Stock Analysis

Top 3 Stocks Estimated To Be Undervalued On The Japanese Exchange In June 2024

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating market sentiments and the recent downturn in Japan's stock indices, investors are keenly observing potential opportunities for value. In such a landscape, identifying stocks that appear undervalued could be particularly compelling, aligning with broader economic cues and investor strategies focused on long-term growth prospects in this nuanced market.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Link and Motivation (TSE:2170) | ¥456.00 | ¥891.20 | 48.8% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥1874.00 | ¥3563.34 | 47.4% |

| Hibino (TSE:2469) | ¥2570.00 | ¥4889.56 | 47.4% |

| OSAKA Titanium technologiesLtd (TSE:5726) | ¥2808.00 | ¥5531.09 | 49.2% |

| Cyber Security Cloud (TSE:4493) | ¥2142.00 | ¥4106.05 | 47.8% |

| S-Pool (TSE:2471) | ¥310.00 | ¥586.68 | 47.2% |

| Macromill (TSE:3978) | ¥858.00 | ¥1671.55 | 48.7% |

| NIHON CHOUZAILtd (TSE:3341) | ¥1428.00 | ¥2776.02 | 48.6% |

| Members (TSE:2130) | ¥899.00 | ¥1718.12 | 47.7% |

| LibertaLtd (TSE:4935) | ¥1023.00 | ¥1954.32 | 47.7% |

Let's review some notable picks from our screened stocks

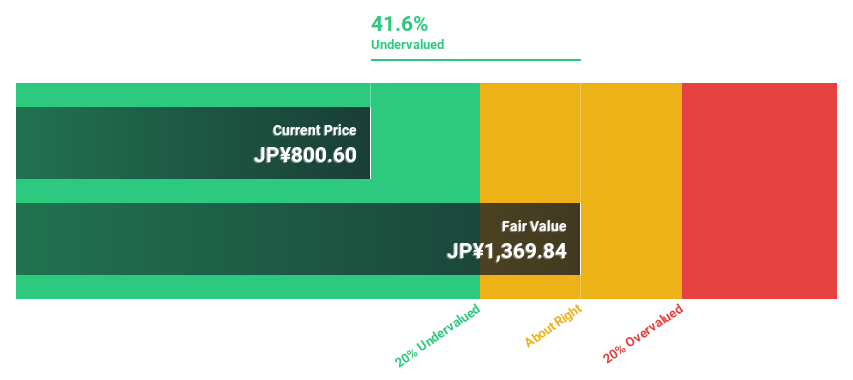

Money Forward (TSE:3994)

Overview: Money Forward, Inc. offers financial solutions to individuals, financial institutions, and corporations mainly in Japan, with a market capitalization of approximately ¥286.63 billion.

Operations: The firm generates revenue by offering financial solutions tailored for various client groups across Japan.

Estimated Discount To Fair Value: 43.4%

Money Forward is trading at ¥5257, significantly below the estimated fair value of ¥9281.54, indicating potential undervaluation based on cash flows. Despite a highly volatile share price recently, its financial outlook appears robust with earnings expected to grow 63.83% annually. Additionally, its revenue growth forecast of 19.9% per year outpaces the Japanese market average significantly. The upcoming merger with Klavis Inc., set for December 2024, could further influence financial dynamics and stability.

- Upon reviewing our latest growth report, Money Forward's projected financial performance appears quite optimistic.

- Dive into the specifics of Money Forward here with our thorough financial health report.

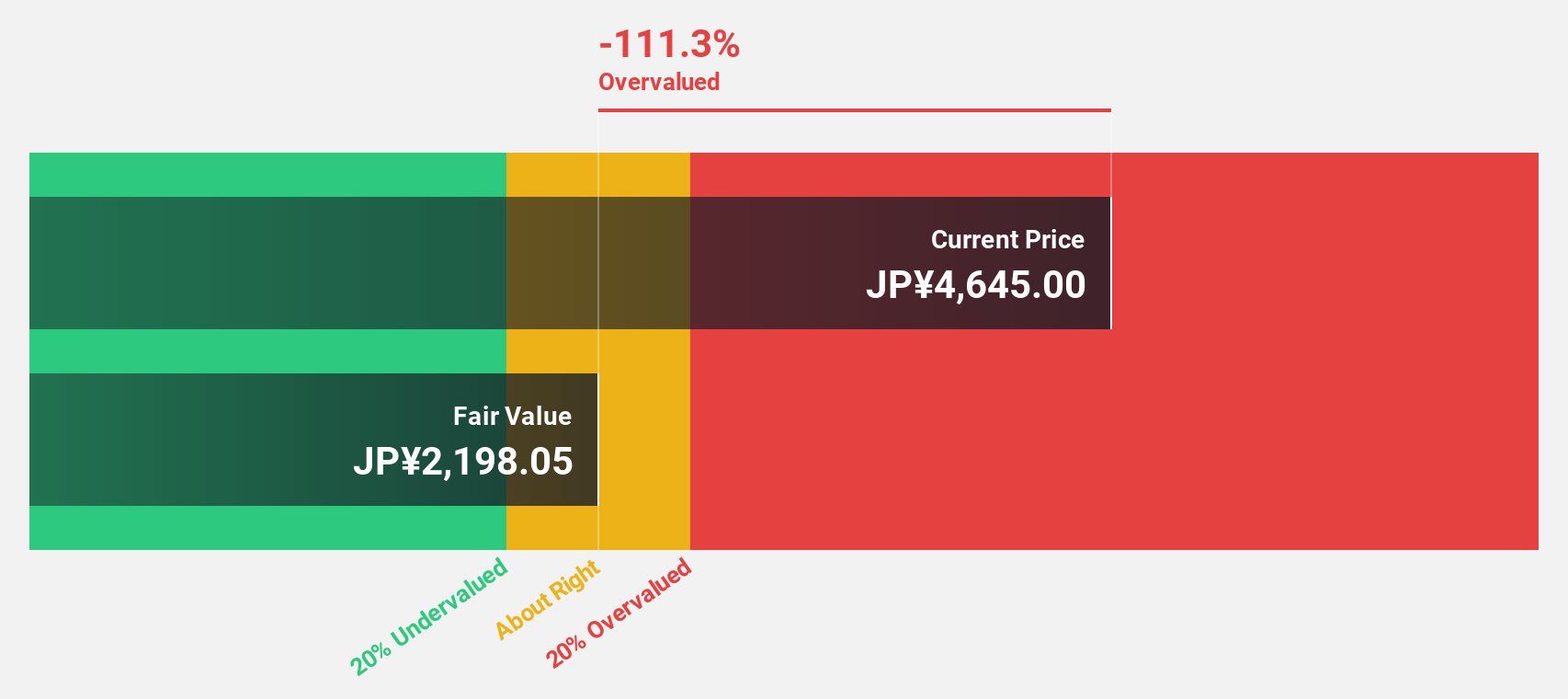

freee K.K (TSE:4478)

Overview: Freee K.K., operating in Japan, specializes in offering cloud-based accounting and HR software solutions, with a market capitalization of approximately ¥142.99 billion.

Operations: The firm generates revenue primarily through its cloud-based accounting and HR software solutions.

Estimated Discount To Fair Value: 45.2%

freee K.K. is currently priced at ¥2447, which is 45.2% below the estimated fair value of ¥4465.16, suggesting it may be undervalued based on cash flows. The company's revenue is projected to increase by 21.4% annually, surpassing Japan's market average significantly. Despite its share price volatility over the last three months and a forecasted low return on equity of 18.6%, freee K.K.'s earnings are expected to grow substantially by 81% per year as it approaches profitability within three years.

- Our earnings growth report unveils the potential for significant increases in freee K.K's future results.

- Click to explore a detailed breakdown of our findings in freee K.K's balance sheet health report.

