- China

- /

- Semiconductors

- /

- SZSE:300831

Hidden Opportunities in Undiscovered Gems for January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. stock indexes climbing higher on the back of easing core inflation and robust bank earnings, investors are increasingly looking towards small-cap stocks for potential opportunities. In this environment, identifying undiscovered gems becomes crucial; these are stocks that may not yet be on the radar but have strong fundamentals and growth potential aligned with current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Macnica Galaxy | 52.99% | 8.23% | 18.45% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Xi'an Peri Power Semiconductor Converting TechnologyLtd (SZSE:300831)

Simply Wall St Value Rating: ★★★★★★

Overview: Xi'an Peri Power Semiconductor Converting Technology Co., Ltd. operates in the semiconductor industry with a market cap of CN¥4.93 billion.

Operations: Xi'an Peri Power Semiconductor Converting Technology Co., Ltd. generates revenue primarily from its semiconductor products, with a focus on efficient power conversion technologies. The company's cost structure is significantly influenced by raw material expenses and manufacturing costs, impacting its overall profitability. Notably, the net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

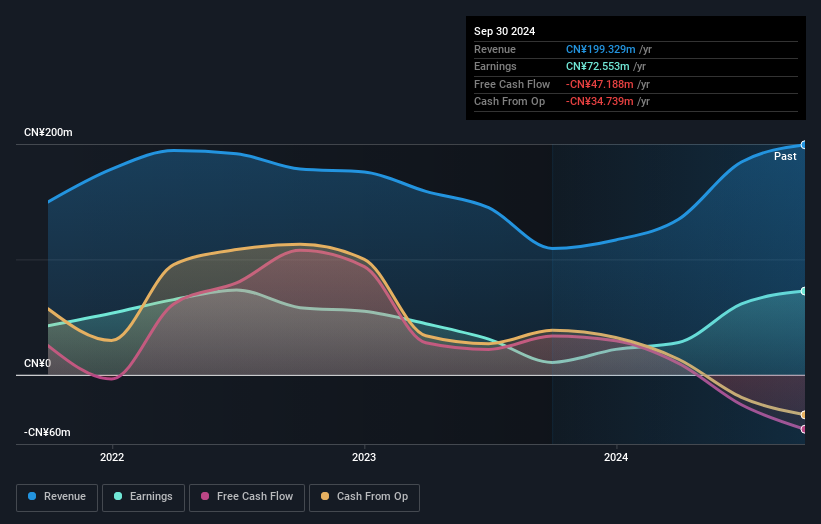

Xi'an Peri Power Semiconductor Converting Technology, a small player in the semiconductor industry, has shown impressive growth with earnings surging 575.5% over the past year, outpacing the industry's 12.1% growth rate. The company reported sales of CNY 152.66 million for nine months ending September 2024, up from CNY 70.19 million a year earlier, while net income jumped to CNY 52.54 million from CNY 2.01 million previously. Despite its robust performance and high-quality non-cash earnings, it remains debt-free but struggles with negative free cash flow recently at -CNY 47.19 million as of September 2024.

- Navigate through the intricacies of Xi'an Peri Power Semiconductor Converting TechnologyLtd with our comprehensive health report here.

Learn about Xi'an Peri Power Semiconductor Converting TechnologyLtd's historical performance.

Zilltek Technology (TPEX:6679)

Simply Wall St Value Rating: ★★★★★★

Overview: Zilltek Technology Corp. is an IC design company that operates in Taiwan, China, and internationally with a market cap of NT$16.46 billion.

Operations: Zilltek Technology generates revenue primarily from its Electronic Components & Parts segment, totaling NT$2.13 billion. The company has a market capitalization of NT$16.46 billion, reflecting its scale in the IC design industry.

