Kurita Water Industries (TSE:6370): Assessing Valuation After Landmark UK Lithium Supply Deal with Northern Lithium and Evove

Reviewed by Kshitija Bhandaru

Kurita Water Industries (TSE:6370) has just announced its involvement in a major three-way partnership with Northern Lithium and Evove. This partnership is set to deliver the UK's first commercial-scale lithium supplies using advanced Direct Lithium Extraction technology. This move places Kurita at a key point in the European battery material supply chain and aligns well with ongoing shifts in regional energy and trade policies.

See our latest analysis for Kurita Water Industries.

The announcement comes at a time when Kurita Water Industries’ stock has shown signs of renewed momentum, with a 4.63% 1-day share price return and a 3.74% gain over the past week, following a stretch of more subdued total shareholder returns. The stock dropped 10% over the past year but is up an impressive 73% across five years. This latest move into lithium extraction could help recalibrate investor perceptions, shifting the narrative from short-term softness to longer-term opportunity in the rapidly evolving battery materials space.

If the lithium partnership has sparked your curiosity, now’s the perfect moment to explore new horizons and discover fast growing stocks with high insider ownership

But with shares still below analyst price targets and recent gains following a downward trend, the question remains: Is the stock now undervalued, or has the market already factored in Kurita's growth potential from these bold new moves?

Price-to-Earnings of 29x: Is it justified?

Kurita Water Industries currently trades on a price-to-earnings (P/E) ratio of 29x, a figure that places the share firmly in the "expensive" category compared to both industry peers and fair value benchmarks. At the last close of ¥5,359, the share price reflects a premium valuation rather than a bargain.

The price-to-earnings ratio is a widely used multiple that compares a company's current share price to its earnings per share. For Kurita, this metric highlights how much investors are willing to pay for each yen of current profits, often reflecting expectations about future profitability and sector growth prospects.

Given where Kurita sits, the market appears to be assigning a steep premium to future earnings potential. However, this premium is hard to justify when compared with the JP Machinery industry average of just 13x. Even the estimated fair price-to-earnings ratio of 22.8x suggests markets may be running ahead of fundamentals, with Kurita's current P/E leaving little margin for error.

With such a notable gap between Kurita's multiple and benchmarks, the market could eventually move toward a more reasonable level in line with the fair ratio.

Explore the SWS fair ratio for Kurita Water Industries

Result: Price-to-Earnings of 29x (OVERVALUED)

However, slowing revenue growth or a sharp adjustment in profit margins could quickly challenge the optimism reflected in Kurita's current valuation.

Find out about the key risks to this Kurita Water Industries narrative.

Another View: What Does the DCF Model Say?

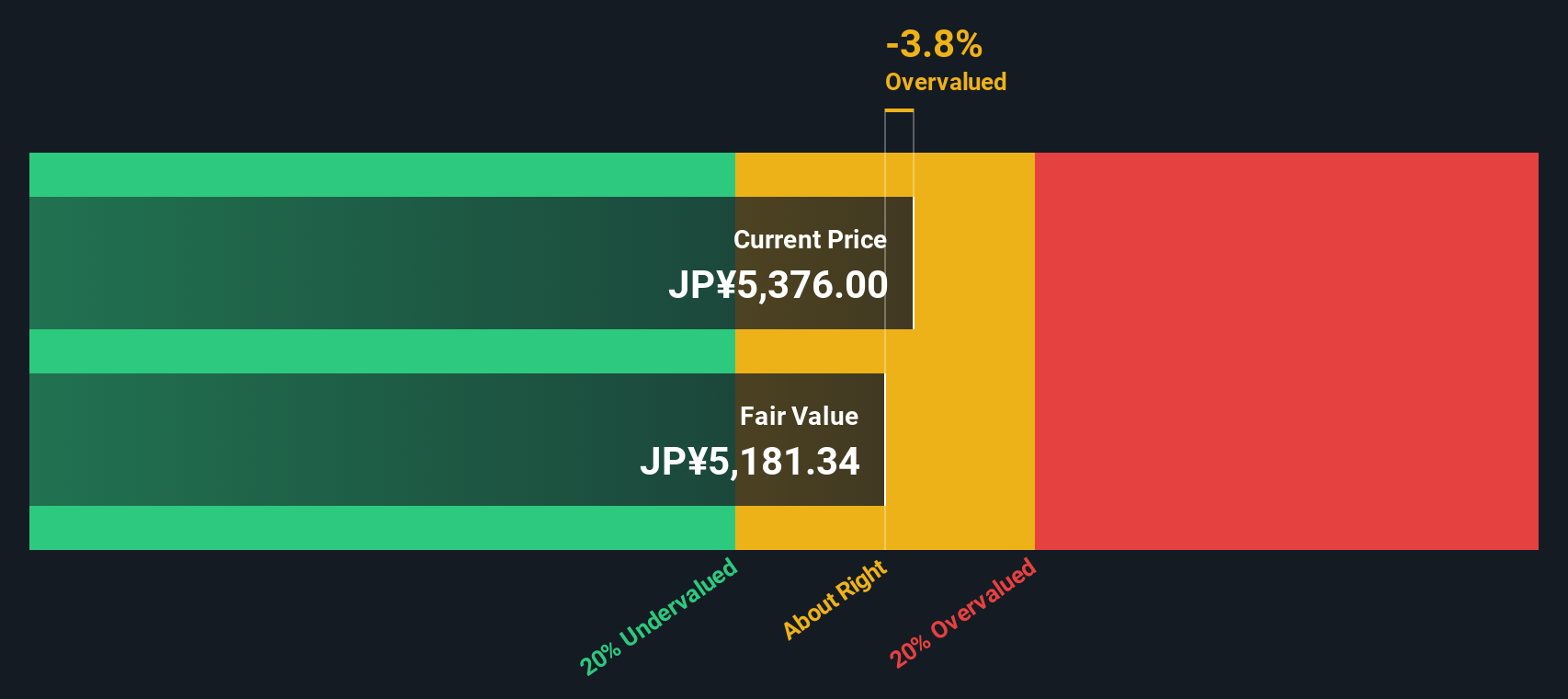

Switching perspective, our DCF model offers a different take on Kurita's valuation. According to this approach, the current share price of ¥5,359 is actually above the estimated fair value of ¥5,187. This suggests the stock may be overvalued based on future cash flows rather than earnings multiples. Which valuation method should investors trust when weighing risk and reward?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kurita Water Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kurita Water Industries Narrative

If you see things differently or want to dig deeper yourself, you have the power to shape your own Kurita Water Industries story in just a few minutes, so why not Do it your way

A great starting point for your Kurita Water Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your portfolio by seizing opportunities others might overlook. Simply Wall Street’s screener makes it effortless to spot standout companies with the potential for tomorrow’s big trends.

- Boost your income strategy by tapping into these 18 dividend stocks with yields > 3% with attractive yields crossing the 3% mark. This can be ideal for investors focused on reliable cash flow.

- Ride the AI innovation wave and position yourself early with these 24 AI penny stocks making breakthroughs in intelligent automation and advanced data solutions.

- Capture value that others might be missing by targeting these 877 undervalued stocks based on cash flows trading below their fair worth based on projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kurita Water Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6370

Kurita Water Industries

Provides water treatment solutions in Japan, Asia, North America, South America, Europe, the Middle East, and Africa.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives