Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative And 2 Promising Small Caps With Solid Potential

Reviewed by Simply Wall St

In a landscape marked by economic shifts and rate cuts from central banks like the ECB and SNB, small-cap stocks have faced challenges, as evidenced by the Russell 2000 Index's recent underperformance compared to larger indices. Amidst this backdrop of fluctuating market sentiment and cooling labor markets, investors often seek out lesser-known stocks with strong fundamentals that can weather such volatility. Identifying promising investments requires a focus on companies with solid financial health and growth potential, particularly those that may be overlooked in broader market downturns. In this article, we will explore Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative along with two other small-cap stocks that exhibit these qualities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative (ENXTPA:CNDF)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative offers a range of banking products and financial services in France, with a market cap of €804.49 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative generates revenue primarily from its Retail Bank segment, amounting to €623.64 million.

Caisse Régionale de Crédit Agricole Mutuel Nord de France, with total assets of €38.9 billion and equity of €5.5 billion, stands out for its robust financial health. The bank's reliance on customer deposits—95% of its liabilities—indicates a low-risk funding structure. Earnings have surged by 31.6% over the past year, significantly outpacing the banking industry's 5.3%. With a sufficient allowance for bad loans at 102%, and non-performing loans at an appropriate level of 1.5%, CNDF seems well-positioned in terms of risk management while trading at a notable discount to estimated fair value by about 53%.

Max (TSE:6454)

Simply Wall St Value Rating: ★★★★★★

Overview: Max Co., Ltd. is a company that, along with its subsidiaries, produces and distributes industrial and office equipment both in Japan and globally, with a market capitalization of ¥159.36 billion.

Operations: Max Co., Ltd. generates revenue primarily from industrial equipment (¥63.90 billion) and office equipment (¥21.38 billion), with a smaller contribution from home care & rehabilitation equipment (¥3.32 billion).

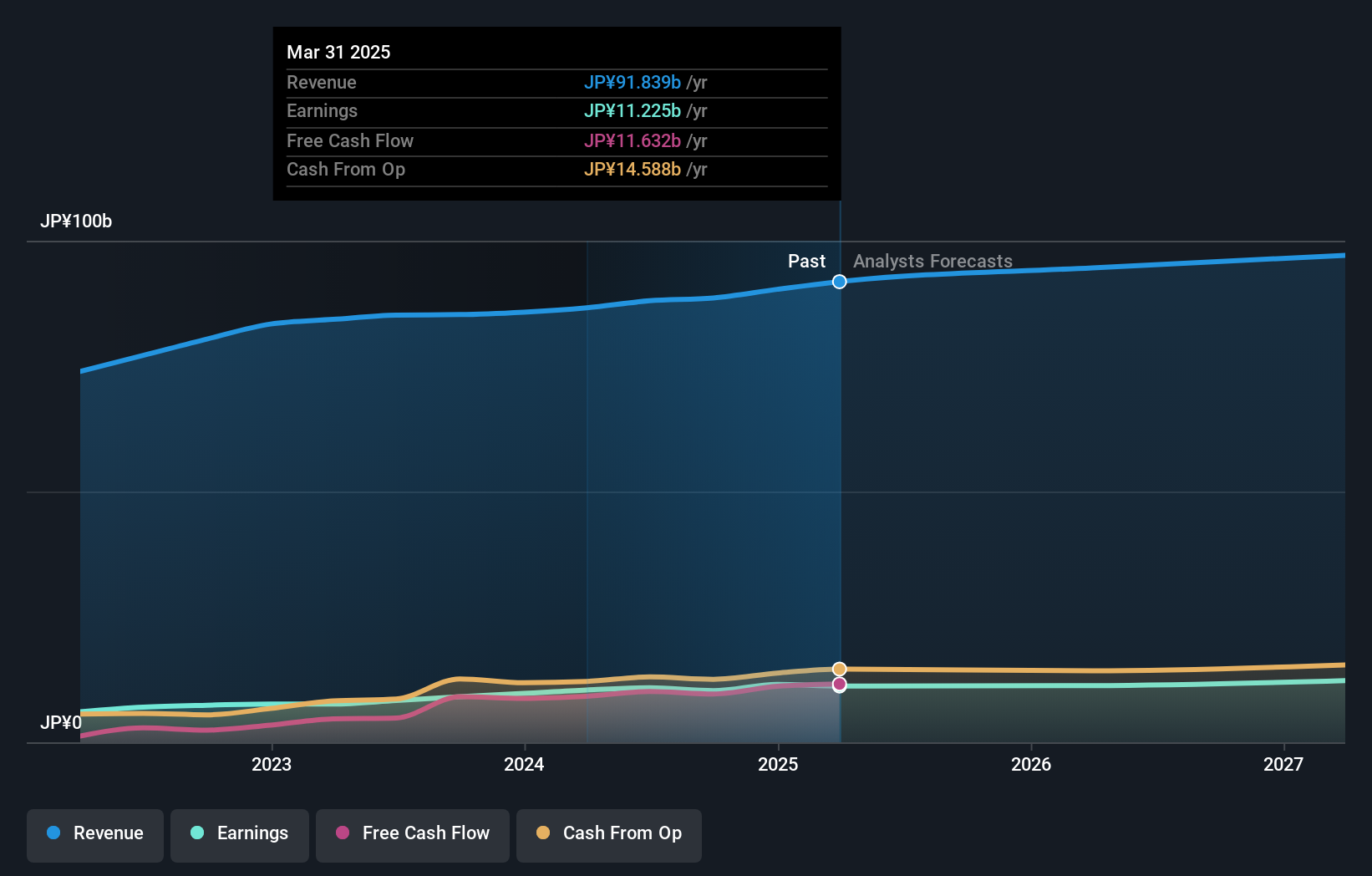

Max Co. is showing promising signs with its debt to equity ratio improving from 2.7% to 1.2% over five years, highlighting a stronger balance sheet. The company has outpaced the Machinery industry with a notable earnings growth of 13.5%, while also trading at nearly 10% below its estimated fair value, suggesting potential undervaluation in the market. Recent strategic moves include a share repurchase program worth ¥2,400 million and a follow-on equity offering of ¥4.14 billion, indicating efforts to enhance shareholder returns and capital efficiency. With high-quality earnings and sufficient cash flow, Max Co.'s financial health appears robust for future growth prospects.

- Click here and access our complete health analysis report to understand the dynamics of Max.

Review our historical performance report to gain insights into Max's's past performance.

Matsuya (TSE:8237)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Matsuya Co., Ltd. operates department stores in Ginza and Asakusa, Japan, with a market capitalization of ¥51.25 billion.

Operations: Matsuya generates revenue primarily from its department stores located in Ginza and Asakusa. The company has a market capitalization of ¥51.25 billion, reflecting its significant presence in the retail sector.