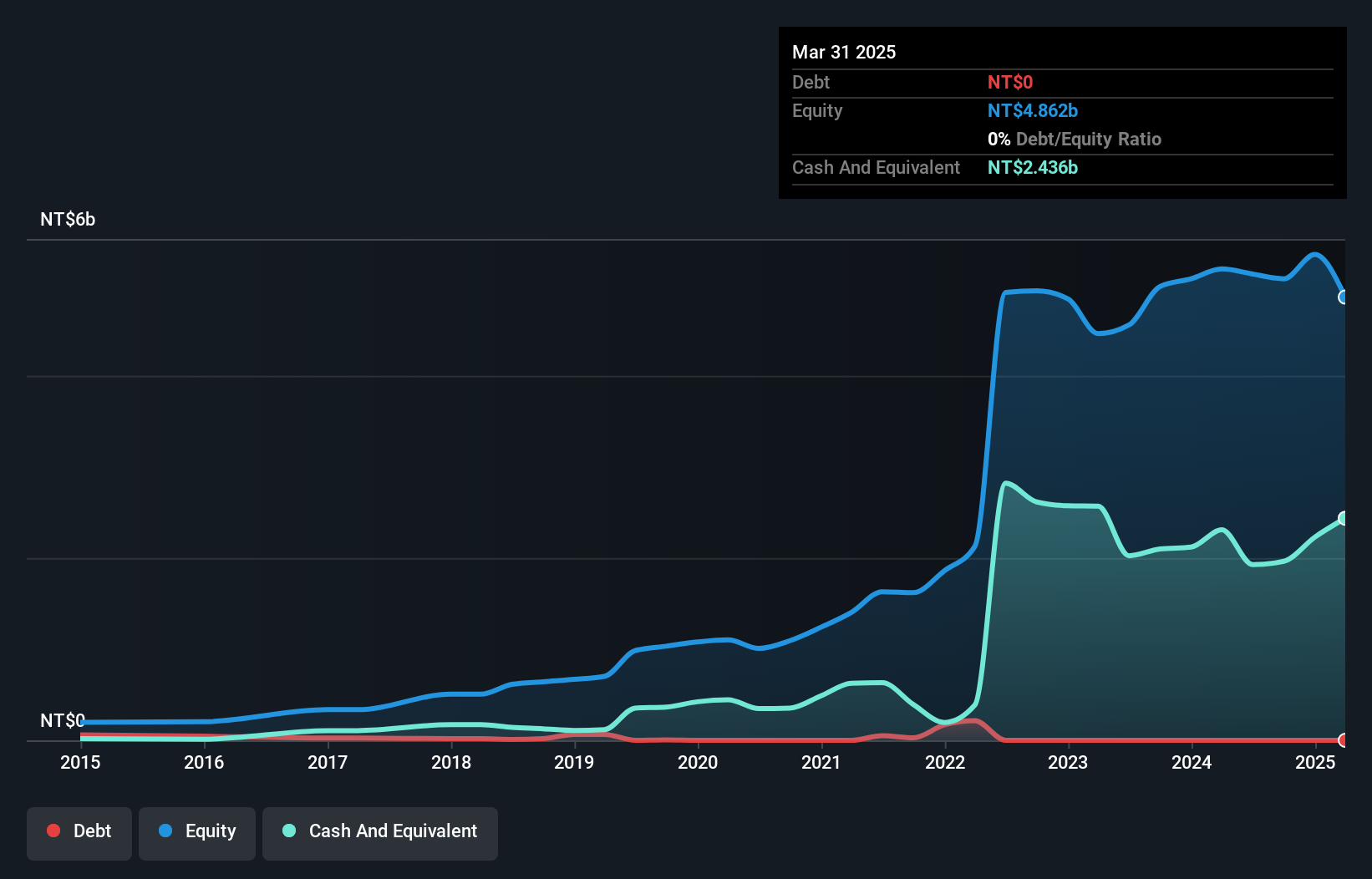

Zilltek Technology, a nimble player in the semiconductor space, has shown impressive financial resilience. Over the past year, earnings surged by 22%, outpacing the industry's 5.9% growth. The company is debt-free now compared to a debt-to-equity ratio of 0.5% five years ago, highlighting its robust fiscal management. Recent earnings reports indicate mixed results; while third-quarter sales rose to TWD 517.91 million from TWD 511.79 million last year, net income dipped to TWD 81.12 million from TWD 159.21 million previously. Despite this dip, Zilltek's high-quality earnings and forecasted annual growth of 35% paint an optimistic picture for future potential.

- Take a closer look at Zilltek Technology's potential here in our health report.

Gain insights into Zilltek Technology's past trends and performance with our Past report.

Fukushima GalileiLtd (TSE:6420)

Simply Wall St Value Rating: ★★★★★★

Overview: Fukushima Galilei Co. Ltd. is involved in the manufacturing, sales, and maintenance of commercial freezer refrigerators, refrigerated showcases, and other refrigeration devices both in Japan and internationally, with a market cap of ¥101.65 billion.

Operations: The company's revenue streams are primarily derived from the manufacturing, sales, and maintenance of refrigeration devices. Its financial performance is characterized by a focus on these core activities in both domestic and international markets.

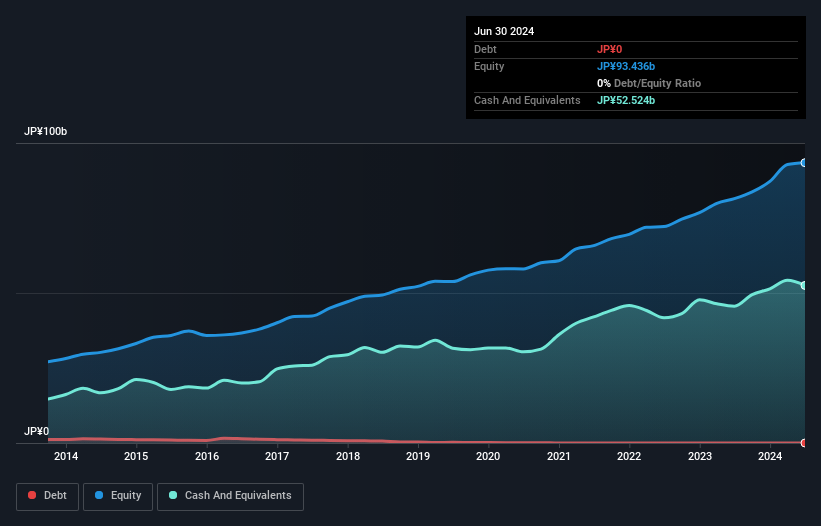

Fukushima Galilei, a company with a knack for innovation in the machinery sector, recently executed a 2-for-1 stock split set for December 27, 2024. This move might attract more investors due to increased accessibility. Over the past year, earnings surged by 20.8%, outpacing the industry average of 1.6%, showcasing its competitive edge. Notably debt-free now compared to five years ago when its debt-to-equity ratio was at 0.3%, it maintains high-quality earnings and positive free cash flow of ¥10,202 million as of March 31, 2024—indicating robust financial health despite forecasted declines in future earnings growth by an average of 1.3% annually over the next three years.

Key Takeaways

- Navigate through the entire inventory of 4663 Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300831

Xi'an Peri Power Semiconductor Converting TechnologyLtd

Xi'an Peri Power Semiconductor Converting Technology Co.,Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives