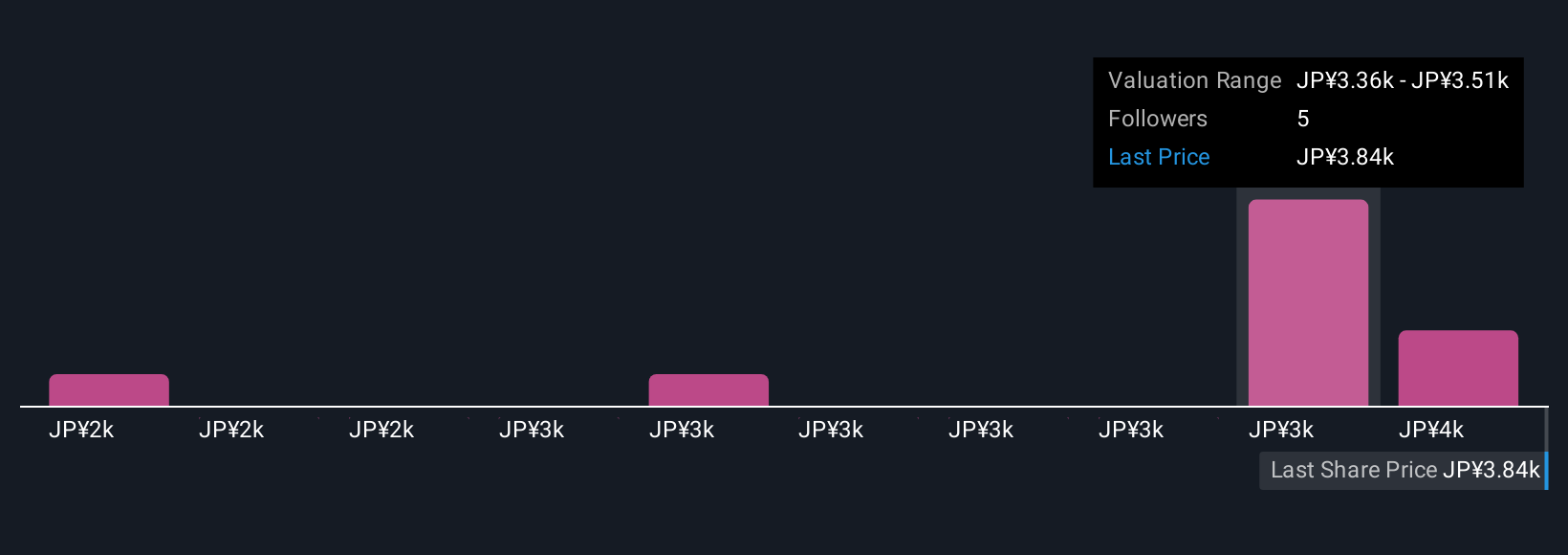

Four members of the Simply Wall St Community currently see fair value between ¥2,114 and ¥4,090, underscoring very different expectations for Mitsubishi Electric. Against this spread, the key question is whether new high efficiency power modules can offset pressure from lower cost Asian rivals and support the company’s broader earnings profile over time.

Explore 4 other fair value estimates on Mitsubishi Electric - why the stock might be worth less than half the current price!

Build Your Own Mitsubishi Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Electric research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mitsubishi Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Electric's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6503

Mitsubishi Electric

Develops, manufactures, sells, and distributes electrical and electronic equipment in Japan, North America, rest of Asia, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026