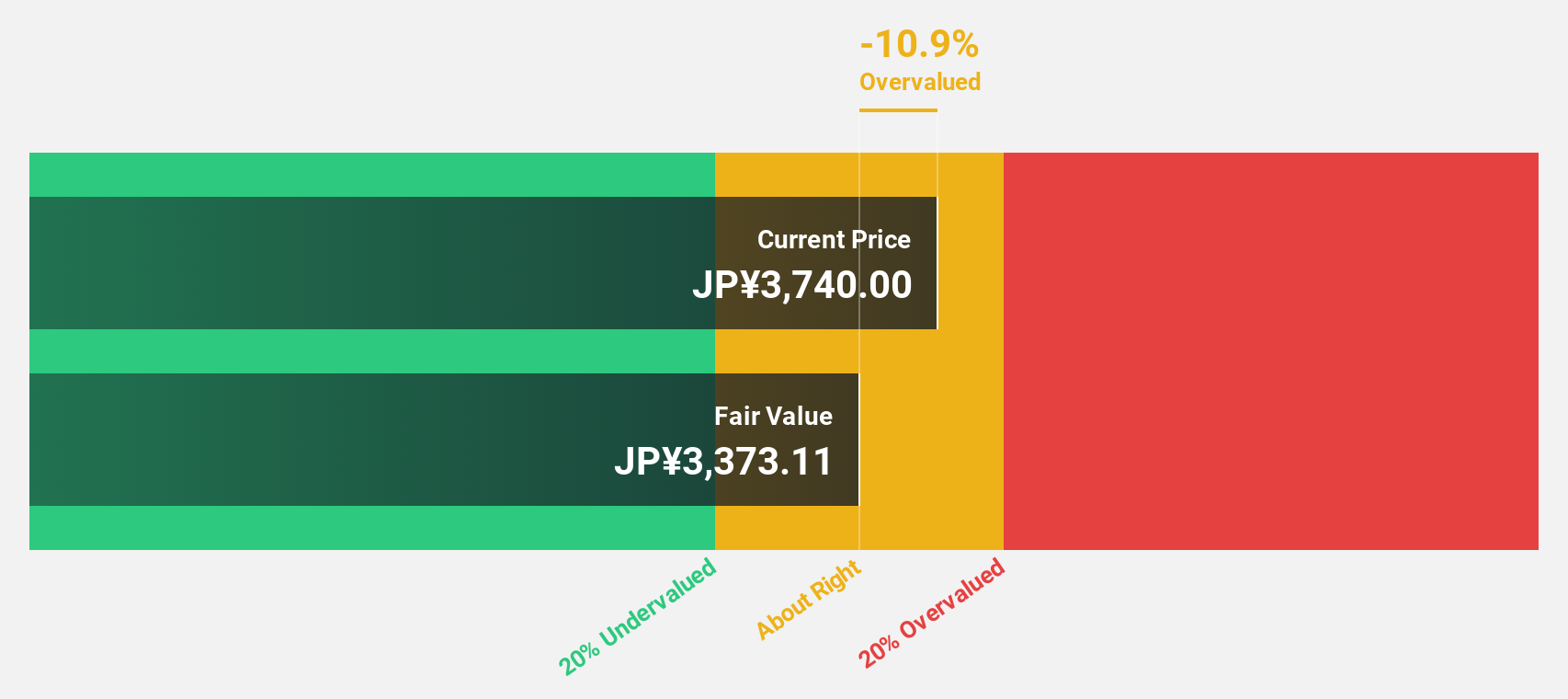

NSK (TSE:6471)

Overview: NSK Ltd. operates globally, manufacturing and selling industrial machinery bearings, automotive products, and precision machinery and parts, with a market capitalization of approximately ¥377.95 billion.

Operations: The company generates revenue primarily from two segments: automotive products, which contribute approximately ¥408.82 billion, and industrial machinery, accounting for about ¥344.85 billion.

Estimated Discount To Fair Value: 37.5%

NSK Ltd., trading at ¥773.4, is perceived as undervalued, with its price 37.5% below the calculated fair value of ¥1236.51. Despite a moderate revenue growth forecast of 4.9% per year, its earnings are expected to surge by 27.07% annually, outpacing the Japanese market's average significantly. However, concerns arise from a dividend coverage issue and a projected low return on equity of 5.5%, which could impact future financial stability and investor returns.

- In light of our recent growth report, it seems possible that NSK's financial performance will exceed current levels.

- Click here to discover the nuances of NSK with our detailed financial health report.

Next Steps

- Click here to access our complete index of 101 Undervalued Japanese Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether freee K.K is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4478

freee K.K

Engages in the provision of cloud-based accounting and HR software solutions in Japan.

High growth potential with adequate balance sheet.