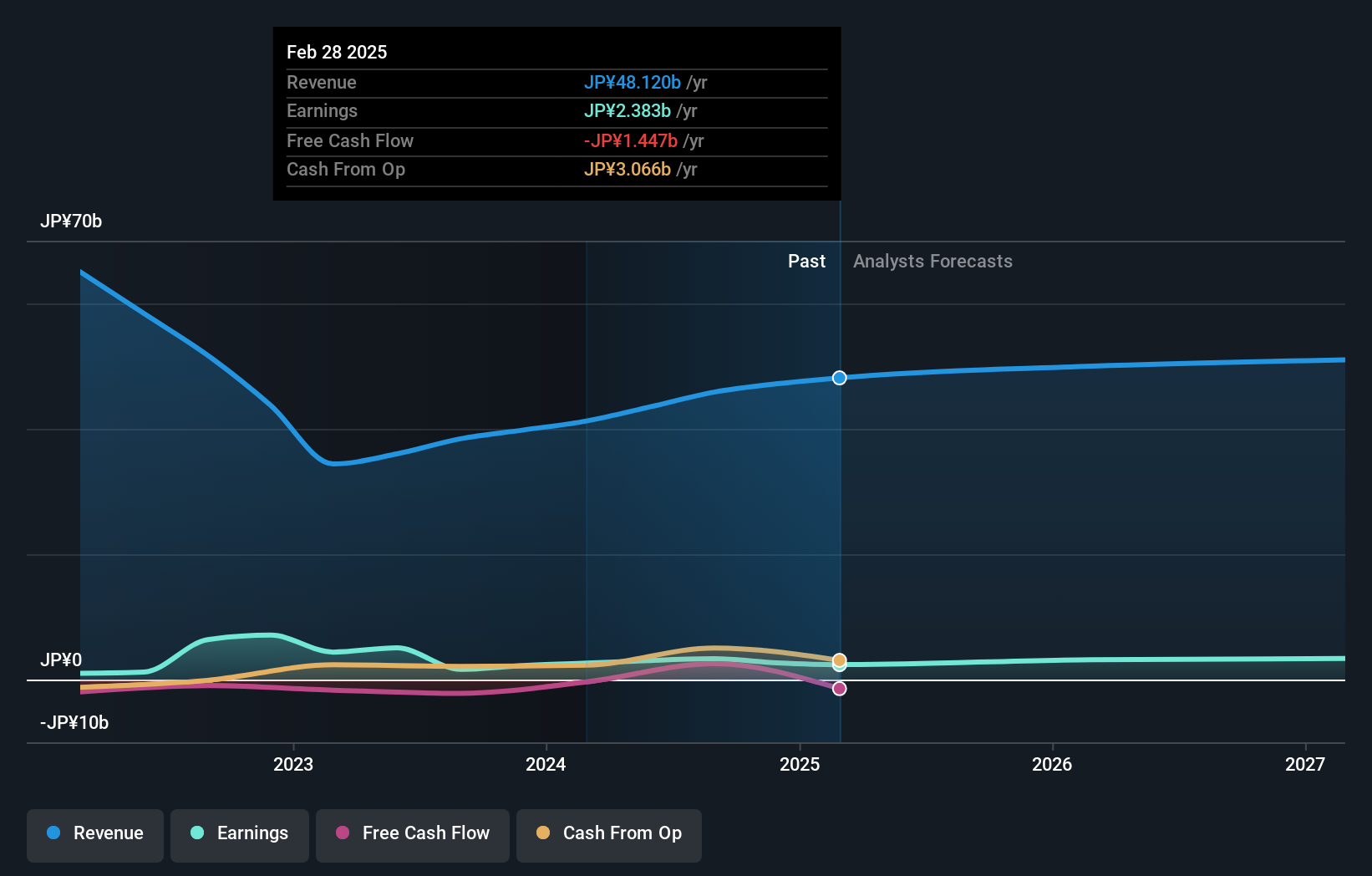

Matsuya has shown impressive growth, with earnings surging 103% over the past year, significantly outpacing the Multiline Retail industry's 22%. The company's debt to equity ratio improved from 90.9% to 59.7% in five years, though its net debt to equity remains high at 47.6%. Despite this leverage, interest payments are well-covered by EBIT at a substantial 131 times coverage. Recent sales figures highlight robust performance with November sales up by 18%, following October's increase of nearly 14%. Trading at nearly 90% below estimated fair value suggests potential for future appreciation in its stock price.

- Navigate through the intricacies of Matsuya with our comprehensive health report here.

Explore historical data to track Matsuya's performance over time in our Past section.

Next Steps

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4492 more companies for you to explore.Click here to unveil our expertly curated list of 4495 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CNDF

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative

Caisse Régionale de Crédit Agricole Mutuel Nord de France Société cooperative provides banking products and financial services in France.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives