Investors Continue Waiting On Sidelines For Hoden Seimitsu Kako Kenkyusho Co., Ltd. (TSE:6469)

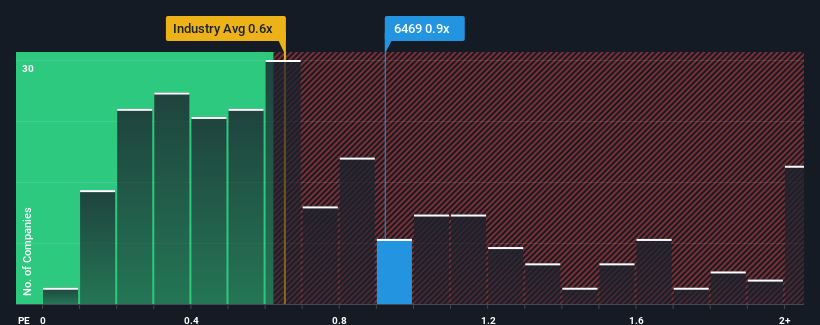

There wouldn't be many who think Hoden Seimitsu Kako Kenkyusho Co., Ltd.'s (TSE:6469) price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S for the Machinery industry in Japan is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Hoden Seimitsu Kako Kenkyusho

What Does Hoden Seimitsu Kako Kenkyusho's P/S Mean For Shareholders?

Recent times have been advantageous for Hoden Seimitsu Kako Kenkyusho as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Hoden Seimitsu Kako Kenkyusho's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Hoden Seimitsu Kako Kenkyusho?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hoden Seimitsu Kako Kenkyusho's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.5% last year. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 8.4% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 4.9%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Hoden Seimitsu Kako Kenkyusho's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Hoden Seimitsu Kako Kenkyusho's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Hoden Seimitsu Kako Kenkyusho currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Hoden Seimitsu Kako Kenkyusho (1 is a bit unpleasant!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hoden Seimitsu Kako Kenkyusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6469

Hoden Seimitsu Kako Kenkyusho

Manufactures and sells electric discharge machining, industrial gas turbine parts, and other metal products.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives