Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hoshizaki (TSE:6465). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Hoshizaki

How Quickly Is Hoshizaki Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Hoshizaki's EPS has grown 34% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

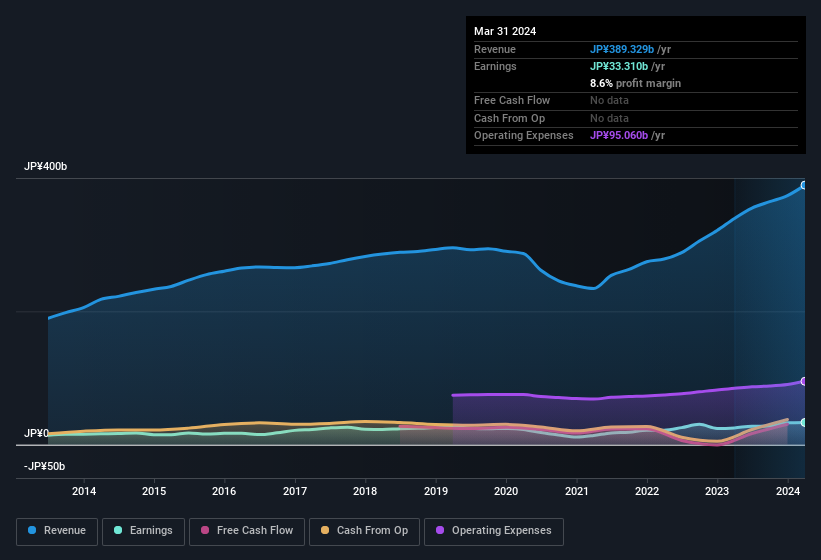

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Hoshizaki shareholders can take confidence from the fact that EBIT margins are up from 9.7% to 12%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Hoshizaki?

Are Hoshizaki Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a JP¥816b company like Hoshizaki. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Notably, they have an enviable stake in the company, worth JP¥107b. Coming in at 13% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Does Hoshizaki Deserve A Spot On Your Watchlist?

You can't deny that Hoshizaki has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Hoshizaki.

Although Hoshizaki certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Japanese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hoshizaki might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6465

Hoshizaki

Researches, develops, manufactures, and sells commercial kitchen appliances and equipment worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives